Analysts at Jefferies Financial Group (JEF) have lifted their price target on the stock of mobile technology and app promotion company AppLovin (APP) by 62%, citing positive trends in spending on mobile games and online advertising.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Jefferies reiterated a Buy rating on APP stock and raised its price target for the company’s shares to $175 from $108. The analysts at Jefferies said their latest survey showed that spending on apps, mobile video games, and advertising within apps is likely to experience year-over-year growth of 6.7% in 2025.

Jefferies expects AppLovin to be a major beneficiary of the increased spending on new mobile video games and apps, as well as advertising on existing titles. The raised price target from Jefferies comes as APP stock is on fire this year, having risen 264% since January. The stock is currently trading at $145 a share.

The Bull Case for AppLovin Stock

The update to APP stock is even more bullish than it may seem initially. Jefferies outlined a potential bull case where AppLovin’s share price reaches $246 over the next 12 months, which is 128% above its previous forecast of $108 a share.

Jefferies said that AppLovin could benefit over the next year from a bigger increase in advertising spending than anticipated, as well as a growing number of ads on mobile apps from e-commerce companies such as Amazon (AMZN) and Shopify (SHOP). The analysts added that they see AppLovin’s revenue growing by 20% to 30% per year through the end of 2026.

Is APP Stock a Buy?

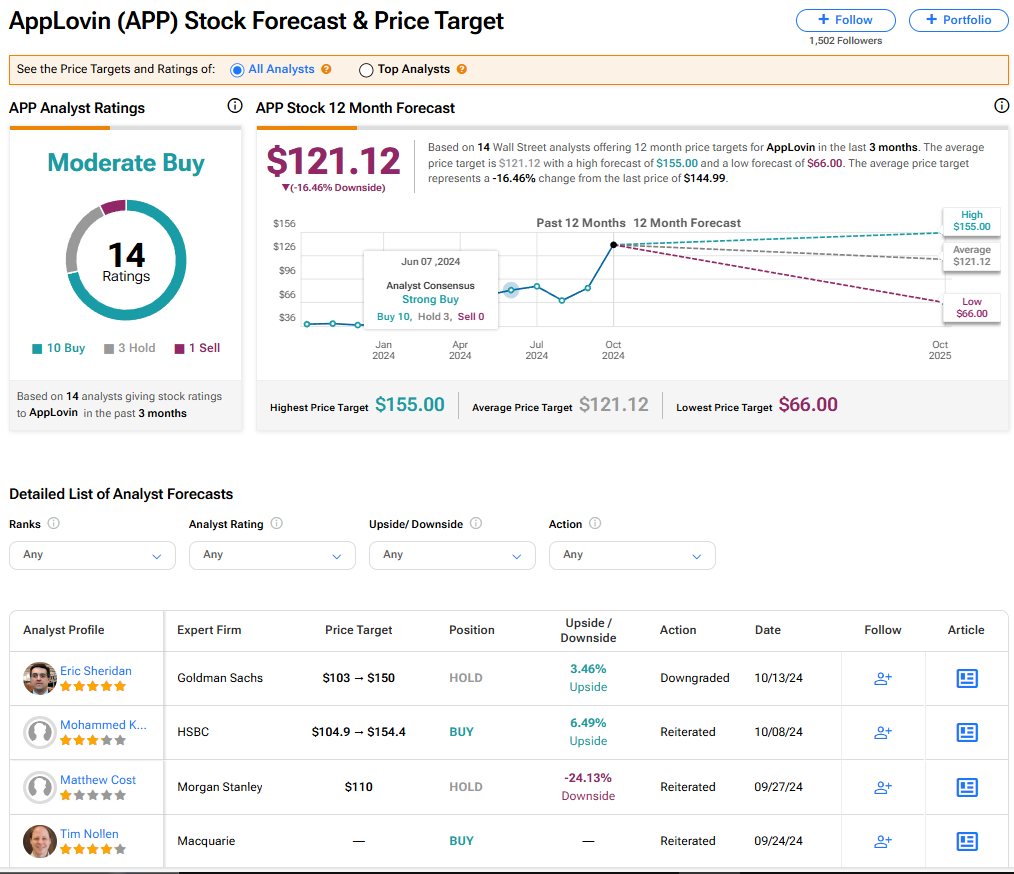

AppLovin stock has a consensus Moderate Buy rating among 14 Wall Street analysts. That rating is based on 10 Buy, three Hold, and one Sell recommendations made in the last three months. The average APP price target of $121.12 implies 16.46% downside risk from current levels.