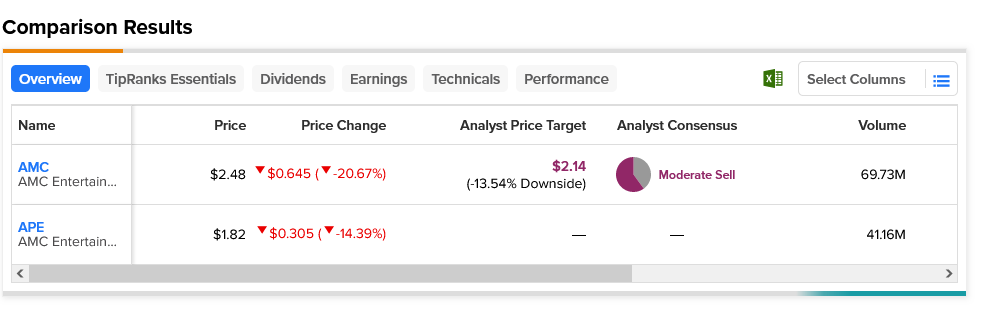

There was a hope, not so long ago, that the resolution between AMC Entertainment (NYSE:AMC) and the AMC Preferred Equity Unit (NYSE:APE) would result in one of the two skyrocketing in value. That proved not to be the case in Tuesday afternoon’s trading, as both AMC and APE lost ground, with AMC down over 20% and APE down over 14% in the session.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

This is actually the second day in a row that the stocks slid. Indeed, AMC shares saw trading halted three times in the space of a morning over volatility issues. In Monday’s trading alone, AMC wound up down 24%, and it’s on track to lose almost that much again today. It’s worth noting, though, that the price gap between the two units is starting to narrow, as the APE unit lost some value, but just over half of what AMC proper did. There are some legal issues left to be settled, however; a class-action suit from several investors over AMC “short-changing” APE investors following the Delaware Court of Chancery decision is also on tap.

Then, of course, there’s the matter of the theater in decline to begin with. While certainly, the “Barbenheimer” phenomenon gave everyone a dose of fresh hope, there are already signs of weakness. Barbenheimer’s components, “Barbie” and “Oppenheimer,” have already dropped to slots two and three, temporarily overtaken by the premiere of “Blue Beetle.” With the writer’s strike and actor’s strike still in play, that’s likely to reduce the flow of high-end films to screens. However, AMC—among other chains—is fighting back; this weekend will feature a celebration of cinema with National Cinema Day. Several chains have united to offer discounted tickets this Sunday.

Both AMC and APE took hits today, but neither one is in that great of shape. APE units carry no analyst perspective, but AMC does, and it’s not good. It’s rated a Moderate Sell by analyst consensus, and with an average price target of $2.14, it comes with a 13.54% downside risk as well.