Movie theater chain AMC Entertainment (AMC) fell in today’s trading, and data shows that short sellers are likely closing in. The struggling company hasn’t seen much upward mobility over the past year since the brief meme stock rally of May 2024.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Indeed, shares are currently down 30% year-to-date. This poor performance seems to be prompting short sellers to bet against the meme stock as it continues to trend downward.

Data from short analysis platform Fintel shows that short interest currently accounts for 17% of AMC stock’s float. In addition, short sellers would require more than 12 days to cover their positions. The clear takeaway is that bearish energy is rising as the stock falls.

What’s Happening with AMC Stock?

After an early pop in trading today, AMC stock gradually declined by 1.61% and looks primed to continue sinking deeper into the red. This may not seem too poor of a performance at first glance, but the fact that AMC has fallen more than 50% over the past year should remind investors that the company is displaying consistent instability.

If the rising interest from short sellers is any indication, shares will likely continue to decline as the year winds to a close. AMC’s problems aren’t likely specific to its industry. Fellow movie theater chain Cinemark (CNK) has enjoyed an excellent year, rising 83%, while AMC stock has been sinking.

Additionally, short sellers don’t seem as focused on meme stock peer Gamestop (GME) as they do on AMC. Short interest accounts for only 9% of GME’s float. This makes sense, as GME has outperformed AMC for the year with gains of 54%. Short interest in it is fairly high but still lower than AMC’s 17%.

Is There Any Hope for AMC Stock?

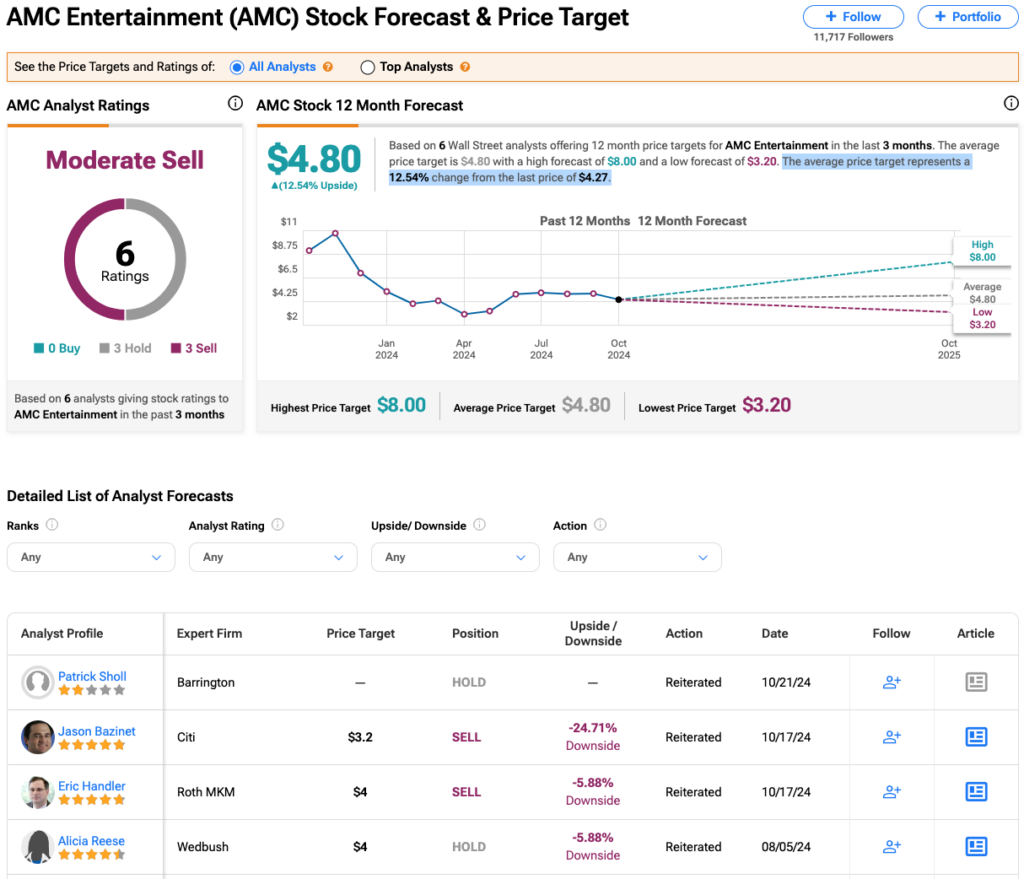

Overall, it definitely seems as though short sellers are increasing their bets against AMC stock. This makes sense, as Wall Street remains mostly bearish on it. Analysts maintain a Moderate Sell consensus on it based on zero buys, three Holds, and three Sells over the past three months. Furthermore, the average AMC price target of $4.80 represents a 12.54% change from current levels.

From short sellers to Wall Street analysts, it’s clear that many people aren’t optimistic about AMC’s growth prospects. TipRanks contributor Bernard Zambonin recently compared it to Gamestop and Trump Media & Technology Group (DJT), flagging AMC as the worst bet out of the three meme stocks. The rising short interest in AMC indicates that this bearish thesis is picking up momentum.