RingCentral (RNG) is an American provider of cloud-based business communication and collaboration solutions. Its partners include telecom companies Deutsche Telekom (DTEGY), Frontier (FYBR), and Vodafone (VOD).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For Q4 2021, RingCentral reported a 34% year-over-year rise in revenue to $448 million and exceeded the consensus estimate of $434.9 million. It posted adjusted EPS of $0.39, which rose from $0.29 in the same quarter the previous year and beat the consensus estimate of $0.37.

RingCentral ended the quarter with $267 million in cash. The company’s board recently authorized a $100 million share repurchase program.

For Q1 2022, the company anticipates revenue in the band of $455 million to $459 million. The consensus estimate calls for revenue of $450.6 million. It expects to post adjusted EPS of $0.34, compared to the consensus estimate of $0.33.

With this in mind, we used TipRanks to take a look at the newly added risk factors for RingCentral.

Risk Factors

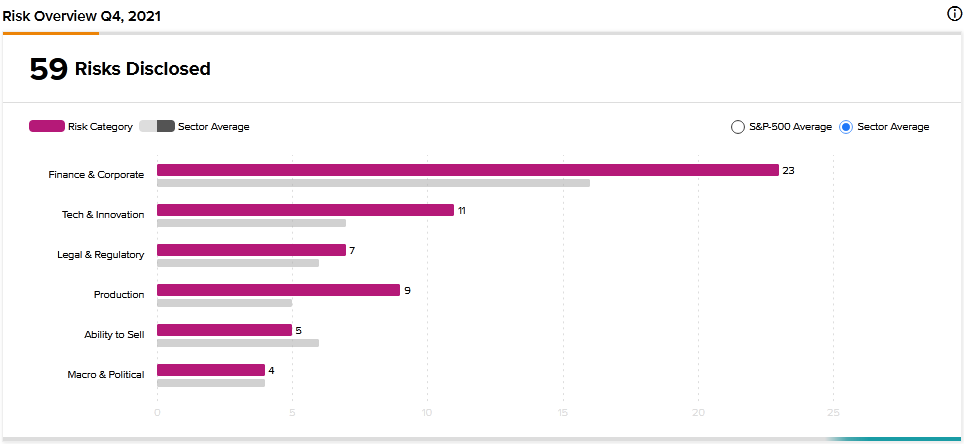

According to the new TipRanks Risk Factors tool, RingCentral’s top risk category is Finance and Corporate, with 23 of the total 59 risks identified for the stock. Tech and Innovation and Production are the next two major risk categories with 11 and 9 risks, respectively. The company has recently updated its profile with four new Finance and Corporate risk factors.

RingCentral informs investors that it cannot guarantee that it will fully implement its $100 million share repurchase program. It explains that it intends to fund the repurchase program with future cash flows and additional potential cash sources. It says that the timing and number of shares repurchased will depend on several factors, including the business condition and stock price.

The repurchase program is effective through December 2022, but RingCentral’s board will review it periodically and may adjust its terms. As a result, the company cautions that the program may be suspended at any time. But even if the program is fully executed, it will reduce the company’s cash reserves and may not enhance long-term shareholder value as anticipated.

In another newly added risk factor, RingCentral tells investors that the ownership interests of holders of its common stock would be diluted when its series A convertible preferred stock is converted into common stock. It further cautions that the conversion could also adversely affect its share price. Additionally, the company says that holders of the preferred stock have voting rights and could influence the outcome of matters related to the company’s capitalization and governance.

Analysts’ Take

KeyBanc analyst Steve Enders recently reiterated a Buy rating on RingCentral stock but lowered the price target to $252 from $295. Enders’ reduced price target suggests 120.43% upside potential.

Consensus among analysts is a Strong Buy based on 21 Buys and 3 Holds. The average RingCentral price target of $236.14 implies 106.56% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Related News:

FDA Approves Bristol Myers’ Injection for Non-Small Cell Lung Cancer

Boeing Signs MOU with Ethiopian Airlines; Shares Down 4%

Inside Bentley Systems’ Newly Added Risk Factors