Amdocs Ltd. (NASDAQ: DOX) reported better-than-expected second quarter results, meaningfully beating both revenue and earnings expectations. The robust results were supported by strong sales momentum and a solid 12-month backlog of $3.89 billion, growing 9.9% compared to the prior-year period.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What’s more, the company even raised its full-year fiscal 2022 guidance on the heels of robust underlying demand for its services and deeper customer engagement.

Founded in Israel, Amdocs specializes in software and services for communications, media, and financial services providers and digital enterprises. DOX stock is up 3% year-to-date, vis-à-vis gaining 7.9% over the past year.

Q1 Results in Detail

Amdocs’s revenue rose 9.2% year-over-year to $1.15 billion and outpaced the Street estimates of $1.07 billion. North America $772 million to the revenue, up 13.7% compared to the prior year period.

Similarly, adjusted earnings of $1.54 per share beat the analyst estimates of $1.18 per share and also came in much higher than the comparable quarter’s figure of $1.13 per share.

Shareholder Rewards

During Q2, Amdocs repurchased ordinary shares worth $130 million. Moreover, the Board declared a common quarterly dividend of $0.395 per share (1.86% current yield) payable on July 29, 2022, to shareholders of record on June 30, 2022.

FY 2022 Outlook

Based on the current business momentum, Amdocs guided Q3FY22 revenue to fall between $1.14 billion and $1.18 billion, while consensus is pegged at $1.09 billion.

Additionally, Q3 adjusted earnings are projected to be between $1.23 per share and $1.29 per share, while consensus is pegged a bit higher at $1.30 per share.

Boosted by the renewal of long-term contracts with existing customers and the addition of new customers, Amdocs raised its guidance for fiscal 2022.

The company now expects FY22 revenue to grow between 5.2% and 7.2%, which is higher than the previous guidance of growth between 3.4% and 7.4%. The consensus estimates for full-year revenue stand at $4.32 billion.

Moreover, FY22 adjusted earnings are projected to grow by 7.3% to 10.3% over FY21 figures, up from the prior guidance. And the consensus for adjusted earnings is pegged at $4.93 per share.

Executive Comments

Shuky Sheffer, President and CEO of Amdocs Management Ltd., said, “Our growth strategy is highly aligned with the needs of the market, and we see an expanding pipeline of opportunities ahead of us which we are well positioned to monetize with our market-leading products, best-in-class execution, and highly talented people.”F

Sheffer also stated that the company is on track to meet its 2022 revenue growth targets of between 8% and 10% on the back of a strong backlog.

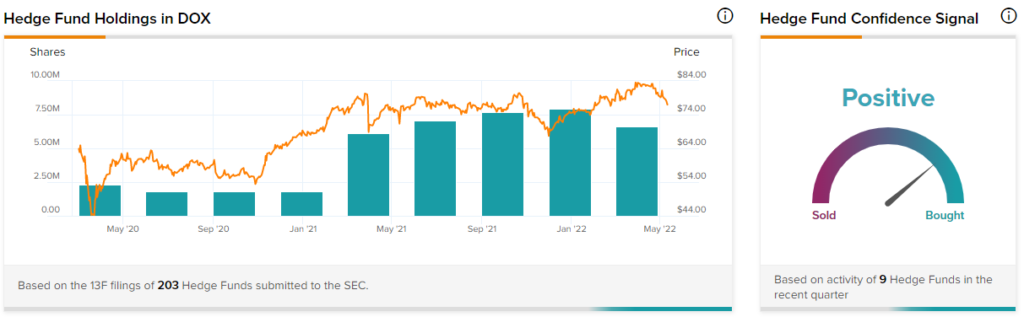

Hedge Funds

The TipRanks Hedge Fund Trading Activity tool shows that confidence in Amdocs is currently Positive, as nine hedge funds increased their cumulative holdings of the stock by 277,000 shares in the last quarter.

Ending Thoughts

According to TipRanks’ Smart Score, Amdocs has a Smart Score of eight, indicating that the stock is likely to outperform the market. Moreover, bloggers are 100% bullish on DOX stock, and corporate insiders have increased their exposure to DOX stock by 3% in the past month.

Amdocs’s robust quarterly results and uplifted view of the future indicate that the company is well positioned to outperform. Additionally, all the other TipRanks’ tools also signal a positive sentiment towards the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Kohl’s Shareholders Signal Trust in Current Board

Apple to Discontinue One of Its Iconic Products

Hyatt Stock Spikes on Flashy Q1 Performance