Tobacco company Altria Group, Inc. (NYSE: MO) offers cigarettes, smokeless products, and wine in the United States.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The cigarette giant projects strong profitability prospects and less volatility in the current uncertain market as it is a provider of necessities in the consumer staples sector and has strong pricing power.

However, Altria’s valuation and financials have been impacted by a number of negative news stories. It lost more than 9% at Wednesday’s close following a Wall Street Journal article about the U.S. Food and Drug Administration’s (FDA) proposed ban on Juul Labs’ vape products.

According to the report, the FDA is on the verge of banning Juul e-cigarettes from the U.S. market. The move is expected to be a strong blow to Altria’s financials as the cigarette giant holds a 35% stake in Juul, which it acquired for $12.8 billion at the end of 2018. As of March 31, 2022, the value of the stake stood at $1.6 billion.

In April, the FDA also proposed its plan to ban menthol cigarettes, which account for one-fifth of the company’s operating profit. Additionally, the FDA declared earlier this week that tobacco companies must reduce nicotine levels in cigarettes sold in the country to non-addictive levels.

Furthermore, Philip Morris International’s (PM) plans to sell smokeless tobacco products in the U.S. added to investor concerns.

Official Comments

Altria commented, “We believe tobacco harm reduction is a better path forward. The focus should be less on taking products away from adult smokers and more on providing them a robust marketplace of reduced harm FDA-authorized smoke-free products. Today marks the start of a long-term process, which must be science-based and account for potentially serious unintended consequences.”

However, no comments were released by Juul.

Wall Street’s Take

Considering the news as a surprise and the subsequent sell-off of Altria stock, Goldman Sachs analyst Bonnie Herzog believes that Altria can sustain with various other options.

Herzog maintained a bullish stance and a price target of $59 (42.17% upside potential) on the stock.

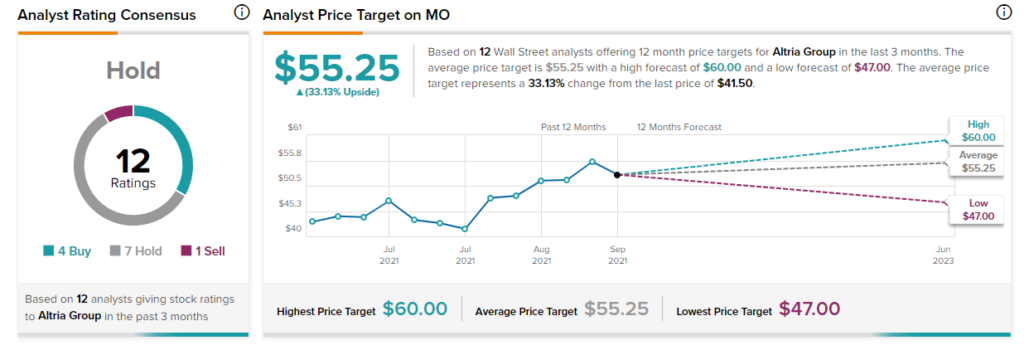

Overall, the stock has a Hold consensus rating based on four Buys, seven Holds, and one Sell. The average Altria price forecast of $55.25 implies 33.13% upside potential from current levels. Shares have lost 5.01% over the past year.

Conclusion

At the current level, despite strong fundamentals, investors might be cautious about the stock due to the ongoing regularization in the cigarettes industry and its outcome.