iPhone maker Apple (AAPL) will release its fiscal Q3 financials on August 1. Analysts expect earnings per share to come in at $1.34, up 6.3% from the year-ago quarter. Meanwhile, analysts expect revenues of $84.17 billion, reflecting a 3.2% year-over-year increase, according to TipRanks’ data.

Interestingly, AAPL has an encouraging earnings surprise history. The company missed earnings estimates just once out of the previous 15 quarters.

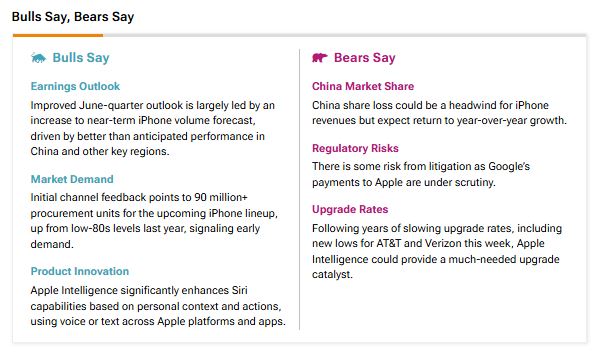

Insights from TipRanks Bulls Say, Bears Say

According to TipRanks’ Bulls Say, Bears Say tool, analysts believe that Apple’s improved June-quarter outlook is driven by an increase in near-term iPhone volume forecasts. However, bears pointed out that China’s market share loss could be a headwind for iPhone revenues. They also pointed out regulatory headwinds, with scrutiny over Google’s payments to Apple posing a potential litigation threat.

Options Traders Anticipate a Minor Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 4.26% move in either direction.

What Is the Price Target for Apple?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on APPL stock based on 25 Buys, nine Holds, and one Sell assigned in the past three months, as indicated by the graphic below. The average AAPL stock price target is $240.61, implying a downside potential of 10.25%.