Alibaba’s (BABA) e-commerce platform in Southeast Asia, Lazada, is making a significant push into generative AI to attract a diverse user base amid rising competition in Southeast Asia. Over the past two years, BABA has poured about $2 billion into Lazada.

The investment comes as Lazada struggles to maintain its market share in Southeast Asia, where Shopee holds a dominant 45% position. Further, TikTok Shop has rapidly captured 20% of the market. It is worth highlighting that while Lazada has a strong appeal among older shoppers, platforms like Shopee and TikTok Shop have gained popularity among younger and tech-savvy consumers.

To address these challenges, Lazada is implementing AI-driven improvements to attract a larger user base and streamline operations for sellers and buyers. The platform will leverage AI to offer users customized recommendations and facilitate after-sales services through AI agents. Additionally, AI tools will allow sellers to create targeted content for varied markets, predict demand effectively, and optimize logistics.

BABA Targets Growth Beyond China

Alibaba’s investments in Southeast Asia reflect its broader strategy to drive growth through geographical expansion. As China’s economy faces headwinds from regulatory challenges and geopolitical tensions with the U.S., Alibaba is leveraging its expertise in AI and technology to gain a competitive edge in the Southeast Asian market.

Is BABA a Good Buy Right Now?

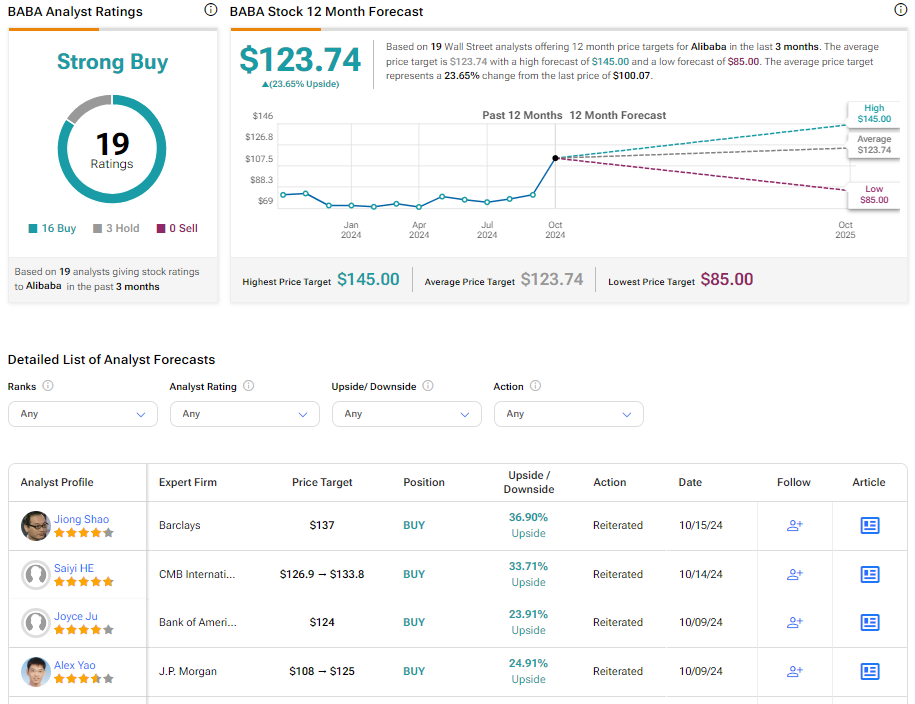

Turning to Wall Street, BABA has a Strong Buy consensus rating based on 16 Buys and three Holds assigned in the last three months. At $123.74, the average Alibaba price target implies 23.65% upside potential. Shares of the company have gained about 32% year-to-date.