As the month draws to a close, we’re seeing more and more earnings results come in – especially from the mega-cap companies that have been leading the stock markets. The market giants – the ‘Magnificent 7’ tech firms, especially – are known as leaders in their fields. Where they go, others will follow.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Today, two standout members of the Mag 7, Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN), are slated to release their quarterly results after market close. All eyes will be on them – and for good reason.

Jefferies analysts have stepped in with a deep dive into both companies, ultimately highlighting one as the prime tech pick to consider ahead of the earnings releases. Let’s take a closer look.

Apple

We’ll get this started with Apple, the $3.45 trillion company that leads the stock market. Since its founding in the 1970s, Apple has consistently led the way in high-tech innovation. This year’s product launches underscore the company’s commitment to maintaining its position at the cutting edge of the tech industry.

In June, Apple unveiled its latest AI initiative, Apple Intelligence. This feature is integrated across Apple’s iPad, Mac, and iPhone product lines, offering users an advanced digital assistant designed to enhance personal expression in digital interactions. Apple Intelligence tailors itself to each user by accessing personal content and files stored across their Apple devices. By leveraging its proprietary operating system, Apple not only reinforces its ecosystem but also provides a rich, personalized foundation for generative AI applications that seamlessly interact across devices.

This month, Apple has made several important pre-earnings announcements that are of interest to investors. First, the company is continuing with efforts to expand its production base outside of China. To that end, Apple announced that, in the six months ending in September, it has exported $6 billion worth of iPhones that were produced in India. The company has also released details on new computers in its Mac line. The new MacBook Pro lineup is based on the M4 chip family featuring 3-nanometer technology, while the new Mac mini, also powered by the M4 chips, is the model’s first new design since 2010. All of the new Macs will feature the Apple Intelligence AI.

One important question remains, however, as we look to Apple’s upcoming earnings results today. The company has become highly reliant on its iPhone line to drive revenues – and last year, the smartphones were responsible for more than half of Apple’s total sales. In the last reported quarter, however – fiscal 3Q24, ending in June of this year – Apple’s iPhone sales, at $39.3 billion, made up 46% of the $85.8 billion revenue total. Investors will be looking to see how that data point is moving in the fiscal Q4 report.

The Street is expecting to see a fourth-quarter top line of approximately $94.4 billion, and earnings of $1.60 per share.

This might not be enough for Jefferies’ Edison Lee. The analyst notes that the company remains dependent on iPhone sales and has yet to prove that its AI will clear the bar of expectations.

“AAPL remains all about the iPhone, as not only did the iPhone contribute 52% of FY23 revenue, but also drives other Apple device adoption and thus service revenue growth. A lack of material new features and limited AI coverage mean high market expectations (5%-10% unit growth) are unlikely to be met. Our analysis suggests weaker-than-expected initial demand. We forecast flattish volume growth for 2HCY24 iPhone 16 vs 15, and only 2.5% growth in lifecycle volume for iPhone 16,” Lee opined.

Looking ahead, Lee adds, “We are cautious near term as: 1) AAPL’s FY24E PE is close to the all-time high, 2) iPhone 16 volume expectations are very high, and 3) our 4QFY24E is below cons. However, our FY26E earnings are above cons, and our upside valuation ($306.99) is based on AAPL charging US$10/month for AI.”

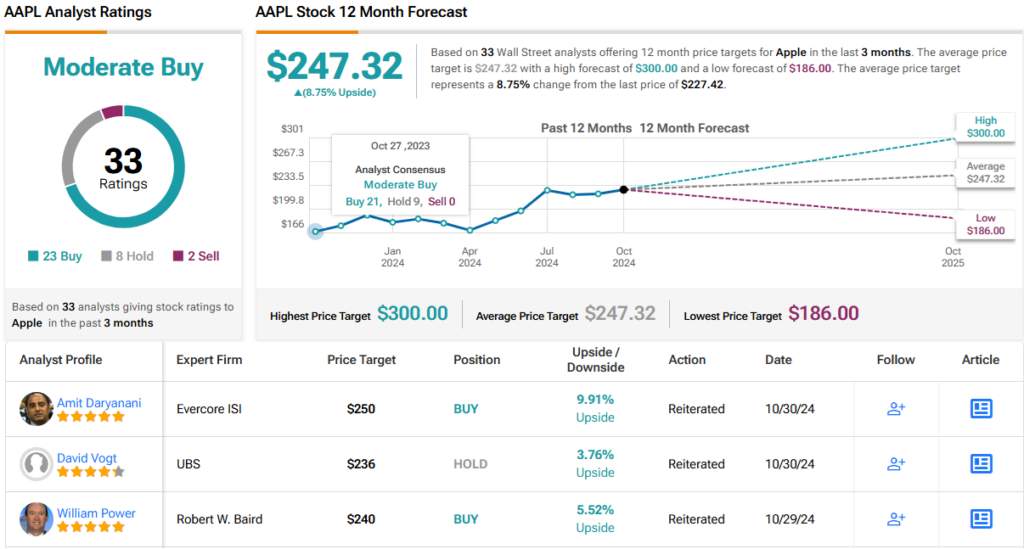

Consequently, Lee advises a wait-and-see approach, rating Apple shares a Hold (i.e. Neutral) with a $212.92 price target, implying a 6% downside from current levels. (To watch Lee’s track record, click here)

Overall, Apple has earned a Moderate Buy consensus rating from Wall Street, based on 33 recent analyst reviews on file that include 23 Buy recommendations, 8 Holds, and 2 Sells. The shares are priced at $227.5, and the average price target of $247.32 implies a ~9% upside. (See AAPL stock forecast)

Amazon

The next stock on our list, Amazon, is the world leader in online retail. The company survived the dot.com bubble of the early 2000s and has expanded from its origin as “the online bookstore” to become a true “one-stop shop” and an absolute giant in digital retail.

Amazon has cemented its place among the “Magnificent 7” with its $2 trillion market cap, ranking it as the 5th largest among Wall Street’s publicly traded companies. Online retail forms the core of Amazon’s business and provides the foundation on which the company is building an array of additional products and services.

These include Amazon Web Services, the company’s cloud computing platform. Dubbed AWS, the cloud platform has become increasingly popular with subscription customers since its launch and is an important component of Amazon’s total revenue. In 2Q24, the last reported quarter, AWS generated $26.3 billion in revenue, or nearly 18% of the company’s total of $148 billion for the quarter.

In the Q3 report, expected after the closing bell today, Amazon is predicted to show a top line of more than $157 billion, marking a year-over-year gain of 10%.

Looking into the Q3 predictions, Jefferies analyst Brent Thill finds reason to maintain an upbeat take on Amazon. He writes of the company’s prospects, “N-T set up looks challenging as investors fear Q4 EBIT guide will miss cons. due to weak consumer and AWS compression from record 1H mgns. Also, stock has rebounded since Q2 earnings and is beating GOOGL & MSFT YTD. We think mgn fears are overblown as cost discipline continue under CEO Jassy, high-mgn AWS and Advertising outgrow retail, and macro is stable. Valuation attractive at 12.1x EV/EBITDA-NTM vs. 10-yr avg 19.2x. Continue to like AMZN L-T.”

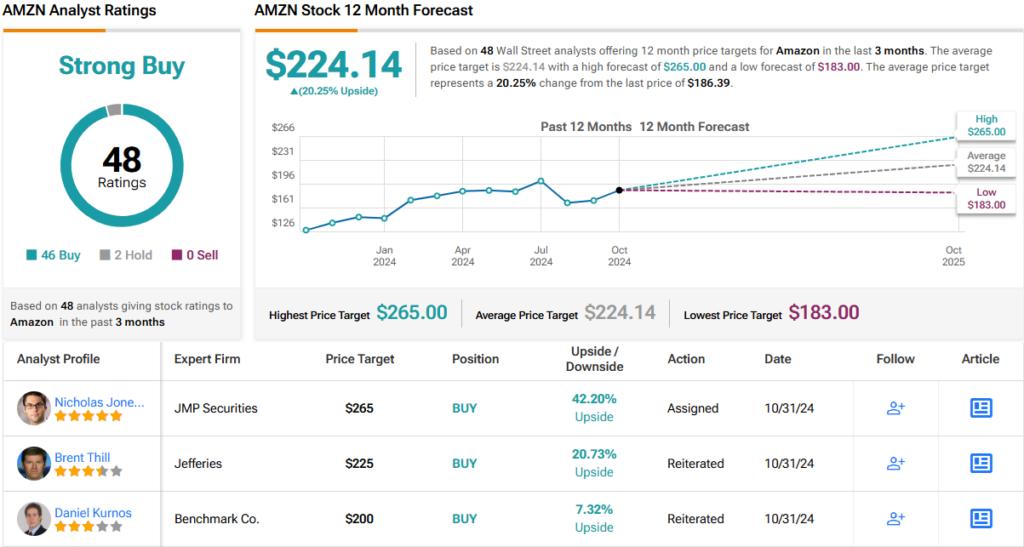

Thill backs up his stance with a Buy rating on the stock, along with a $225 price target that reflects his confidence in a ~21% upside by this time next year. (To watch Thill’s track record, click here)

All in all, Amazon has picked up 48 analyst reviews from the Street’s analyst corps in recent weeks, showing a lopsided split of 46 Buys and 2 Holds – giving the shares a Strong Buy consensus rating. The Street’s average target of $224.14 is practically the same as Thill’s. (See AMZN stock forecast)

Now that the facts are in and we’ve read the analysts’ comments, it’s clear that Jefferies sees Amazon as the better tech stock to buy in advance of the earnings reports.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.