On July 23, Google’s parent company, Alphabet (GOOGL), is expected to report its fiscal second-quarter earnings. I’m bullish on GOOGL ahead of earnings day due to ongoing tailwinds from robust advertising spending and margin growth in Google Cloud, fueled by advancements in AI. Despite facing mildly tough comps in revenue growth, I believe that updates on AI innovations will be what investors focus on the most, likely marking the start of a new chapter in its growth story.

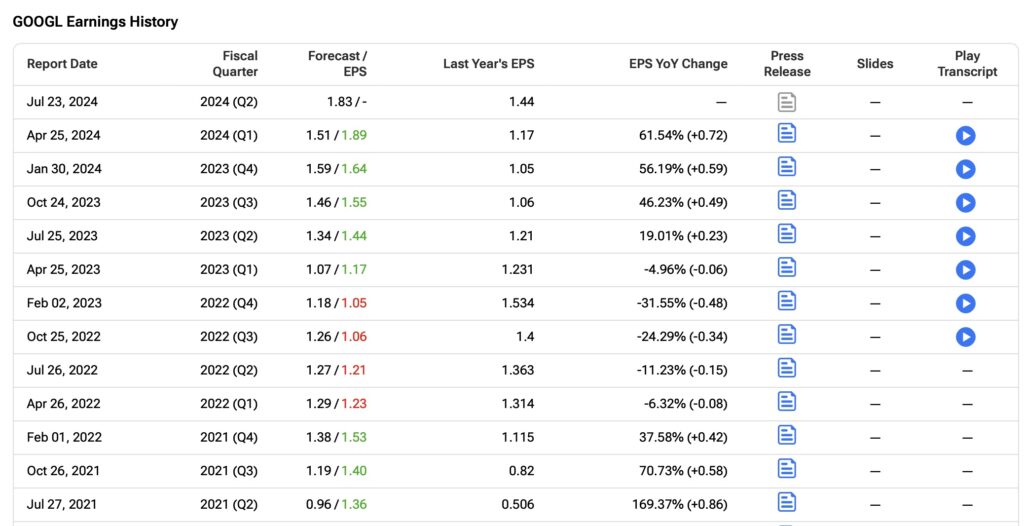

If Alphabet beats market estimates once again, it will mark the sixth consecutive quarter of exceeding EPS expectations despite missing estimates for four straight quarters in Fiscal 2022. See below.

What to Look for in Alphabet’s Q2 Earnings

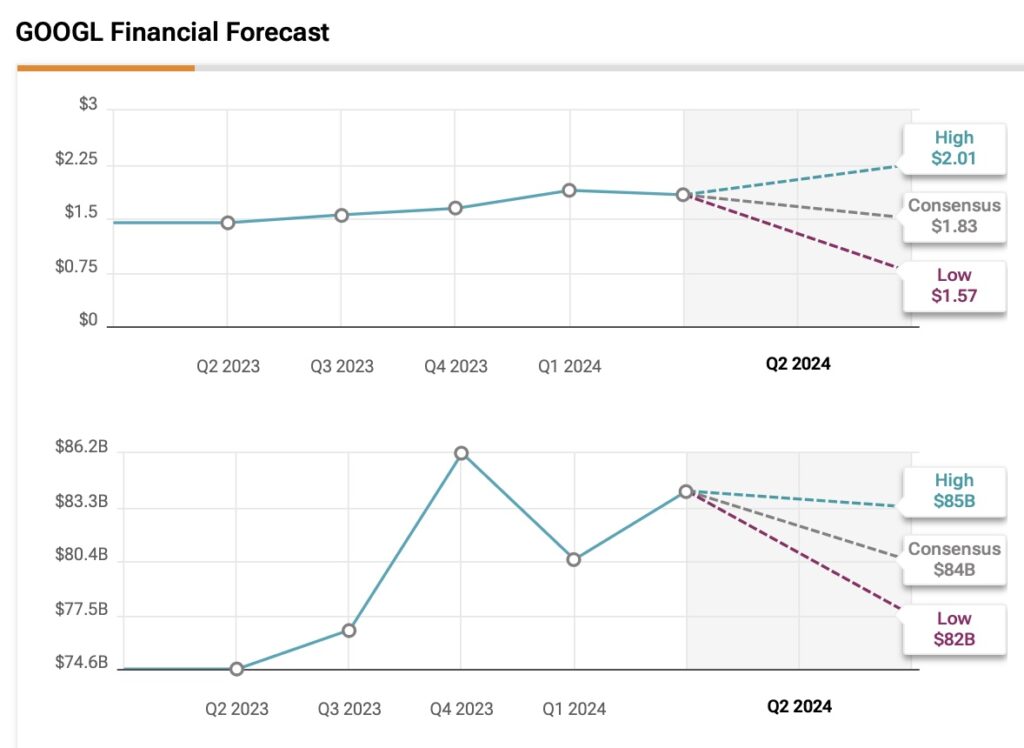

Alphabet’s upcoming Q2 results are eagerly anticipated, with market expectations running high. Over the past three months, 43 out of 49 analysts have raised their forecasts for Q2, showing unwavering confidence in the company’s performance.

To beat Wall Street’s Q2 expectations, Alphabet needs to achieve EPS above $1.83, marking a 27.5% rise, and achieve revenues above $84 billion, indicating a 12.7% increase from the previous year.

But I believe that, above all, the market will really want to hear updates on the AI innovation wave.

Last quarter, Alphabet highlighted several key points, such as consolidating its AI models like Gemini 1.5 Pro and building a strong infrastructure with efficient data centers to support advanced AI development. It also integrated AI into Search to improve user experience and engagement, which helps clear monetization paths through ads, cloud services, and subscriptions.

Alphabet’s recent strong performance, driven by robust ad spending trends and advancements in AI capabilities, has solidified its position as a two trillion-dollar company with double-digit growth. In Q1 alone, Alphabet saw its revenues climb 15.4% year-over-year, a significant increase of over $10.75 billion compared to Q1 2023, highlighting its growth story.

I’m especially curious to see the numbers reported in the Google Cloud segment, which I believe should continue to show double-digit revenue growth. Alphabet’s Cloud segment reported operating margins of 9% last quarter, still much lower than Amazon’s (AMZN) AWS, which was 37%. Progress in this area will be key to maintaining bullish momentum, in my opinion.

Alphabet has set ambitious targets, aiming for Google Cloud and YouTube to achieve a combined annual run rate exceeding $100 billion by this year. This commitment is underscored by significant investments in infrastructure, including nearly doubling capital expenditures (CapEx) to $12 billion in Q1 2024 compared to the previous year, despite Google Cloud operating at a loss until 2022 due to reinvestment for growth.

However, management said it expects CapEx for the coming quarters to come in roughly at or above Q1 levels. This suggests that Alphabet should continue at least to prioritize substantial investments in infrastructure to support its growth targets.

Anticipating Tough Comps in Q2

Since Alphabet doesn’t provide guidance, expectations can sometimes be misaligned. Last quarter, Google’s management hinted at tougher comparisons for Q2.

Alphabet’s revenue growth might be slightly lower because of the Q1 leap year benefit and the anticipation of a stronger impact from foreign exchange rates in Q2.

Regarding YouTube Ads revenue, the over 20% yearly growth in Q1 was accelerated by increased spending on both brand and direct response advertising. Looking ahead, Alphabet’s management highlights two important trends: (1) in Q1, a significant portion of advertising spend came from retailers in Asia-Pacific, a trend that began in mid-2023 and is expected to decrease in Q2; (2) the strong revenue growth in Q1 also reflects a comparison to a period of slower growth in the previous year’s Q1.

While these points are just one piece of the puzzle, these comparisons might present minor challenges currently. That said, given the diverse strengths of GOOGL’s business fundamentals, I don’t think these comps will come as a surprise.

GOOGL Stock’s Momentum

The 49% increase in value over the last 12 months, with 33% of that growth occurring in this year alone, underscores the strong trading momentum behind Alphabet stock. Google’s dominance in the advertising sector, coupled with significant growth prospects in Google Cloud driven by AI technologies, explains much of this surge.

While past performance doesn’t guarantee future outcomes, historically, July—when Q2 earnings are released—has been the strongest month in terms of average returns, averaging 8.2% over the last 16 years. This highlights heightened expectations surrounding Q2 results. In contrast, August tends to show flat returns, indicating the market’s anticipation of a strong Q2 without significant surprises later on.

However, since the AI boom took off, GOOGL’s post-earnings day reaction has been quite volatile over the past four quarters. As the table below shows, the stock has either sharply risen or fallen, without much of a middle ground in the aftermath.

Another notable point is that despite the recent strong price gains, Alphabet shares are currently trading at a forward P/E multiple of 24.5x, which is slightly below their average over the past five years. This suggests that either Alphabet was previously trading at historically high multiples, or there is potential for growth driven by advertising trends and AI in cloud computing that may still be undervalued. I personally think it’s a mix of both factors.

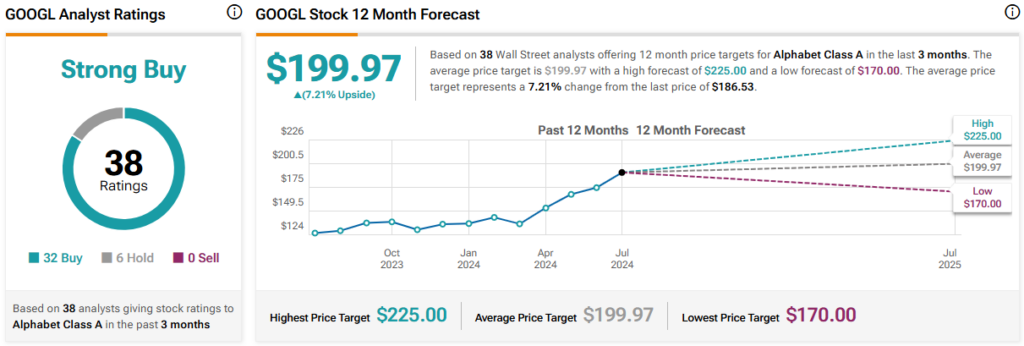

Is GOOGL Stock a Buy, According to Analysts?

Wall Street analysts are extremely bullish on Alphabet stock, with the consensus rating being a Strong Buy and 32 out of 38 analysts recommending buying GOOGL. The average GOOGL stock price target is $199.97, implying upside potential of 7.2%.

The Takeaway

I believe Alphabet’s Q2 results are likely to please GOOGL bulls. Mildly tough comps might pose some minor challenges, but they shouldn’t overshadow the achievement of double-digit growth in both the top and bottom lines.

However, perhaps the most crucial aspect regarding the stock’s reaction will depend on updates about AI. It will also hinge on how successful the Google Cloud business is in improving margins through data center efficiency and how much the integration of AI into Search is enhancing segment monetization.