Archer Aviation (ACHR) has reached a new milestone after adding more than 300 patents from Lilium’s (LILMF) former portfolio, bringing its total to over 1,000 assets. The company paid about €18 million ($21 million) for the package after winning a competitive bidding process that included Joby Aviation (JOBY) and Vertical Aerospace (EVTL).

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following this latest win, Canaccord Genuity’s four-star analyst Austin Moeller reiterated a Buy rating on Archer with a $13 price target, which implies an 8.5% upside. He believes the acquisition gives Archer access to valuable eVTOL technologies that could strengthen its future aircraft lineup.

Meanwhile, ACHR shares rose an impressive 5.68% on Monday, closing at $11.98.

New Technology and Industry Implications

The Lilium patents cover several key areas such as advanced battery design, high-voltage systems, propellers, flight controls, and ducted fans. According to Moeller, Archer’s decision to buy these assets suggests confidence in Lilium’s earlier work, particularly its silicon-dominant anode battery technology.

That battery design was validated by the U.S. Department of Energy’s Idaho National Laboratory in 2023, showing up to 50% higher energy density and five times more power than earlier cells. Moeller said Archer may adapt the technology for the next generation of its Midnight eVTOL aircraft. With that, the aircraft could gain better range and carry more weight, while also addressing flight reserve limits required under visual flight rules.

Potential Catalysts Ahead

Moeller advised investors to watch for updates on Archer’s future Midnight battery systems in upcoming earnings calls. He also pointed to Archer’s joint work with defense contractor Anduril on a hybrid-VTOL drone project for the Department of War. In addition, he noted that the U.S. Army plans to launch a new Collaborative Combat Aircraft program that could feature rotorcraft drones, offering another potential growth path for the company.

Overall, Moeller’s reiterated rating signals steady confidence in Archer’s strategy as the company strengthens its patent portfolio and positions itself for future opportunities in both commercial and defense aviation markets.

Is Archer Aviation Stock a Good Buy?

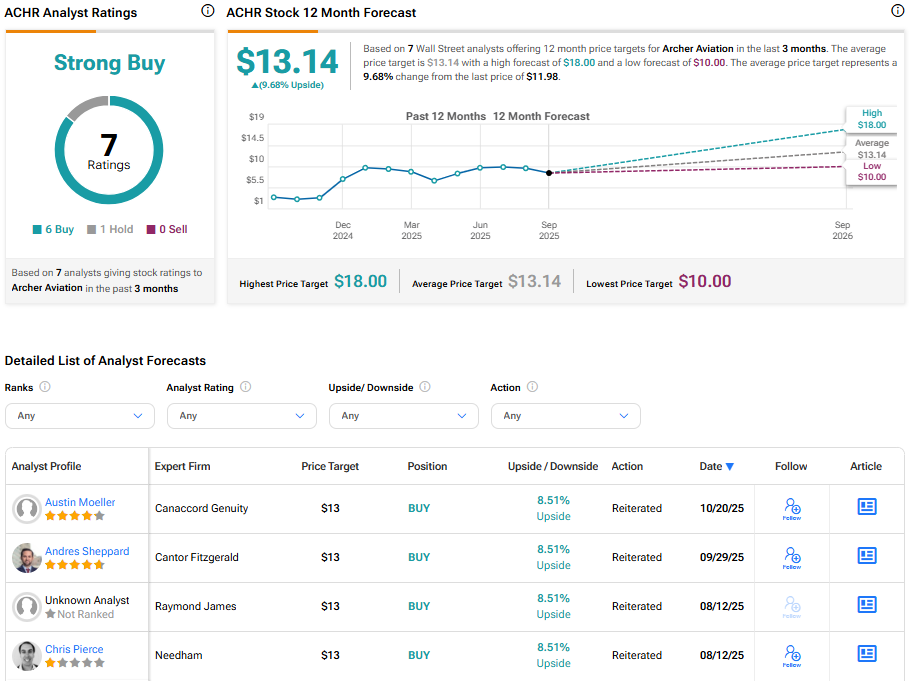

On Wall Street, analysts remain optimistic about the company’s prospects. Based on seven recent ratings, Archer Aviation boasts a “Strong Buy” consensus with an average 12-month price target of $13.14. This implies a 9.68% upside from the current price.