Apple (AAPL) is scheduled to report its Fiscal third-quarter earnings on August 1st. Since hitting its yearly low in mid-April, AAPL stock has surged 40%, despite earlier doubts about its AI capabilities. As a long-term bull on Apple, I believe much of what will be reported in Fiscal Q3 has already been factored into the stock price. However, this quarter could also mark the end of Apple’s recent struggles, with the iPhone “supercycle” on the horizon.

The upcoming launch of AI-powered iPhones is expected to boost demand for Apple’s devices over the next few quarters. And even if Fiscal Q3 results disappoint, I believe the company’s growth trajectory in AI is just beginning, and neglecting the stock now would be a mistake.

iPhone’s Cycle Update in Progress

The Cupertino company has experienced an inflection point over the past few months regarding its advances in AI technology. While Big Tech peers like Microsoft (MSFT), Google (GOOGL), and Nvidia (NVDA) have arguably been the biggest beneficiaries of the AI boom, Apple was apathetic until May at the earliest.

Everything changed when Apple previewed some of its newest software at June’s developer conference (WWDC). For example, iOS 18 was built around a new AI feature set, and big changes are coming to Siri. Some of these announced features will only be available on newer devices, which could stimulate the exchange of older iPhones for newer models.

This year, iPhone demand has taken a hit in critical regions like China, where market share has declined against local competitors. An example of how AI updates could ignite a new upgrade cycle can be seen in China. According to Wedbush analyst Dan Ives, out of 230 million iPhones there, 70% haven’t been upgraded in the last three years. Zooming out globally, out of the 1.5 billion iPhones in use worldwide, 270 million haven’t been upgraded in four years.

In my view, Apple’s durable hardware quality often delays the upgrade cycle. However, AI innovations in software and chips could likely accelerate the need for upgrades.

But this transformation will take time and will only materialize in the coming quarters. This makes Fiscal Q3 potentially a transitional quarter in this process, with customers possibly waiting for the iPhone 16 launch, thus holding back iPhone demand.

What Else to Watch in AAPL’s Fiscal Q3 Report

The main numbers to watch for Apple’s Fiscal Q3 are the consensus revenue estimate of $84 billion and EPS of $1.33. If Apple manages to beat EPS results again, it will mark the sixth consecutive quarter of beating estimates. In fact, with the exception of Fiscal Q1 2023, Apple hasn’t missed an EPS estimate since 2016.

However, even if Apple meets these numbers, they will represent modest annual top and bottom line increases of 2.7% and 5.6%, respectively. I believe this consensus is already loaded with skepticism about Apple delivering a modest June quarter in terms of performance.

Apple has been slipping with underperforming iPhone net sales for the past three quarters. In Fiscal Q2, year-over-year comparisons showed a roughly 10% drop in iPhone revenues as well as in the Wearables, Home and Accessories segment. iPad sales also fell dramatically by 17%. If it hadn’t been for the Services segment, which reached a record $23.8 billion in revenue for 14% growth, last quarter would have been even more tragic.

If there are any positive surprises expected in Apple’s Fiscal Q3 that could deviate from the current trend, they are likely linked to the performance of the Services segment. Investors should closely monitor this segment because it’s crucial for sustaining Apple’s growth, especially with the new iPhone “supercycle,” powered by AI, rolling out.

The seamless integration within Apple’s ecosystem has been key to the segment’s strong performance. This business often uses a subscription model, effectively capturing future revenues and adding predictability to Apple’s financials.

Thus, the Cupertino company managed to report gross margins of almost 75% in this segment, while products had a gross margin of 36% last quarter. The increased representation of Services also contributed to Apple maintaining strong operating income, reaching $27.9 billion, slightly higher than the LSEG consensus of $27.6 billion. This was not only due to increased revenue but also to a margin that exceeded expectations by 10 basis points.

AI Updates Are Likely Priced In

Many analysts have already accounted for Apple achieving 15% EPS growth and 8% revenue growth for Fiscal 2024. Some might find the forward P/E of nearly 31x quite high for a Big Tech company with single-digit projected top-line growth and trading well above its five-year average P/E of 28x (its current trailing P/E is 36x).

The stock’s notable underperformance earlier this year was quickly turned around following Apple’s forward-looking announcements about integrating AI into its devices. This propelled AAPL to all-time highs (see below for how much AAPL rose after the WWDC).

Even though Apple’s AI updates are likely priced in ahead of Fiscal Q3 earnings, I believe that when AI demand starts hitting Apple’s immense user base, it will lead to continuous linear growth in net sales. That’s why my bullish stance on Apple remains strong for the long haul. I believe it’s a one-of-a-kind stock to own rather than trade.

Is AAPL Stock a Buy, According to Analysts?

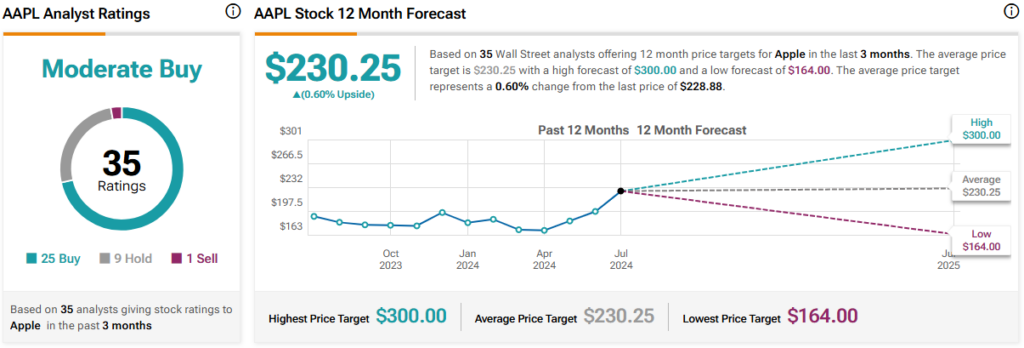

Most Wall Street experts are bullish on Apple, though moderately. Out of the 35 analysts covering AAPL, 25 recommend buying, nine are neutral, and only one holds a bearish view, giving it a Moderate Buy consensus rating. This moderation is reflected in the average AAPL stock price target of $230.25, indicating upside potential of just 0.6%.

Key Takeaway

Although Apple’s fiscal third quarter might show lackluster demand growth, it could signal the end of recent demand struggles, especially with AI advancements on the horizon. Challenges in product demand are likely to continue until the new iPhone launches and the AI-driven innovation cycle gains momentum in the coming quarters.

Therefore, Apple bulls shouldn’t worry too much if the Cupertino giant reports numbers that aren’t stellar. Fiscal Q3 might just be a period of holding steady until the bigger moves come into play.