The Chinese e-commerce giant Alibaba Group (BABA) has reached a $433.5 million settlement to resolve a class action lawsuit filed by shareholders in a Manhattan federal court. The lawsuit accused the Chinese e-commerce giant of engaging in monopolistic practices, specifically by forcing merchants to sell exclusively on its distribution platform.

Importantly, the settlement agreement still requires court approval and will involve a cash payment to the affected shareholders. Meanwhile, Alibaba has denied any wrongdoing and stated that it entered into the settlement just to avoid further legal costs and disruptions.

Alibaba Faces Legal Scrutiny Over Misleading Investors

The lawsuit, filed in March 2023, claimed that the company violated federal securities laws by making several false statements about its antitrust and exclusivity practices. These statements allegedly inflated its stock price, leading to financial losses for investors.

Furthermore, the lawsuit alleged that BABA’s practices pressured merchants to sell only on its platforms and punished those who also sold on competing sites. This behavior continued even after the company pledged to cease such practices in a 2020 agreement with Chinese regulators.

Analyzing Alibaba’s Exposure to Legal Risks

Legal and regulatory challenges are not new for Alibaba, which has undergone several investigations in recent years. These issues have stemmed from various factors, including alleged monopolistic practices, data privacy concerns, and antitrust investigations.

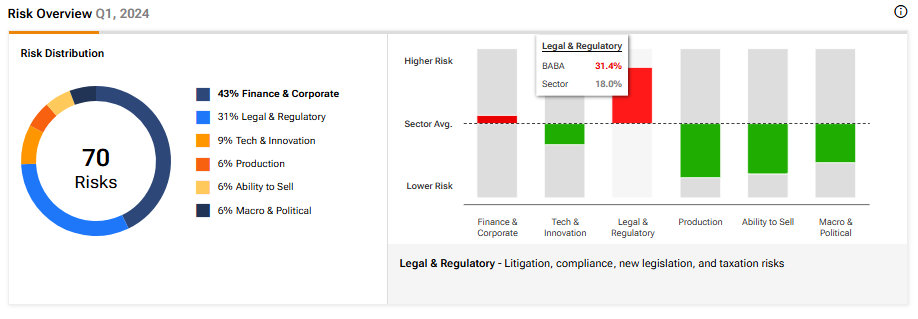

As BABA is subject to several litigations, TipRanks’ Risk Analysis tool shows its legal and regulatory risk exposure is much higher than the industry average.

It’s worth noting that BABA’s legal and regulatory risks account for 31.4% of its total risks and compare unfavorably with the industry average of 18%. This is a substantial difference, and investors should keep a close eye on it.

Is BABA a Good Stock to Buy Now?

Turning to Wall Street, BABA has a Strong Buy consensus rating based on 16 Buys and three Holds assigned in the last three months. At $125.11, the average Alibaba price target implies a 28.42% upside potential. Shares of the company have gained more than 28% year-to-date.