Amazon.com, Inc. (NASDAQ: AMZN) has asked the Federal Trade Commission to give its verdict by mid-March related to the company’s proposed $8.5 billion buyout of the MGM movie and television studio, according to a Wall Street Journal report. The deal was announced last May.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The e-commerce giant has fulfilled antitrust investigators’ demands by providing all the necessary information. Therefore, Amazon assumes that if the FTC does not come up with any legal issues before the deadline, the deal could be free to complete. However, post-closure of the deal, the commission’s review may continue.

Notably, the deal is also under review by the European Union’s antitrust enforcers, the delay of which could buy more time for the FTC.

No comments have been released by Amazon.

Wall Street’s Take

Recently, Tigress Financial analyst Ivan Feinseth reiterated a Buy rating on Amazon and a price target of $4,655 (57.37% upside potential).

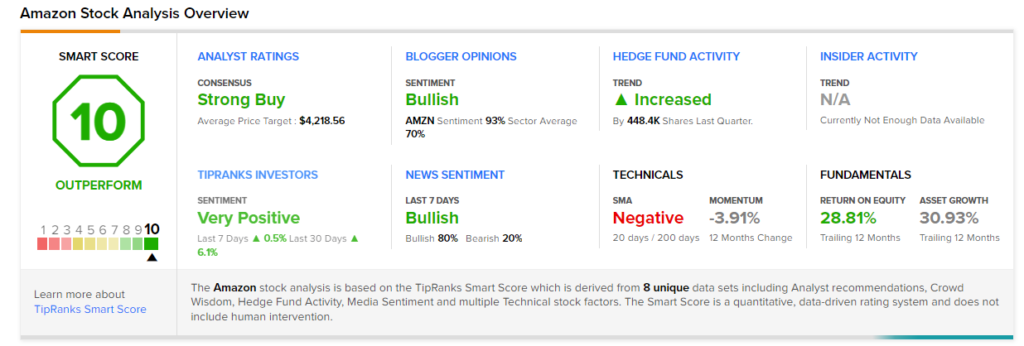

Consensus among analysts is a Strong Buy based on 34 unanimous Buys. The average Amazon price target of $4,218.56 implies 42.62% upside potential from current levels. However, shares have lost 15.75% over the past six months.

Smart Score

Amazon scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Baidu Posts Upbeat Q4 Results; Shares Jump 7%

ChargePoint Books Loss in Q4; Shares Rise on Revenue Beat

Snowflake Drops 22% on Surprise Quarterly Loss & Disappointing Guidance