Alibaba Group (BABA) sold its first public dollar bonds in nearly four years, according to an exclusive Bloomberg report. This dual-currency offering aims to repay offshore debt and repurchase equity.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

What Are Dual Currency Bonds?

A dual currency bond is a debt instrument where the interest on the bond is paid in one currency (base currency) and the principal is repaid in another. The principal amount and exchange rate are fixed at issuance. These bonds often offer higher coupon rates than standard fixed-rate bonds, with payments typically made in the weaker currency. However, they carry exchange rate risk as bondholders benefit if the principal currency appreciates but incur losses if it depreciates.

BABA Offers $2.65B in Dual Currency Bond Offering

The report stated that Alibaba issued $2.65 billion in dollar notes across three tranches. The 30-year bond, the bond with the longest period in the offering, was priced at 1.05 percentage points above the comparable U.S. Treasuries rate, narrowing from an initial premium of 1.30 percentage points. This offering saw a surge in interest from investors, as the order book rose to over $18 billion.

Simultaneously, Alibaba tapped the offshore yuan market, raising RMB17 billion ($2.3 billion) through a note issuance in four tranches. Earlier this year, the company also raised $5 billion through a private convertible note sale.

Why Has BABA Issued Dual Currency Bonds?

Interestingly, the issuance of these dual currency bonds by Alibaba comes at a time when Chinese issuers have ramped up dollar-bond activity, encouraged by domestic stimulus measures and the Federal Reserve’s monetary easing in the U.S.. Monetary easing in the U.S. has led to lower interest rates leading investors to chase higher interest rates on debt instruments in other currencies.

In fact, according to Bloomberg, dollar-bond issuance by Chinese companies more than doubled in October compared to the prior year.

However, Alibaba faces challenges in China. Its core Chinese e-commerce business reported lackluster growth for the quarter ending September 30, overshadowing stronger performances in its international and cloud divisions.

Is BABA Stock a Good Buy?

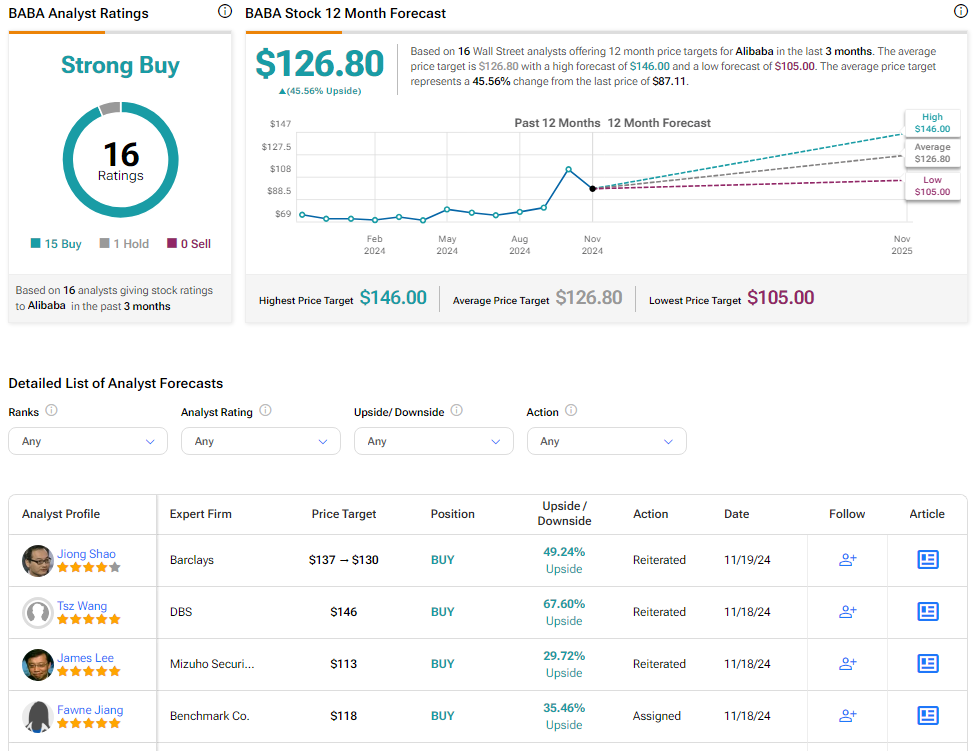

Analysts remain bullish about BABA stock, with a Strong Buy consensus rating based on 15 Buys and one Hold. Over the past year, BABA has increased by more than 10%, and the average BABA price target of $126.80 implies an upside potential of 45.6% from current levels.