Zoom Video Communications (ZM) operates a cloud-based platform that connects people through videos and online chat services. Its solutions are used in areas such as videoconferencing and distance education.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Fiscal Q4 2022 ended January 31, Zoom reported a 21% year-over-year rise in revenue to $1.07 billion and surpassed the consensus estimate of $1.05 billion. It posted adjusted EPS of $1.29, which improved from $1.22 in the same quarter the previous year and beat the consensus estimate of $1.05.

For Fiscal Q1 2023, Zoom anticipates revenue in the band of $1.07 billion to $1.08 billion. It expects adjusted EPS in the range of $0.86 to $0.88.

Zoom ended Q4 with $5.4 billion. The company’s board has approved a $1 billion share repurchase program expiring in February 2024.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Zoom.

Risk Factors

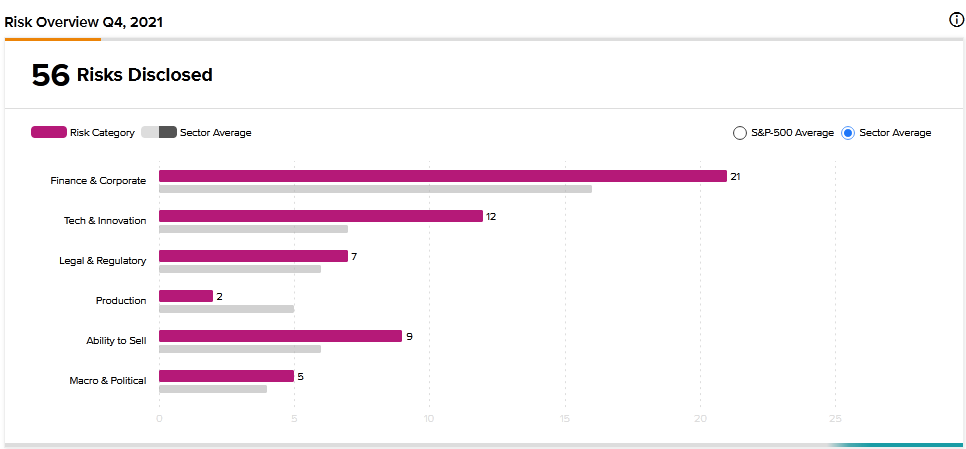

According to the new TipRanks Risk Factors tool, Zoom’s main risk category is Finance and Corporate, with 21 of the total 56 risks identified for the stock. Tech and Innovation and Ability to Sell are the next two major risk categories with 12 and 9 risks, respectively. Zoom has recently added three new risk factors to its profile. Here are the takeaways.

The company cautions investors that they should not rely on past revenue growth as an indication of future performance. It explains that while it has experienced robust growth in the past, revenue growth has begun to decline and may continue in future periods.

The company mentions that factors such as increased market penetration, slowing demand for its products, and increased competition may contribute to the slowing growth rate. It further cautions that declines in the growth rate could shake investor confidence in the business, which could adversely affect its stock price.

Zoom informs investors that it has made strategic investments in public and private companies. But it cautions that those investments may not deliver the expected returns, which could, in turn, have a material adverse effect on its business and operating results.

Finally, Zoom tells investors that its measurement of key business performance metrics may turn out to be incorrect. As a result, the company may have a distorted understanding of its business, which could affect its long-term strategies. It cautions that if its metrics are found to be inaccurate, its business and reputation may be harmed.

Zoom’s stock has declined about 40% year-to-date.

Analysts’ Take

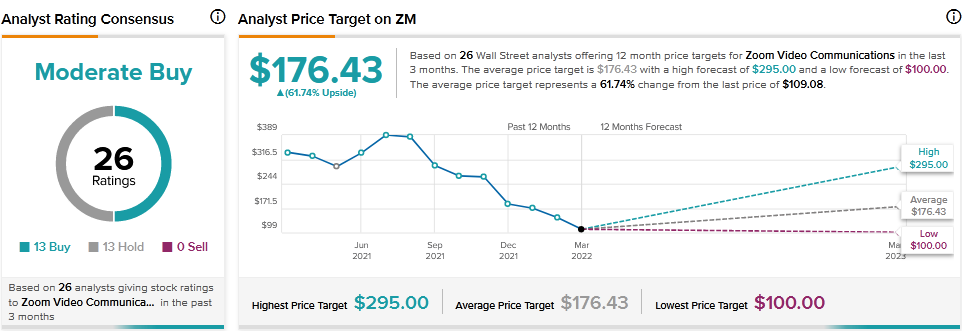

Barclays analyst Ryan MacWilliams recently reiterated a Hold rating on Zoom stock but lowered the price target to $150 from $245. MacWilliams’ reduced price target still suggests 37.51% upside potential.

Consensus among analysts is a Moderate Buy based on 13 Buys and 13 Holds. The average Zoom Video price target of $176.43 implies 61.74% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Related News:

CIBC Named One of Canada’s Best Diversity Employers

TD Bank Discloses 2030 Interim Financed Emissions Targets

Sun Life Launches Hybrid Online Advice Platform