Alphabet’s (GOOGL) stock rally paused after its second-quarter earnings report despite strong results that beat EPS and revenue estimates. The cool-down is due to high CapEx spending, worries about Google Cloud’s margins, and questions about the impact of AI investments. Nonetheless, with AI being just one aspect of Alphabet’s diverse portfolio and the market largely not considering the amazing growth in the Search business, I remain bullish. The stock is trading at much more de-risked levels now.

In this article, I’ll dive into why Google’s Q2 performance was strong and why I think the market is focusing on short-term noise rather than real threats to the investment thesis.

Alphabet’s Q2 Earnings: Almost No Room for Criticism

As expected, Alphabet beat consensus estimates, delivering its sixth consecutive quarter of exceeding EPS estimates with $1.89, compared to an expected $1.85, marking a 31% year-over-year increase. Further, operating margins grew to 32% from 29% in Q2 2023, showcasing strong financial performance and effective cost management.

On the revenue front, Alphabet reported $84.64 billion, a 15% year-over-year increase, beating estimates for the sixth quarter in a row by a tiny margin. Analysts had expected $84.22 billion this time. Google Search revenues were a standout, growing by around 14%.

Despite competition from Microsoft’s (MSFT) Bing, Google still leads the global search market with a 91% share, slightly down from 92.2% at the end of 2022. Further, YouTube ads grew 11% year-over-year, reaching $8.66 billion, but fell short of the $8.93 billion consensus estimate.

For Google Cloud, a key area for AI investments, Alphabet reported a 29% year-over-year revenue increase, surpassing $10 billion for the quarter. The segment also posted an operating profit of over $1 billion, with margins improving to around 11.3% from 9% last quarter.

So, why the bearish reaction despite these impressive numbers? Well, the devil lies in the details.

As expectations for AI investments soar, guidance for Q3 operating margins fell short of market hopes. According to Alphabet’s CFO, operating margins in the third quarter are expected to be more conservative, reflecting increased depreciation, expenses, and high investment levels. It’s important to note that Alphabet does not provide official guidance.

Further, management hinted at maintaining or even increasing CapEx by the end of the year. This led investors to question whether Google is overspending relative to the short-term returns on these investments.

Why the Big Picture Should Prevail in Alphabet’s Growth Story

Since the AI boom took center stage, concerns have arisen about how AI might impact Google’s search business, especially with new players like ChatGPT and the emerging SearchGPT.

First off, remember that Alphabet is primarily an ad-driven company. Google Services, which includes ads, subscriptions, platforms, and devices, accounts for 87% of total revenues. Within this segment, Google Search represented 57% of the revenue in the last quarter. In contrast, Google Cloud contributed just 12% of the total revenue.

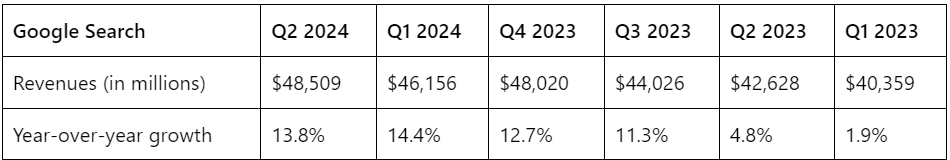

Although Google Cloud is getting a lot of attention right now, some investors might be overlooking the fact that Q2 marked the sixth consecutive quarter of steady growth for Google Search, with the last four quarters showing double-digit increases.

Here’s a snapshot of Google Search revenue growth:

Investors should recognize that Google Search, a nearly $200 billion business, grew at 13.8% from Q2 2023 to Q2 2024. Given this strong growth in Search, it is likely to outweigh any shortfalls in YouTube revenue or temporary headwinds in Google Cloud’s operating margins until investments in the Cloud segment show otherwise.

The valuation makes more sense now, too. After the Q2 sell-off, GOOGL’s forward P/E stands at 22.3x, down from 24.5x prior to earnings. Historically, the average P/E over the past five years has been above 25x, presenting a potential opportunity.

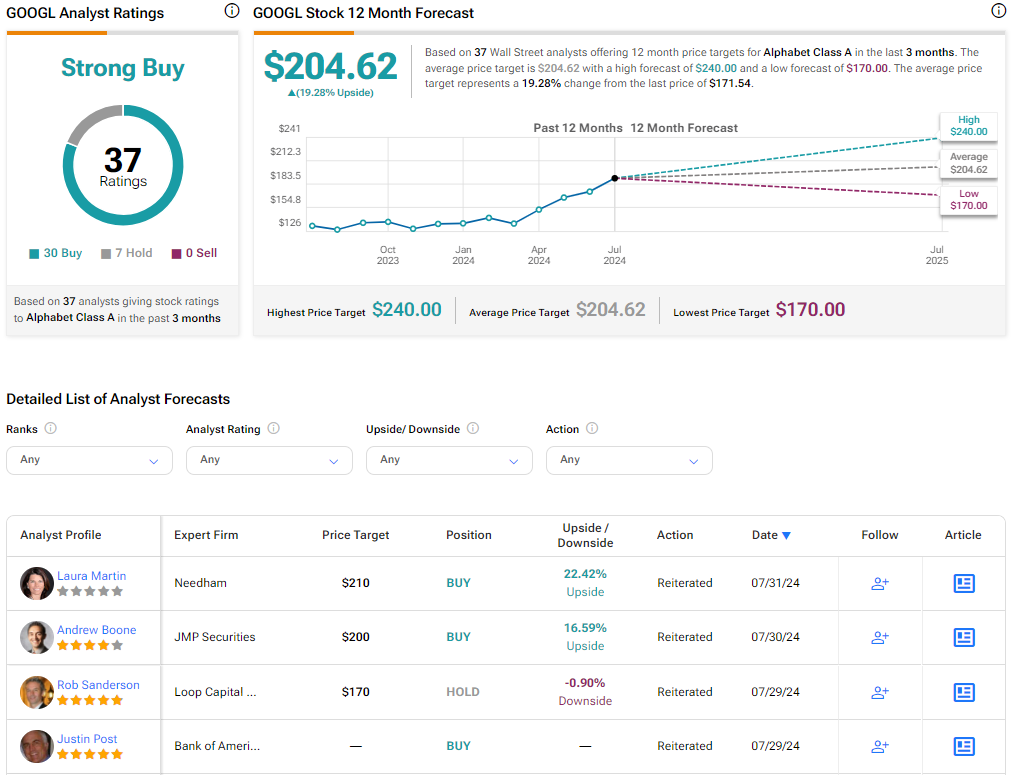

Is GOOGL Stock a Buy, According to Analysts?

Wall Street analysts are generally very bullish on GOOGL, with a Strong Buy consensus rating. Out of the 37 analysts covering the stock, only seven have a neutral stance, and everyone else has a bullish stance. Following the Q2 results, many analysts have raised their price targets. The average GOOGL stock price target now stands at $204.62, which implies solid upside potential of 19.3% from the current share price.

See more GOOGL analyst ratings

The Takeaway

Alphabet delivered Q2 results pretty much as bulls expected, with just a slight miss on YouTube revenue expectations but nothing that affects the overall picture.

While there are some concerns about a cautious outlook due to potential expense increases, I think the bearish reaction is a bit overblown. Alphabet didn’t provide official guidance and only hinted that cloud operating margins might be more conservative in Q3. On the bright side, the continued double-digit growth in Search puts AI fears to rest and reinforces Google’s virtually unbeatable leadership position.