Canada’s Constellation Software (TSE:CSU) is getting a number of price target upgrades after the company issued its latest financial results.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Toronto-based Constellation Software reported third-quarter financial results that largely beat analysts’ consensus expectations with revenue for the quarter ended September 30 rising nearly 20% year-over-year to $2.5 billion. The company reports its financial results in U.S. dollars.

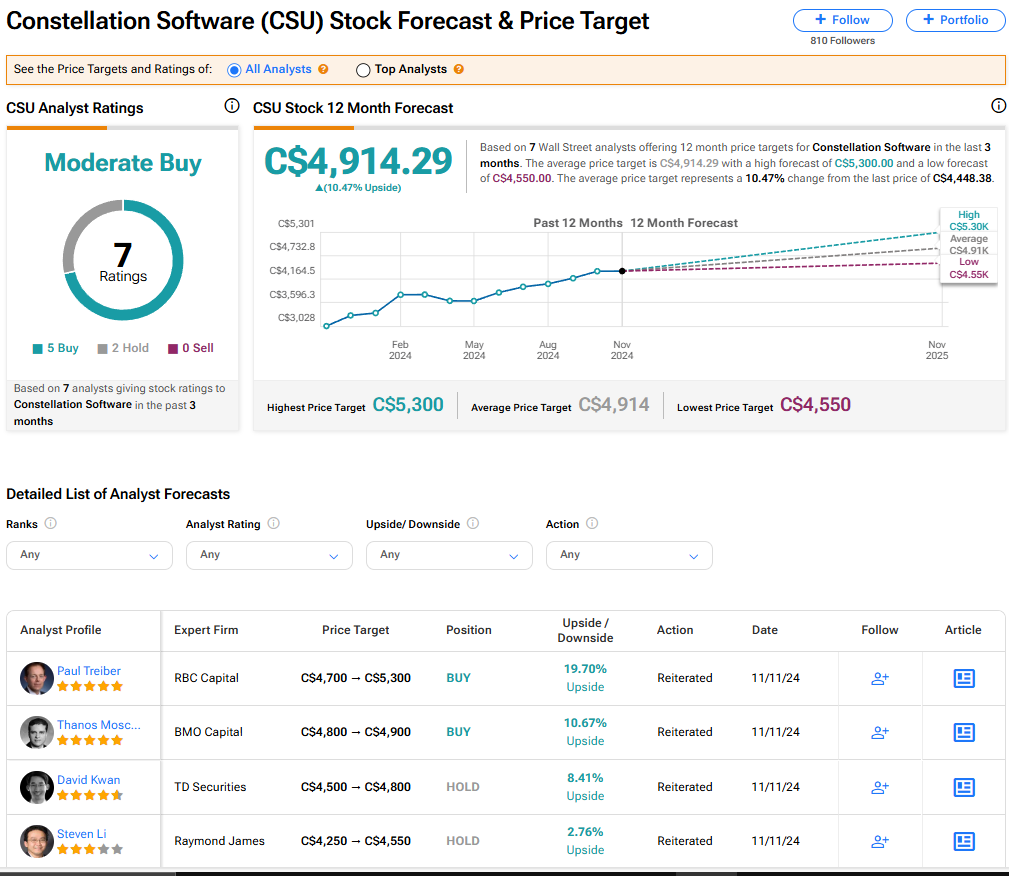

Following the Q3 print, a number of analysts have come out with bullish reports on CSU stock. RBC Capital Markets (RY) lifted its price target to C$5,300 from C$4,700 and maintained a Buy rating. Additionally, BMO Capital Markets (BMO) raised its price target on Constellation’s stock to C$4,800 while also keeping a Buy rating on the shares.

Canada’s Berkshire Hathaway

Constellation Software is a holding company or what’s sometimes called a “serial acquirer.” The company acquirers small and mid-sized specialty software companies. Constellation Software is often referred to as Canada’s Berkshire Hathaway (BRK.A) due to its status as a holding company, as well as its share price performance and the fact that the company has never split its stock.

CSU stock currently trades at C$4,427.61 a share, having risen 43% in the last 12 months and gained 274% in the past five years. Since going public in 2006, the share price has increased more than 24,000%, placing it among the top-performing publicly traded companies in Canada. The stock hit a record intraday high of C$4,476.50 per share this July.

Is CSU Stock a Buy?

The stock of Constellation Software has a consensus Moderate Buy rating among seven Wall Street analysts. That rating is based on five Buy and two Hold recommendations issued in the last three months. There are no Sell ratings on the stock. The average CSU price target of C$4,914.29 implies 10.47% upside from current levels.