Shares of medical device company Align Technology (NASDAQ:ALGN) are plummeting today after its third-quarter numbers missed expectations on top-line as well as bottom-line fronts.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue contracted 12.4% year-over-year to $890.3 million, lagging consensus by nearly $83 million. During the quarter, Clear Aligner revenue was $732.8 million (down 12.5%) and Imaging Systems and CAD/CAM services revenue was $157.5 million (down 11.7%).

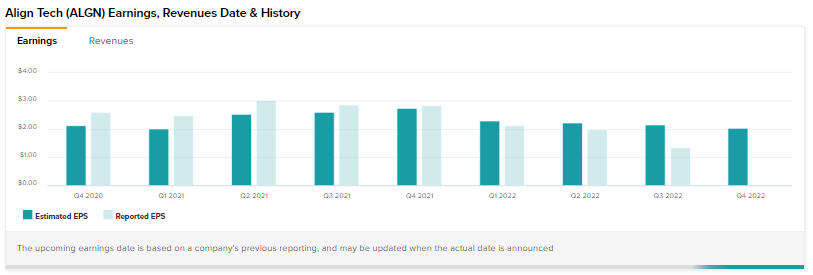

EPS at $1.36 too, missed expectations by a massive $0.80. Further, Align plans to buy back shares worth up to $200 million in the fourth quarter.

The company is seeing challenges from subdued consumer sentiment and foreign currency gyrations. Nonetheless, it expects long-term top-line growth between 20% to 30%.

Read full Disclosure