Nvidia (NASDAQ:NVDA) is the name Wall Street eagerly awaits as the Q3 earnings season winds down. The chip giant is scheduled to release its October quarter (FQ3) earnings this Wednesday (November 20), and all eyes are definitely on the company’s performance to see if it can sustain its impressive growth trajectory.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Rick Schafer, a top analyst at Oppenheimer and ranked 11th among thousands of Wall Street experts, anticipates another strong readout and guidance. “We see upside to F3Q (Oct) results and F4Q (Jan) outlook led by sustained CSP/enterprise demand for AI accelerators,” Schafer commented.

With the H200 taking the lead, Data Center – which accounts for 87% of revenues – should be up by 97% year-over-year and 9% sequentially. The Blackwell ramp takes off in F4Q and Schafer sees it contributing low-mid-single digit $billions in the quarter with a more “robust ramp” expected in F1Q.

Networking (which makes up 14% of DC) is anticipated to be up 9% quarter-over-quarter (+60% y/y) in F3Q. Spectrum-X Ethernet (Switches, DPUs) are “shipping in volume,” and within a year are anticipated to contribute “multibillion-dollar” revenues.

Looking ahead to 2025, discussions with investors show the buyside is factoring 5-6 million GPUs for next year. The CY25 product mix is expected to lean toward “drop-in” HGX modules and air-cooled NVL36 GB200 racks, as these options “best accommodate” current data center infrastructure while challenges with liquid cooling are addressed.

For Gaming, not that long ago Nvidia’s main breadwinner, led by discrete PC GPU, Schafer sees y/y growth of 6% and a sequential increase of 6%.

With sound prospects ahead, Schafer has now increased his CY24/25/26E EPS estimates from $2.80/$3.77/$4.51 to $2.85/$4.16/$5.04, respectively.

Despite a staggering 183% year-to-date gain, far outpacing the SOX index’s 17% rise, Schafer contends Nvidia shares remain attractively priced.

“NVDA trades at 29x our CY26E vs. 5-yr avg 37x,” the 5-star analyst said. “One of the best GM/OM profiles in the group, NVDA is the purest scale play on AI proliferation. Sustained structural growth led by DC/AI as accelerator attach increases. NVDA’s entrenched DC/AI ecosystem core to GenAI. We’re long-term buyers.”

Accordingly, Schafer rates NVDA shares as Outperform (i.e., Buy), while his new $175 price target (up from $150) makes room for 12-month returns of ~25%. (To watch Schafer’s track record, click here)

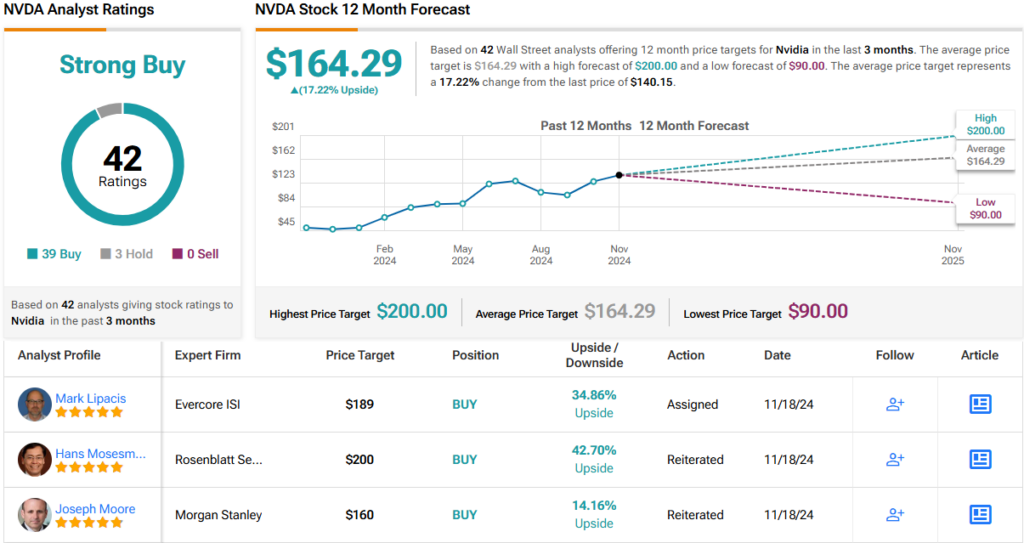

The rest of the Street likes NVDA too. The stock claims a Strong Buy consensus rating based on 39 Buys vs. 3 Holds. At $164.29, the average price target factors in one-year gains of ~17%. (See NVDA stock rating)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.