In my view, Alphabet (GOOGL) stock is very cheap and is one of the best AI stories to consider right now. While the stock hasn’t been propelled by AI excitement that much in 2024, having risen a little over 18% year-to-date, there’s no reason to ignore its long-term potential as a leader in AI.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Alphabet is the company behind Google Search, YouTube, and Google Cloud. It’s a dominant player in the Internet space, having a near monopoly status in the search business and an oligopoly status in cloud. It’s one of the world’s best-run businesses with a dominant position in a market with high barriers to entry.

I am bullish on Alphabet for the long term because of a competitive advantage stemming from its data and its size, along with its long term AI potential and a compelling valuation.

Alphabet’s Size Provides Large Scale Data Collection Capabilities

I am bullish on Alphabet as an AI stock primarily because of its large scale data collection capabilities. Data is the lifeblood of AI, and who would have more data than a company that controls nearly all internet searches worldwide? According to statistics from StatCounter, Google has a 90.01% market share in the global search engine market, as of September 2024. Google’s entire business is built atop data collection, that’s how consumers arrive at desired webpages when they’re looking for things online.

Consequently, these large data collection capabilities give Google the opportunity to improve its products further and enhance the consumer experience. Google has the largest platform for showcasing its AI integrations: the billions of people that use its search engine every day. Over 2 billion people use six Google products on a monthly basis, and they’re also using Gemini, formerly the “Bard” AI chatbot. Alphabet is also seeing “great progress” with AI Overviews, its new AI-powered tool for Search, and is on track to scale it further.

My Thoughts on the Google Antitrust Case

Investors have been concerned about the potential break up of Google since August 2024 after a U.S. District Court in Washington D.C. determined that the company operated via monopolistic powers in internet search and were abusing that advantage. While I acknowledge the gravity of the antitrust case against Google, it does not deter my bullish outlook for Alphabet stock.

The latest update on judicial proceedings was an October 8 filing by the Department of Justice in which the law enforcement agency indicated that it may seek to force a break up of Google’s empire. The proposed recommendations include asking the company to dispose of its deals that position Google as the default search engine on smartphone devices, and to make its data available to competitors.

Google plans to appeal the ruling and judge Amit Mehta plans to issue a final decision by August 2025. In the event that Google does appeal, the conclusion of this matter might be stretched years into the future. I don’t see reason yet to waiver from my optimistic view of GOOGL stock.

Alphabet’s Long Term AI Potential

Alphabet is already an extremely strong and profitable company. Over the past 10 years, its profits have compounded at ~ 21% and have outpaced sales growth of 18% over the period. Operating margins are also improving and stand at about 30% over the trailing twelve month period. Alphabet is a cash cow and has a healthy balance sheet, including $100.7 billion in cash, cash equivalents, and short term investments.

I like GOOGL stock due to the long-term AI potential, and the management team has plenty of investable capital available. Alphabet is playing the long game and is building its AI capabilities. At the same time government officials are putting pressure on Google to break up, the company’s engineers are hard at work and building new and exciting AI products. Google has been at the forefront of AI for years now, beginning in 2014 when it acquired a British AI research lab, DeepMind. It was also ahead of competition in making its own chips, the TPUs, which are tailored for AI workloads.

Being an early-mover should allow Alphabet’s Google Cloud Platform (GCP) to remain the platform of choice for building and deploying AI models. Google shares the stage with Microsoft (MSFT) and Amazon (AMZN) in the cloud computing industry and its GCP has a 28% market share, according to data by HG Insights. In FQ2 2024, Google’s Cloud segment’s revenue grew 29% year over year to $10.3 billion, outpacing the growth for AWS (19% year over year in FQ2 2024).

Alphabet’s AI potential cannot be ignored. Its cloud business is growing and that growth is being driven by AI. During Q2 of this year, management stated that the company has helped its cloud customers leverage its AI Infrastructure and Generative AI Solutions, driving billions of dollars in revenue. Additionally, more than two million developers use the company’s AI products and services. As Alphabet continues to ramp up investments in AI, it is likely to further build its user base and drive future earnings growth.

Alphabet Stock Looks Ridiculously Cheap Right Now

Alphabet stock is currently trading at just 18.8x next year’s earnings, even cheaper than the S&P 500 as a whole which is trading at a forward P/E of ~23.8x. Analysts on Wall Street expect Alphabet to grow earnings by 32% in the current year and ~ 14% next year. If Alphabet can maintain its 10-year average EPS growth rate of 22% over the next five years and trade at 26x earnings (its 5-year average P/E), the stock could hit ~ $540 by 2030. That’s would represent more than 200% upside.

Does Wall Street Rate Alphabet Stock a Buy?

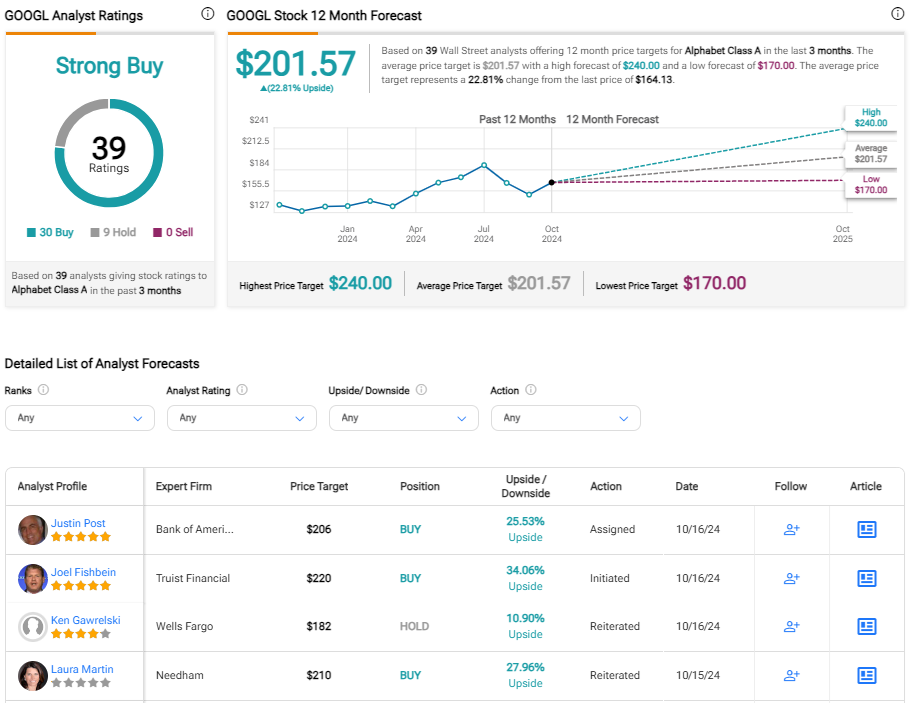

On TipRanks, GOOGL shares sport a consensus Strong Buy rating based on 30 Buy and 9 Hold recommendations from Wall Street analysts. There have been no Sell ratings issued on GOOGL in the past three months. The average GOOGL price target of $201.57 implies upside potential of 23% from the recent market price.

The Takeaway

Alphabet stock is currently trading at an attractive multiple relative to its tremendous future potential and the valuation of the broad market. The company’s technological prowess should help it solidify a position amongst the most important players in AI over the long term. While investors worry about the impact of a potential break up, that event might never happen.

Alphabet is a profitable company with high quality earnings. Given traits including its size, access to data, and first-mover advantage in AI, GOOGL stock is a high quality choice at an excellent price.