Smartphone giant Apple (AAPL) has always been, at the very least, a popular brand. But there are some distressing signs about just how popular it really is. Reports from China suggest it is losing some ground against Huawei. Investors have taken it mostly in stride, and shares have recovered strongly this week after some shaky trading earlier this month.

New reports from CNBC noted that there was a growing interest in Huawei’s new trifold phone, which is actually more expensive than the alternative from Apple. However, while there was a line outside the Apple Store the day the new iPhone 16 was released, there was no line discovered outside Huawei’s shop.

Yet, despite this, Apple actually appears to be on the decline in China. Apple dropped out of the top five slots in overall market share for the first time, replaced by domestic brands, noted data from Canalys. Huawei has been trying to recover its prominence after United States sanctions cost it the United States market back in 2019. It has been focused on its domestic operations in China.

A Matter of Timing, and Preorders

While, as mentioned above, customer lines were observed at Apple stores but not Huawei stores, there may have been a reason for that. A report from Reuters noted that several potential Huawei customers left the store, angry because they could not get the phone in question. Apparently, the new Mate XT—the trifold phone in question—could only be purchased with a confirmed preorder.

Huawei seems to have reestablished momentum in China and, ultimately, potentially a bigger following than Apple.

Is AAPL Stock a Good Buy Right Now?

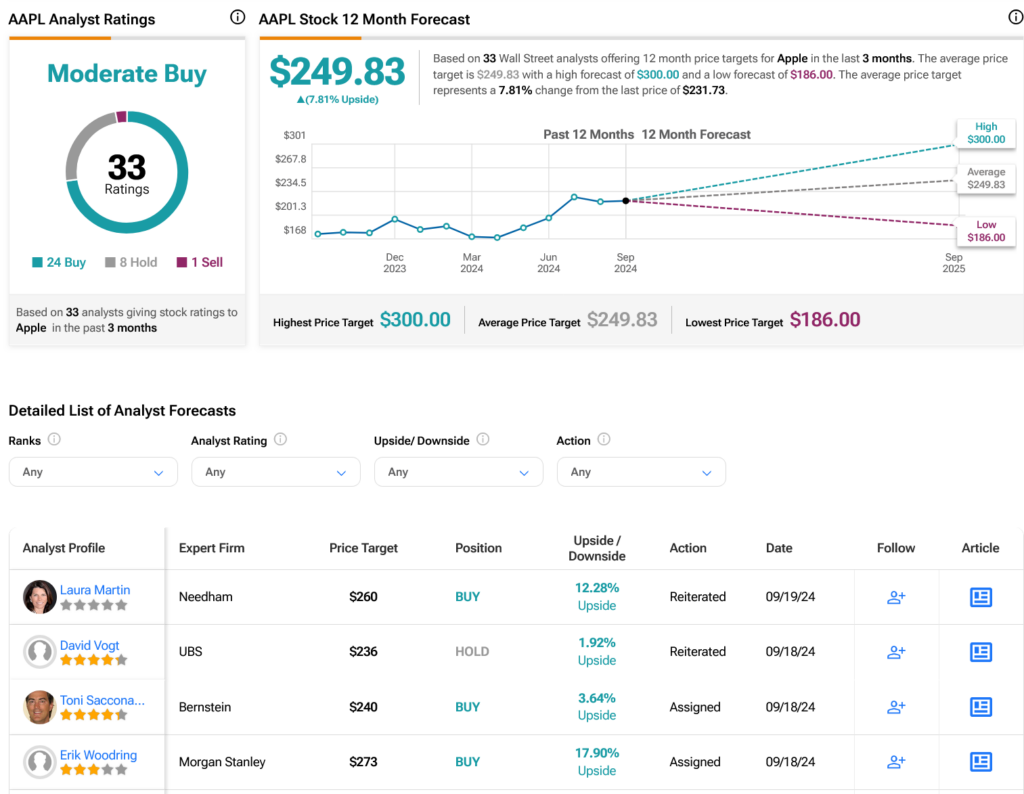

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 24 Buys, eight Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 33.82% rally in its share price over the past year, the average AAPL price target of $249.83 per share implies 7.81% upside potential.