It was the king of meme stocks and the exemplar of a dying way of life. It’s AMC Entertainment Holdings (AMC), and it’s about to release its earnings for the second quarter. The early news suggests good things to come, as shares of the movie theatre chain are up over 4% in Wednesday afternoon’s trading.

The projections are somewhat mixed. TipRanks data reveals a consensus earnings per share (EPS) projection of -$0.43 per share, which is a catastrophe compared to this time last year when AMC brought in $0.09 per share. Meanwhile, it looks to bring in around $1.03 billion in revenue, which is itself down substantially from the $1.35 billion it saw in the second quarter of 2023.

Yet, it’s clear that costs are on the rise; AMC looks for a loss of $32.8 million, which, again, compares darkly to the second quarter of 2023, when it brought in $8.6 million in net earnings. Still, the company holds around $770 million in cash and cash equivalents, so it has resources to weather such storms for some time to come.

Better Times Ahead?

AMC is looking for brighter times to come, as it pointed out that there’s a substantial lineup of movies to come. Indeed, Deadpool & Wolverine is on track to be the highest-grossing R-rated film in history, which is a staggering feat in and of itself.

Yet, less optimistic worldviews persist. Second quarter weakness is clearly in play, and there’s the issue of a voice actor’s strike in Hollywood right now. Though the strike may have a great impact on AMC, it’s still likely to prompt some sort of slowdown in the entertainment industry as a whole. And then, there’s the whole issue of home theaters; they’ve long been forecast to take over the market, and with streaming on the rise, a night at the movies has lost a lot of its appeal.

Is AMC a Buy or Sell Right Now?

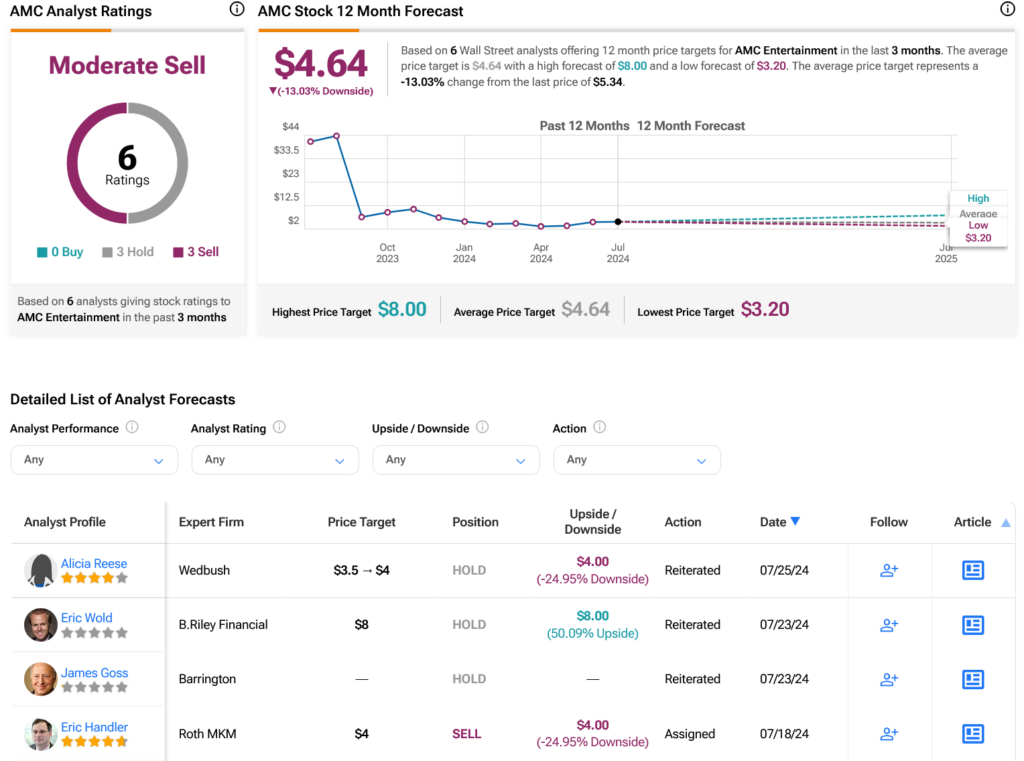

Turning to Wall Street, analysts have a Moderate Sell consensus rating on AMC stock based on three Holds and three Sells assigned in the past three months, as indicated by the graphic below. After an 87.85% loss in its share price over the past year, the average AMC price target of $4.64 per share implies 13.03% downside risk.