E-commerce retailer and cloud service provider Amazon.com (AMZN) is considering an additional multi-billion dollar investment in artificial intelligence (AI) firm Anthropic. This will be Amazon’s second investment in the generative AI startup following its initial $4 billion investment. The news was first reported by The Information.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Details of Amazon’s Investment

Amazon’s additional investment is contingent upon a clause that Anthropic must use Amazon-made silicon chips (Trainium) hosted on Amazon Web Service (AWS) to train its large language models (LLMs) and AI. The investment amount could be dependent on the number of Amazon chips Anthropic agrees to utilize.

Anthropic already utilizes AWS servers to train its Claude family of AI models. However, these servers are lined with semiconductor giant Nvidia’s (NVDA) chips, and Anthropic must make this tough decision to get the capital infusion. Meanwhile, Amazon will provide early access to Anthropic’s technology to its customers. Just yesterday, Anthropic and Palantir Technologies (PLTR) announced a deal to provide the U.S. intelligence and defense agencies access to the Claude 3 and 3.5 family of models on AWS.

Anthropic has said that it will need more capital to train and develop its AI offerings. It is expected to burn $2.7 billion this year for AI operations. Reportedly, the OpenAI rival is looking to raise new funding at a valuation of $40 billion and has been in discussions with potential investors. As of date, Anthropic has raised a total of $9.7 billion, while larger rival OpenAI has raised $21.9 billion.

Is AMZN a Buy Right Now?

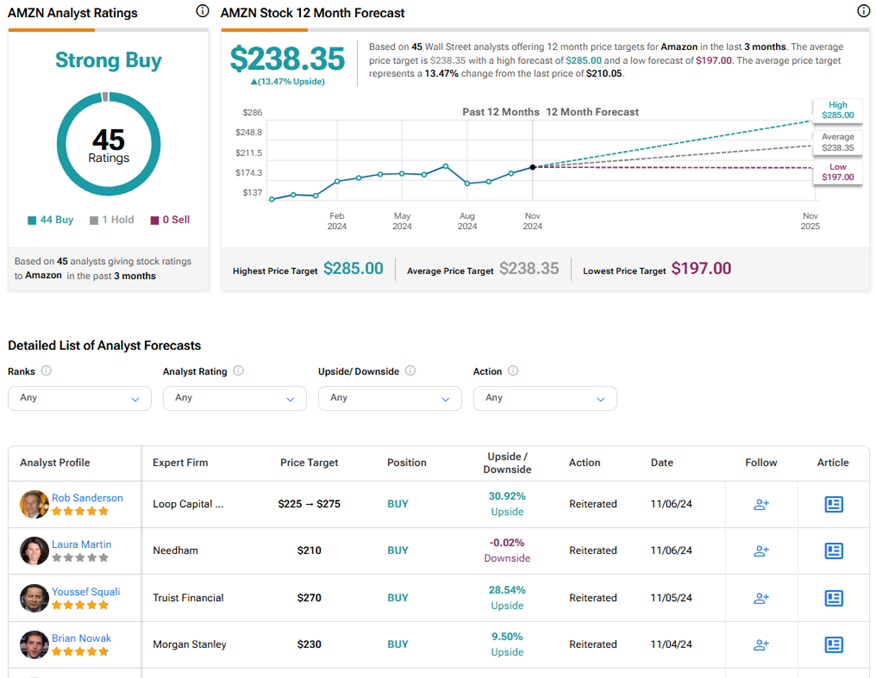

Wall Street is highly bullish about Amazon stock’s trajectory with its well-established business model and solid Q3 FY24 financial performance. On TipRanks, AMZN stock has a Strong Buy consensus rating based on 44 Buys and one Hold rating. The average Amazon.com price target of $238.35 implies 13.5% upside potential from current levels. Year-to-date, AMZN shares have gained 38.3%.