Shares of Chinese tech giant Alibaba Group Holding Ltd. (NYSE: BABA) closed up 2.9% at HK$122.20 today on the Hong Kong Stock Exchange, after its biggest shareholder SoftBank Group Ltd. denied speculation of a stock sale.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

BABA stock continued the upward trajectory from yesterday’s news, when the stock had gained as much as 7% during intraday trading on the HKG. Meanwhile, on the NYSE, its stock closed up 3.8% at $126.50 yesterday, February 9.

SoftBank Denies Speculation

On Monday, a Citi analyst speculated that SoftBank may sell its stake in BABA stock, following which BABA shares dropped 6% on the NYSE. The speculation followed an F-6 filed by Alibaba on February 4, with the Securities and Exchange Commission (SEC), which disclosed the registration of one billion additional American Depositary Shares (ADS).

According to Bloomberg, in a private post-result briefing with analysts on Tuesday, SoftBank executives clearly denied the speculation and said they had nothing to do with the registration filing. The statement sent a breather to investors, ensuring them that the company’s largest shareholder still believes in its future prospects.

SoftBank reported its third-quarter results on February 8, wherein it disclosed a separate cash settlement on Alibaba’s forward exchange contracts. When enquired about the same, the company confirmed that it still continues to hold a little less than 25% of BABA stock and has converted a very small fraction of its holding into cash.

Previously in 2020, SoftBank had sold $13.7 billion of BABA stock to reduce its debt and to undertake share buybacks.

Official Comments

The company said in an email statement to Bloomberg, “The registration of the ADR conversion facility (F6 filing, which was filed by Alibaba), including its size, is not tied to any specific future transaction by SBG.”

Moreover, SoftBank founder Masayoshi Son also told analysts that he and his firm were as surprised as everybody else by the filing.

Target Price

With 20 Buys and 3 Holds, the BABA stock commands a Strong Buy consensus rating. The average Alibaba price target of $188.79 implies 49.2% upside potential to current levels. Shares have lost 44.4% over the past year.

Blogger Opinions

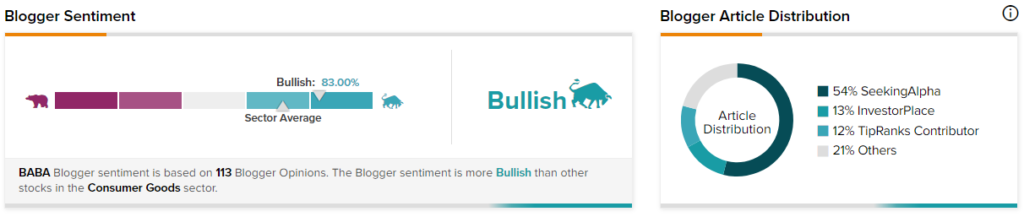

TipRanks data shows that financial blogger opinions are 83% Bullish on BABA, compared to a sector average of 72%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Pfizer Falls 6.6% on Q4 Earnings Beat and Revenue Miss

Global Foundries Tops Q4 Results; Shares Up 4%

Fiserv Exceeds Q4 Expectations; Shares Drop 6%