Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The U.S. Federal Trade Commission (FTC) has paused a challenge it filed in its internal court to block biopharma company Amgen’s (NASDAQ:AMGN) proposed $27.8 billion acquisition of Horizon Therapeutics (NASDAQ:HZNP). The move is expected to give the parties involved time to consider a settlement. The pause is effective until September 18.

FTC Could Weigh Settlement in Amgen-Horizon Deal

The FTC filed a lawsuit on May 16 to oppose Amgen’s acquisition of Horizon due to antitrust concerns. In particular, the agency is worried that Amgen, one of the largest pharma companies in the world, would leverage the monopoly of Horizon’s two key products – the rapidly growing thyroid eye disease treatment Tepezza and gout drug Krystexxa. In 2022, Tepezza generated $1.97 billion in revenue, while Krystexxa brought in $716 million for Horizon. With the FTC’s decision to pause its in-house proceedings, Amgen and Horizon can now propose a settlement to the agency and end the need for further litigation.

Reacting to the FTC’s latest move, Amgen said that it was aware of this action and it is ready to prove that there is no “legal or factual” reason to oppose the acquisition, which the company originally announced in December last year. Amgen also said that it wouldn’t bundle Horizon’s Tepezza and Krystexxa treatments with its own products, which the FTC thinks would give the company a favorable position on insurers’ lists of covered medicines.

“We would be pleased if our commitment were honored instead of going through a lengthy court process,” said the company in a statement.

Amgen expects to close the acquisition by mid-December this year. Meanwhile, the FTC and Amgen will be facing each other over the injunction in Chicago federal court in September. If the two sides reach a settlement, the injunction hearing won’t be required.

What is the Forecast for Amgen?

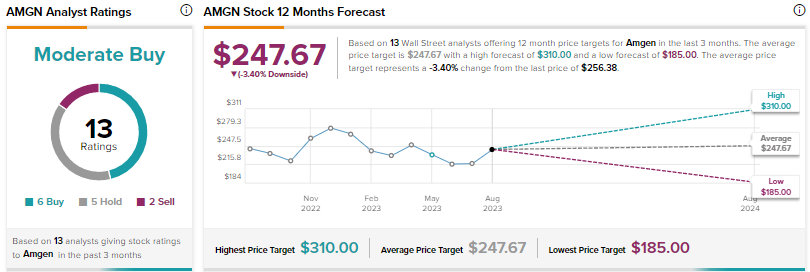

Wall Street has a Moderate Buy consensus rating on AMGN stock based on six Buys, five Holds, and two Sells. The average price target of $247.67 implies a possible downside of 3.4%. Shares have declined 2.4% year-to-date.

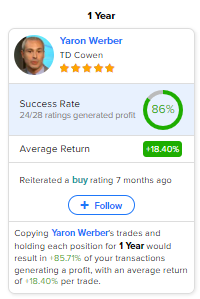

Investors should note that TD Cowen analyst Yaron Werber is the most accurate analyst for AMGN stock, according to TipRanks. Copying the analyst’s trades on AMGN and holding each position for one year could result in 86% of your transactions generating a profit, with an average return of about 18.4% per trade.