Amazon-backed (AMZN) artificial intelligence (AI) startup Anthropic is set to achieve profitability before archrival OpenAI.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Financial documents cited in a Wall Street Journal article show that Anthropic is likely to achieve profitability two years ahead of OpenAI, whose main financial backer is Microsoft (MSFT). The article states that Anthropic, known for its Claude AI chatbot, is forecast to break even by 2028.

OpenAI, the creator of the rival ChatGPT chatbot, is projected to post an operating loss of $74 billion in 2028 due largely to escalating computing expenses. In the end, OpenAI is expected to consume 14 times more cash than Anthropic before it finally breaks even and then reaches profitability in 2030.

High Stakes

There’s a lot at stake for both Anthropic and OpenAI as the two privately held startups jockey for AI chatbot supremacy. There’s also a lot at stake for their mega-cap technology backers. Amazon has invested a reported $8 billion in Anthropic, making it the company’s largest investor. At the same time, Microsoft has poured more than $13 billion into OpenAI.

For now, Anthropic and OpenAI are each burning through cash. For 2025, OpenAI forecasts burning $9 billion in cash, while Anthropic expects to spend almost $3 billion, representing about 70% of their respective sales. Some analysts have praised Anthropic for taking a more conservative approach and focusing on growing its corporate customers, who currently generate about 80% of its revenue.

Is AMZN Stock a Buy?

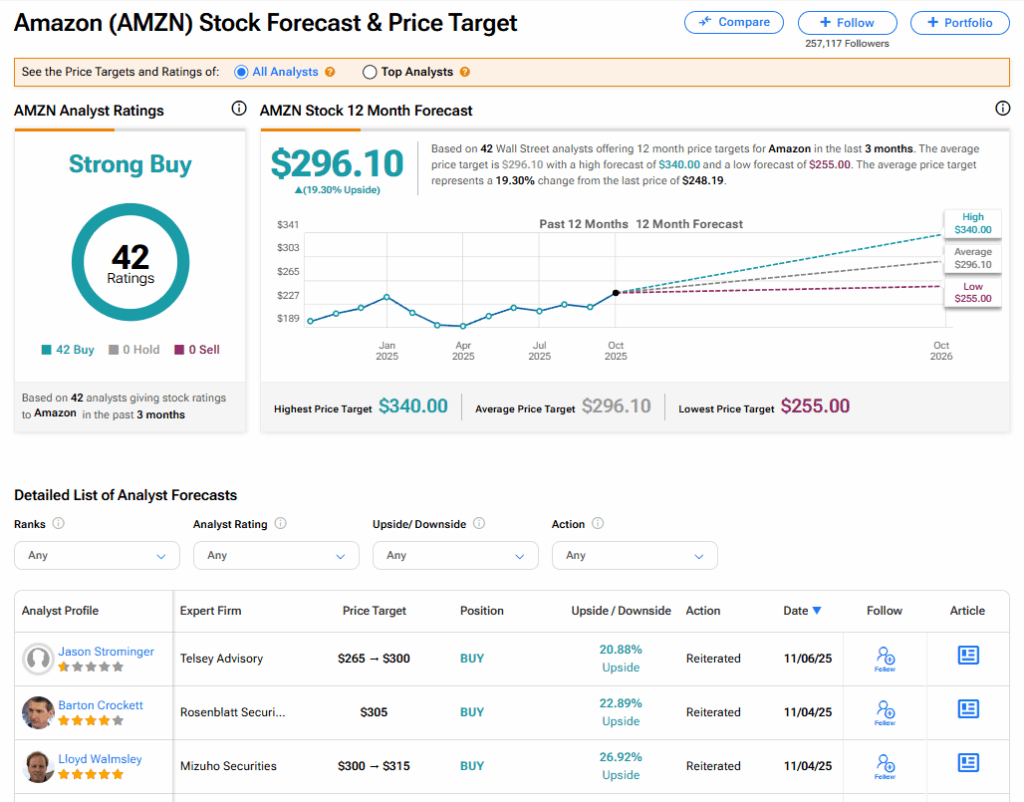

AMZN stock has a consensus Strong Buy rating among 42 Wall Street analysts. That rating is based on 42 Buy recommendations assigned in the last three months. The average AMZN price target of $296.10 implies 19.30% upside from current levels.

Read more analyst ratings on AMZN stock