As the global landscape shifts towards clean energy, industry, and market dynamics lay the groundwork for a more sustainable future. This trend could present lucrative opportunities for solar power providers such as Altus Power (NYSE:AMPS), the leading owner and operator of commercial-scale solar solutions in the U.S.

With a firm hold in the rapidly growing solar energy market, along with strategic acquisitions to boost its capabilities, and significant institutional backing, Altus Power is in a good position to potentially reward its shareholders over the long-term.

Altus Power’s Footprint

Altus Power is a commercial-scale provider of clean electric power, focusing on offering end-to-end solutions to commercial, industrial, public sector, and Community Solar customers. The company leads the industry in originating, developing, owning, and operating locally-sited solar generation, energy storage, and charging infrastructure across the country.

As a part of its portfolio, it has 470 megawatts (MW) of solar PV. It holds long-term power purchase agreements with over 300 commercial and industrial entities and has contracts with more than 500 residential customers. Additionally, the company operates around 40 megawatts of Community Solar Projects. Its extensive network comprises more than 2000 subscribers nationwide, and it leverages local expertise and intermediaries for marketing its solar energy offerings.

Altus’ Recent Financial Performance & Outlook

Altus Power recently reported financial results that outperformed expectations in Q1 2024. Revenue reached $40.7 million, reflecting a 38.5% year-over-year increase and beating expectations by $1.46 million. Additionally, the company saw a surge in its GAAP net income, up to $4.1 million compared to $3.8 million in Q1 2023. EPS at $0.05 surpassed estimates by $0.14.

The company remains confident in its financial projections and maintains its projected operating revenues of $200-222 million and adjusted EBITDA of $115-135 million. If met, these estimates indicate respective growth of 36% and 34% from 2023 at the midpoints.

What Is the Price Target for AMPS Stock?

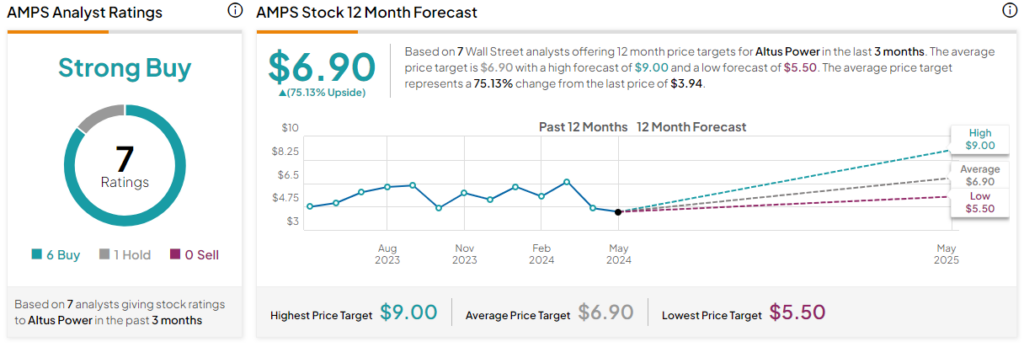

Analysts following the company have a cautiously optimistic outlook on the stock. For example, B. Riley analyst Christopher Southern recently lowered the price target on the shares from $7 to $6 while maintaining a Buy rating, citing the company’s macro tailwinds and ability to maintain its leading position in the commercial and industrial solar markets.

Altus Power is rated a Strong Buy based on seven analysts’ recommendations and price targets issued over the past three months. The average price target for AMPS stock is $6.90, representing an upside of 75.13% from current levels.

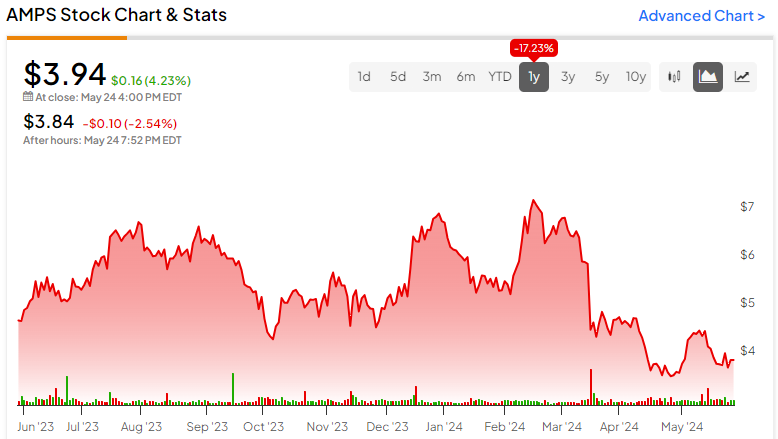

The stock has been trending, climbing 8.8% in the past month. It sits at the low end of its 52-week price range of $3.40-$7.28 and shows negative price momentum, trading below its 20-day (4.07) and 50-day (4.43) moving averages.

AMPS in Summary

As the world gears toward sustainable energy solutions, Altus Power is harnessing this trend with a stronghold in the burgeoning solar energy market. As a testament to their capabilities, Altus recently reported Q1 2024 financial results that exceeded market expectations, exhibiting an impressive revenue and net income progression.

This momentum and the company’s optimistic financial projections substantiate its compelling growth narrative, making it a compelling investment option in the renewable energy market.