Microsoft (NASDAQ:MSFT) is set to lead the lineup of market giants reporting earnings this week, with its fiscal first-quarter (June quarter) results scheduled for release on Wednesday after market close.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The readout comes against a backdrop of underperformance for the tech giant. Although its shares are up by 14.5% this year, this falls short of the Nasdaq 100’s 21% gain, with the stock cooling off after a strong 2023 fueled by AI hype.

However, this could present an opportunity for investors, says Truist’s Joel Fishbein, an analyst ranked in the top 3% of Wall Street’s stock experts.

“We believe that the numbers are set to catch up to the hype in the year ahead,” the 5-star analyst said ahead of the print. “Based on our conversations with customers, partners, and resellers, and survey work with enterprise IT buyers, we believe Microsoft is set to outperform across key enterprise categories.”

As for what investors will be hoping to hear on the earnings call, Fishbein thinks Cloud demand, contributions from AI services, the expanding suite of Copilot products, operating margins, and Capex, are all key issues. Although there has been recent investor skepticism – especially concerning 365 Copilot – that’s not the feedback Fishbein has been getting in the field, with Cloud, AI Services and Copilot adoption all appearing poised to deliver the goods.

Fishbein also thinks the company has been playing it conservative with the guide, anticipating Azure will “sustain momentum.” Once again that take is based upon industry conversations, which show Azure “continues to win” workloads for generative AI applications, while the partnership with OpenAI remains a key driver, even amidst ongoing speculation about potential changes to the relationship as OpenAI aims to transition to a for-profit model. Microsoft currently boasts more than 60,000 Azure AI customers, and Fishbein thinks the company has “ways to win at all layers of the developing AI stack.” As long as there are no hardware-related setbacks affecting Azure’s growth, the analyst anticipates the 11-percentage-point contribution from AI to Azure’s growth mentioned last quarter will “continue to expand.”

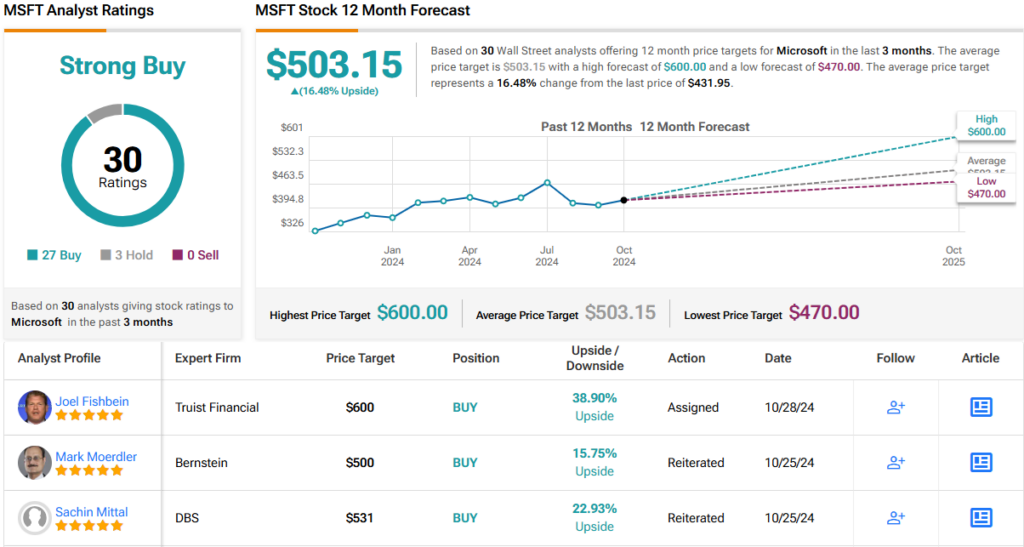

All told, Fishbein remains an MSFT bull, giving the shares a Buy rating and a Street-high price target of $600. The implication for investors? Upside of a robust 39% from current levels. (To watch Fishbein’s track record, click here)

The consensus outlook for MSFT is similarly positive, with a Strong Buy rating based on 27 Buy recommendations and just 3 Holds in the past three months. The shares have an average price target of $503.15, indicating a potential 16.5% gain from their current $432 price. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.