Amazon (AMZN) is considering tabling a takeover bid for London-listed podcasting group Audioboom. Sky News reports that the tech behemoth has been exploring bids in recent weeks and could make an offer before the end of the month. AMZN shares rose 1.22% to close at $3,103.34 on February 14.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Amazon is a U.S. company that offers online shopping services through its platform. It also offers cloud computing services. Amazon’s upcoming earnings report for Q1 2021 is scheduled for April 28, 2022.

Audioboom Acquisition

According to Sky News, Amazon has already engaged the services of investment bankers JPMorgan, affirming its strong interest in Audioboom. However, it is not the only company interested in the podcasting group, which has seen its revenues and share price surge amid the pandemic.

Spotify Technology SA (SPOT) is another company that has shown strong interest in pursuing a deal for Audioboom.

Reports indicate that Amazon and Spotify could table bids at a significant premium to Audioboom Friday’s closing price of £17.60. However, a person close to the situation has also warned that the two digital giants may pull out.

Stock Rating

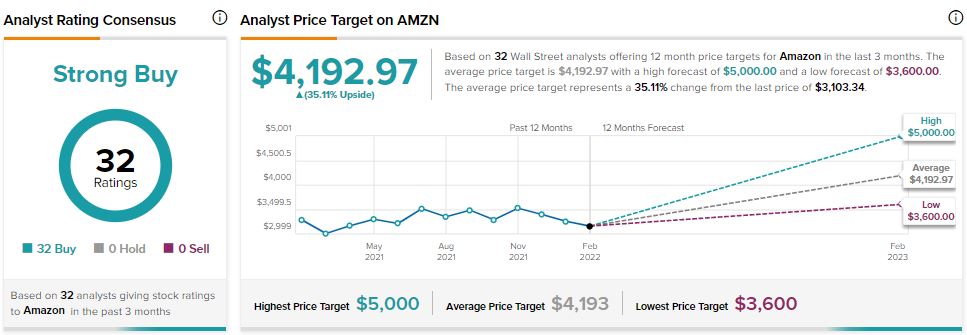

Last week Bank of America Securities analyst Justin Post reiterated a Buy rating on Amazon stock with a $4,450 price target, implying 43.39% upside potential to current levels.

Consensus among analysts is a Strong Buy based on 32 Buys. The average Amazon price target of $4,192.97 implies 35.11% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Related News:

Green Plains Tanks 9% on Wider-Than-Expected Q4 Loss

Copper Mountain Mining Posts Lower Q4 Production

Cerence, Inc. Updates 1 Key Risk Factor