Tech giant Amazon (AMZN) is set to announce its Q3 2024 financial results on October 31. Wall Street analysts anticipate robust earnings, with expectations of $1.14 per share, reflecting a 21% increase from the same quarter last year. Additionally, revenue is projected to hit $157 billion, marking a 10% year-over-year rise, according to data from the TipRanks Forecast page.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Here’s What Amazon’s Q3 Website Traffic Data Reveals

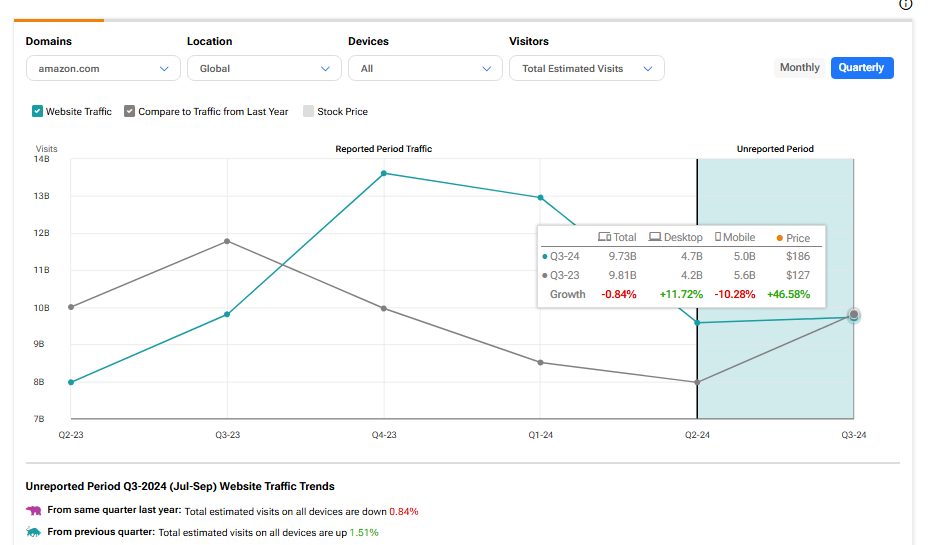

Although analysts anticipate Amazon’s revenues to rise compared to the same quarter last year, the company’s website traffic data suggests a less robust Q3 performance. It should be noted that investors can use TipRanks’ Website Traffic Tool to gain insights into a company’s upcoming earnings report. The tool offers information on how a company’s website domain performed over a specific time frame.

For AMZN, TipRanks’ traffic screener shows a sequential increase in visits but a year-over-year decline in Q3. Specifically, visits to amazon.com fell by 0.84% compared to Q3 last year, potentially reflecting the impact of economic uncertainty and rising competition from companies like Microsoft (MSFT) and Alphabet (GOOGL) in the cloud sector.

Key Takeaways from TipRanks’ Bulls & Bears Tool

According to TipRanks’ Bulls Say, Bears Say tool, bullish analysts believe that Amazon’s profit margins are improving, driven by strong growth in both advertising and cloud services. They argue that the rising demand for AI-powered cloud solutions is boosting confidence in AWS, making the stock more attractive. In contrast, bearish analysts highlight challenges such as escalating competition, rising labor costs, and ongoing regulatory hurdles that could negatively impact Amazon’s performance.

Nevertheless, if Amazon can maintain robust growth in its AWS segment while continuing to improve margins, it may report strong Q3 results, potentially propelling its share price to new highs.

AMZN’s Share Price Rises, Despite Competitive Pressures

Amazon’s share price has shown consistent growth, even amid increasing competition in the retail and cloud sectors. The stock has risen approximately 44% over the past year and 25% year-to-date, primarily driven by effective cost-cutting initiatives and streamlined operations. Additionally, the company’s focus on its cloud segment, especially Amazon Web Services (AWS), has notably strengthened its profitability.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 6.68% move in either direction.

Is Amazon a Buy or Sell Right Now?

Turning to Wall Street, Amazon stock has a Strong Buy consensus rating. Out of the 48 analysts covering the stock, 46 have a Buy recommendation and two have a Hold recommendation. Furthermore, at $224.14, the average AMZN price target implies 17.46% upside potential.