Apple (AAPL) has increased its investment offer in Indonesia to $100 million from $10 million, according to Bloomberg’s report. With this new investment, the tech giant aims to reverse the ban placed by the Indonesian Ministry of Industry on the iPhone 16 sales in the country.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The new proposal reflects AAPL’s interest in the Indonesian market. With a population of over 278 million, the country offers potential for Apple to boost its consumer base and revenue growth.

Investors should note that the Indonesian Ministry of Industry is yet to approve AAPL’s new proposal.

Indonesia Seeks Higher Local Investments

To gain access to the Indonesian market, Apple must comply with the Domestic Component Level (TKDN) certification, which requires foreign companies to have at least 40% local parts in their products. This can be achieved by either manufacturing locally or setting up R&D facilities in Indonesia.

Notably, Apple’s failure to meet these TKDN requirements led to a sales ban in October. In response, the ministry has asked Apple to focus on developing R&D capabilities in Indonesia for its smartphones.

Just like Apple, Alphabet’s (GOOGL) Google Pixel phones have faced similar restrictions due to limited investment in the country. Also, TikTok owner ByteDance invested $1.5 billion in a joint venture to operate in Indonesia.

What Is the Price Target for AAPL?

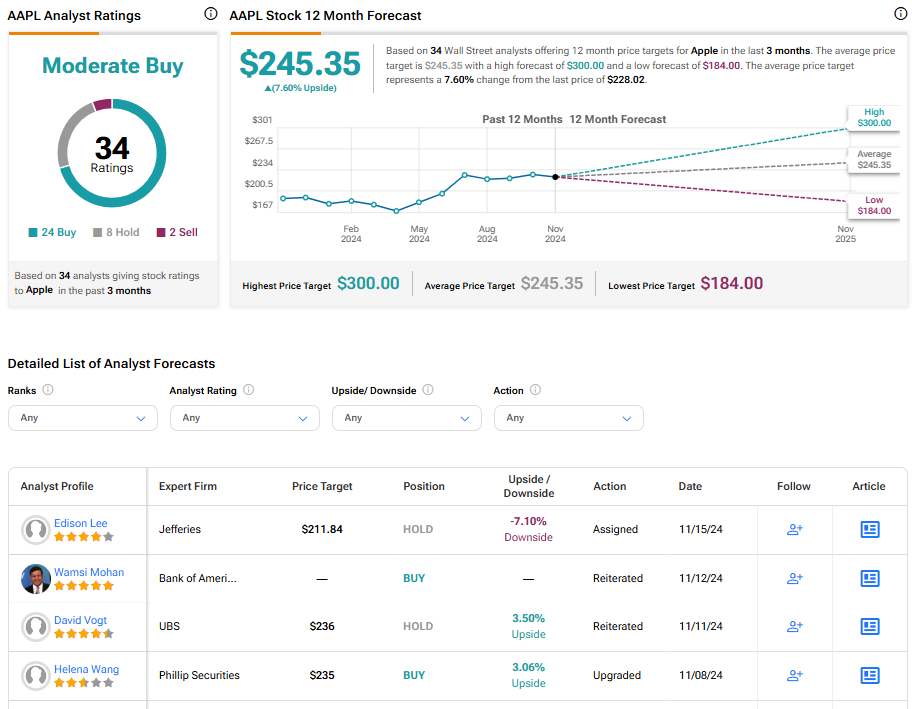

Turning to Wall Street, AAPL has a Moderate Buy consensus rating based on 24 Buys, eight Holds, and two Sells assigned in the last three months. At $245.35, the average Apple price target implies a 7.6% upside potential. Shares of the company have gained over 19% year-to-date.