High stock prices can be both a sign of strength and a potential barrier. On the one hand, they indicate that a company is performing well enough to attract investors. On the other, when shares reach several hundred dollars, they may scare off potential buyers, slowing the influx of fresh capital.

To address this issue, companies often turn to a stock split. This strategy lowers the price per share while increasing the total number of shares, all without affecting the company’s overall market cap. In a stock split, shareholders receive more shares proportional to their existing holdings. This adjustment makes the stock more accessible to new investors.

Historically, stock splits have been viewed favorably by investors, and the data backs up this sentiment. Looking at 40-year data for the first 12 months following a stock split, the average post-split return comes to 25.4%, doubling the average return seen on the broader S&P index for those months.

But not all split transactions are created equal, and some stocks will benefit more than others. We’ve used the TipRanks database to find two upcoming stock splits that have widely diverging reviews from the Street’s analysts. Let’s delve into these splits and discover which one analysts are leaning toward.

Cintas Corporation (CTAS)

We’ll start with Cintas, a name that many of you may recognize, although you may not know from where. This company has a large footprint, and its logo is found in many places, but its business is one that most of us don’t think about: uniforms. Cintas is a provider of support services equipment for the business sector, including uniforms but also a full range of cleaning supplies for restrooms, general janitorial use, and kitchens; industrial cleaners; first aid and safety equipment; fire protection services and equipment, including fire-resistant clothing; and training and compliance materials and courses. In short, Cintas provides everything that a business needs to keep well-dressed, clean, and compliant with occupational safety standards.

This is a big business, and in its last fiscal year, which ended on May 31 of this year, the company brought in a total of $9.6 billion in revenues. The company operates across the US and Canada, and boasts more than 1 million enterprise customers. Cintas has 12 distribution centers and operates more than 11,700 distribution routes. The company is based in Ohio, has been in operation for more than 90 years, and is one of the largest firms in its industry.

In July of this year, Cintas reported strong earnings and gave better forward guidance – and the stock jumped as a result. Shares quickly hit record high levels and continued to rise through the end of August. Even after some losses in recent sessions, the shares are still near their record high levels.

The earnings that pushed the shares up that far were released on July 18. The company had a top line of $2.47 billion, up more than 8% year-over-year and in line with the forecasts. The bottom line, a $3.99 EPS, was up by 66 cents per share and beat the estimates by 19 cents. Looking forward, the company gave fiscal 2025 revenue guidance in the range of $10.16 billion to $10.31 billion, representing a 6.6% y/y gain at the midpoint. EPS for fiscal 2025 is guided in the range of $16.25 to $16.75.

In addition to the upbeat earnings outlook, Cintas has also recently raised its dividend by more than 15%. While the dividend yield is low, at less than 1%, the current payment of $1.56 per common share annualizes to $6.24. The higher dividend was paid on September 3.

But the biggest news for Cintas investors is the coming stock split. The company announced this move back in May; on September 11 this year, shareholders of record as of September 4 will benefit from a 4-for-1 stock split; that is, each shareholder will receive 3 new shares to add to the existing holding. Based on current pricing levels, the split will bring the shares down to slightly less than $200 each.

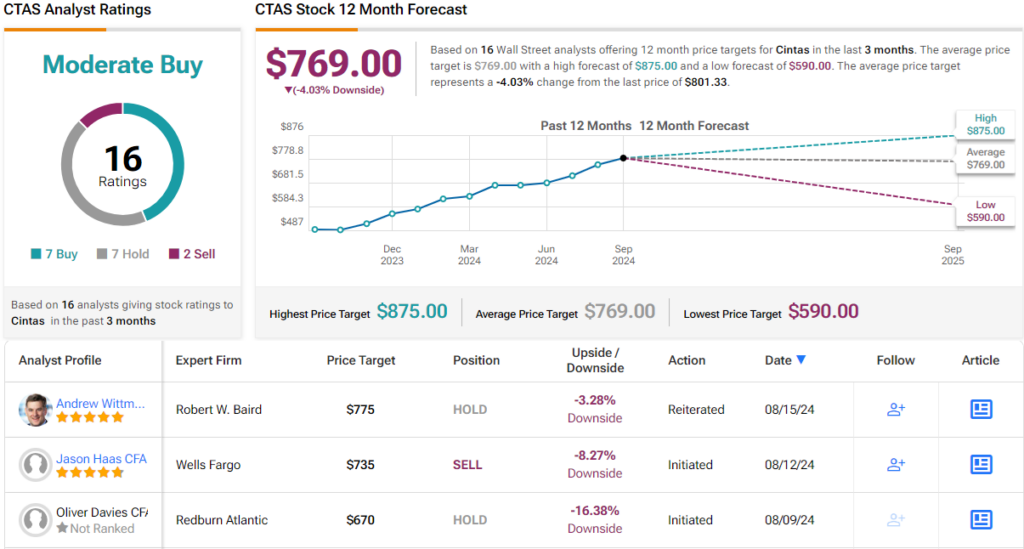

Nevertheless, Baird analyst Andrew Wittmann does not see a lot of upside here. He believes the stock is overvalued, even with the split in the offing.

“At present valuation levels we see limited upside… We want to be clear, we do not have any fundamental concerns about CTAS’ model/value-proposition, execution quality, or any of the myriad of benefits which stem from its scale advantage. Moreover, while the labor market appears to have shown some signs of softening, and competitors have highlighted a degree of increased competition, even these are not overly concerning to us… Net, we’re hopeful that we’ll get another shot to recommend CTAS, but for now we believe shares discount most of the good news,” Wittmann opined.

Wittmann rates CTAS shares a Neutral, with a price target of $775, suggesting the shares will stay rangebound for the time being. (To watch Wittmann’s track record, click here)

As for Wall Street’s overall stance on Cintas, the stock holds a Moderate Buy consensus, based on 16 analyst reviews: 7 Buys, 7 Holds, and 2 Sells. However, with a current trading price of $802 and an average price target of $769, analysts project a potential decline of 4% from current levels. (See CTAS stock forecast)

Lam Research (LRCX)

For the next stock on our list, we’ll shift our sights to the semiconductor chip industry. Lam Research is a provider of the sophisticated fabrication equipment used in manufacturing silicon microchips. Lam specializes in the high-tech devices used to make and prepare silicon wafers, the basic raw material of the semiconductor chip. Lam’s products cover a wide range of chip-making processes, and the company is known as an innovative supplier of services and devices within the industry. Lam operates globally and is headquartered in Fremont, California, near the heart of Silicon Valley.

Shares in Lam Research peaked in the first half of July this year, at more than $1,120, and the stock has fallen almost 35% since then. Headwinds on the stock include a sluggish market for memory chips and increased tensions between the US and China as the two powers argue over imports and exports in the technology sector.

On the company’s financial side, both revenues and earnings have been showing modest sequential gains for the last several quarters. In the last report, covering the ‘June quarter’ of 2024, the company reported $3.87 billion at the top line, up year-over-year by more than 20% and beating the forecast by a modest $40 million. The bottom line, reported as a non-GAAP EPS, came in at $8.14 per share, or 55 cents better than had been anticipated.

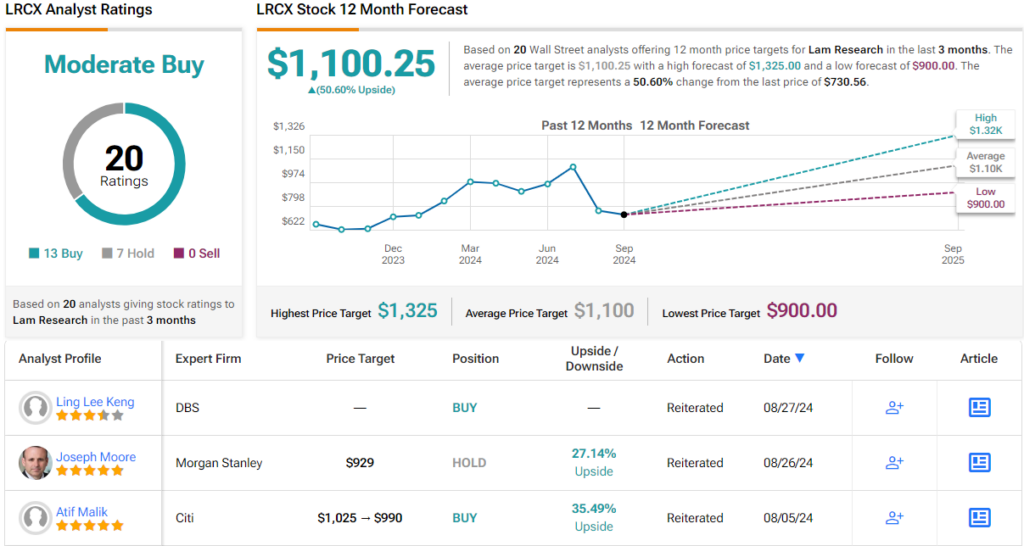

Bank of America’s 5-star analyst, Vivek Arya, who ranks in the top 1% of Wall Street experts, believes the stock is poised for a rebound. Arya views a recovery in the memory chip market as a key positive for Lam’s prospects.

“Optimism around a NAND recovery is building supported by an upwardly revised view for modest YoY CSBG growth in part fueled by higher utilization rates. Importantly, LRCX is revenue agnostic to a tech-transition led upgrade cycle vs. greenfield adds. Leading-edge foundry/logic should see pickup from both GAA and HBM/advanced packaging ($1bn+ sales each this year), both of which are trending higher vs 1-quarter ago into C2H/C2Y5E due to outsized demand. L-t, LRCX can maintain dep/etch leadership with new conductor etch tools for 4F squared DRAM and cryo etch for NAND,” Arya opined.

Arya goes on to give LRCX shares a Buy rating, with a $1,200 price target that suggests a one-year upside potential better than 63%. (To watch Arya’s track record, click here)

The general view of LRCX from the Street is a Moderate Buy, based on 20 reviews that include 13 to Buy and 7 to Hold. The shares are trading for $729.10 and the average target price of $1,100.25 points toward a gain of ~51% on the one-year horizon. (See LRCX stock forecast)

Looking at the available data, it’s clear that Wall Street’s analysts see LRCX shares as the superior stock pre-split.

To discover promising stock ideas that are poised for stock splits, check out TipRanks’ Upcoming Stock Splits Calendar, a comprehensive resource for staying ahead of potential opportunities.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.