Nvidia (NASDAQ:NVDA) has generated plenty of excitement (and some uncertainty) surrounding the development of its new Blackwell chips, the company’s latest offering.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The successor to the Hopper GPU, Blackwell’s release was delayed for a few months due to design issues. However, the chips are now expected to begin shipping later this year.

The chips are already in hot demand from tech firms – they are sold out for the next 12-months – backing up CEO Jensen Huang’s gung-ho declaration of “insane demand” for Blackwell.

The question for investors is whether or not this will translate into additional gains for Nvidia’s stock, which is already up 190% in 2024.

One investor, known by the pseudonym Envision Research, is confident that it will.

“The recent Blackwell deployment by Microsoft and the integration with closed-loop liquid cooling suggest to me that Nvidia is poised for another ramp-up in its AI chip sales,” the 5-star investor opined.

Envision highlights Blackwell’s improved computing power and energy efficiency. With expertise in renewable energy and thermal-fluid sciences, the investor asserts that cooling is a key obstacle for AI expansion, and Nvidia is well-positioned to overcome it.

Microsoft seems to agree, having recently integrated Blackwell and closed-loop liquid cooling into its Azure infrastructure, further validating the potential of Nvidia’s new chips.

Super Microcomputers, another big player, has also seen success with liquid cooling, reporting power savings of up to 40% for AI applications.

Envision highlights that Nvidia’s Blackwell chips, boasting 30x higher throughput and 25x better energy efficiency, paired with liquid cooling, could revolutionize customers’ budget allocations.

Moreover, Envision underscores Nvidia’s robust software ecosystem is what allows Blackwell to operate at peak performance, giving the company yet another layer to its industry-leading moat.

“This could mean that AI developers can rely on Nvidia for all their AI needs in the future, from hardware to software, without having to piece together solutions from multiple vendors,” continues Envision.

All this is happening while major tech firms continue ramping up capex spending to expand their data capacity.

“AI is a race that the tech majors cannot afford to lose,” Envision explains. “Multiple chief executives have all expressed the willingness to overinvest now rather than underinvest.”

As a result, Envision is upgrading Nvidia from a Buy to a Strong Buy. (To watch Envision Research’s track record, click here)

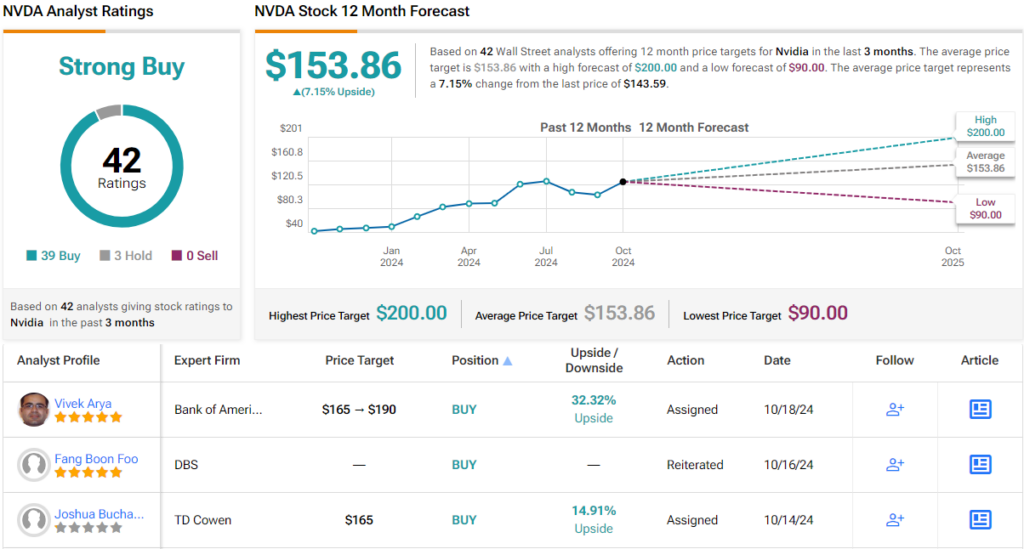

Wall Street agrees with this sentiment. With 39 Buy and 3 Hold ratings, Nvidia holds a consensus Strong Buy, and a 12-month average price target of $153.86 suggests potential gains of ~7%. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.