Chinese conglomerate Alibaba Holdings (BABA) (HK:9988) is set to raise $5 billion in dual currency bonds, according to a regulatory form filed this morning. The news comes after the e-commerce giant posted solid Q2 FY25 results, beating both top and bottom-line expectations.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Further Details of Alibaba’s Bond Sale

The offering will include multi-tranche and multi-currency bonds of both U.S. dollar and offshore Chinese yuan denominations. The proceeds from the sale would be used for general corporate purposes such as share buybacks and debt reduction.

The dollar tranche would consist of 5.5-year, 10.5-year, and 30-year dollar bonds, while the Chinese yuan offering would include 3.5-year, 5-year, 10-year, and 20-year bonds. In aggregate, Alibaba hopes to raise $5 billion through the bond offerings, banks have told prospective investors. However, the size, interest rates, and maturity of bonds would be decided with the passage of time.

This is Alibaba’s second big bond offering aimed at raising cash to enhance shareholder returns. The company has constantly rewarded shareholders with hefty share buybacks. In Q2, BABA repurchased $4.1 billion worth of shares, with more than $22 billion worth of buybacks pending under the current program.

Analyst’s First Take on BABA’s Q2 Print

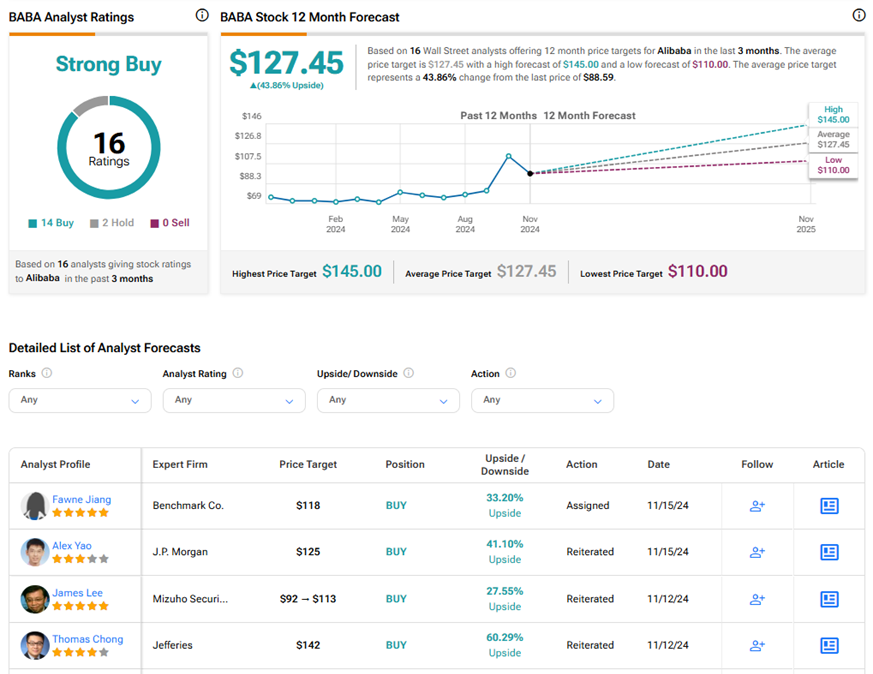

JPMorgan analyst Alex Yao was encouraged with BABA’s Q2 print as the metrics fell mostly in line with expectations. Yao specifically mentioned the healthy improvement in Alibaba’s operating metrics in the domestic e-commerce segment, including active users, new users, and GMV (gross merchandise value) growth. Yao reiterated a Buy rating and $125 (41.1% upside potential) price target on BABA stock and expects shares to react positively to the results.

Similarly, Benchmark Co. analyst Fawne Jiang reaffirmed a Buy rating and $118 (33.2% upside) price target on BABA stock, following the Q2 print. Jiang noted that the top-line beat was light while revenue missed consensus in RMB terms. The analyst was impressed by the growth at Tmall and Taobao.

Is Alibaba Stock a Buy Right Now?

So far, only two analysts have reviewed their ratings following the latest results, so the consensus could change if other analysts review their recommendations on Alibaba stock. On TipRanks, BABA stock has a Strong Buy consensus rating based on 14 Buys versus two Hold ratings. The average Alibaba Group Holdings price target of $127.45 implies 43.9% upside potential from current levels. Year-to-date, BABA shares have gained 16.8%.