Online advertising is a big revenue generator. And that makes advertising technology firm AppLovin (APP) a particularly attractive play for some investors. However, that investor enthusiasm is putting it on the spot in terms of its upcoming earnings.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

APP stock is up nearly 300% this year. Thanks to that massive run-up, AppLovin is the best-performing stock among U.S. technology companies, at least among those with a market capitalization of $5 billion or more. And with its earnings report coming out on November 6, that means a lot of very real concerns about whether or not it can produce earnings that justify the huge surge in its share price.

AppLovin stock started its ascent three years ago, when it got a boost from online gaming during the pandemic. AppLovin has capitalized by connecting itself to artificial intelligence (AI), technology that has allowed it to better target online advertisements.

Other News About AppLovin

That alone might be reason enough to take interest in AppLovin stock, but another point from Wells Fargo (WFC) analysts is helping APP stock as well. Wells Fargo currently has an Overweight rating on AppLovin stock and a $200 price target.

Wells Fargo compared AppLovin to Alphabet (GOOGL), noting that AppLovin’s presence in mobile gaming is very similar to Alphabet’s, and its position in overall “programmatic advertising.” In fact, the bank noted that AppLovin might be in line for a compound annual growth rate (CAGR) of 20% to 30% through 2027 thanks to the sheer size of its “mobile-game user acquisition market.”

Is AppLovin Stock a Good Buy?

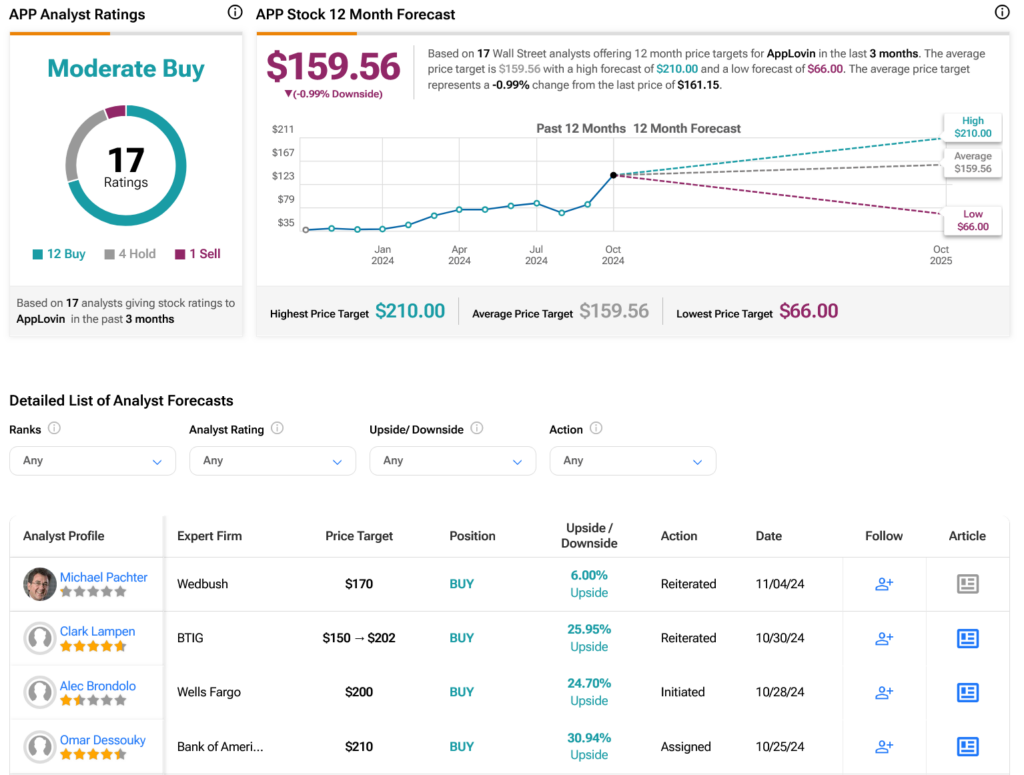

Turning to Wall Street, analysts have a Moderate Buy consensus rating on APP stock based on 12 Buys, four Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 306.85% rally in its share price over the past year, the average APP price target of $159.56 per share implies 0.99% downside risk.