Shares of automation platform provider Appian (NASDAQ:APPN) are tanking in the pre-market session today on its third-quarter numbers.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

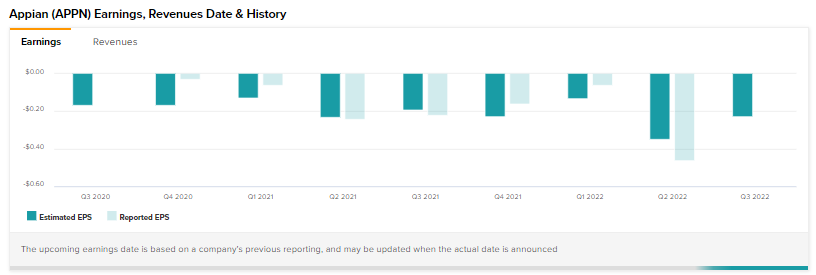

Revenue rose 27.6% year-over-year to $117.9 million, outperforming estimates by ~$1.8 million. Net loss per share at $0.43 though, came in wider than estimates by $0.20.

During the quarter, while cloud subscription and total revenue grew by over 30% (in constant currency), adjusted EBITDA loss came in higher owing to pull-forward hiring and a decline in attrition.

The company plans to lower losses to 10% of its top line by H2 2023. For the fourth quarter, Appian now expects total revenue to land between $121.5 million and $123.5 million, implying a growth between 16% and 18%.

Net loss per share is expected to hover between $0.36 and $0.42. The net loss outlook came in wider than the investors’ expectations.

Read full Disclosure