Alaska Air Group, Inc. (NYSE: ALK) has communicated that its fuel costs are bound to be higher than previously estimated for the first quarter of 2022. As mentioned in Tuesday’s Sec filing, the hike reflects the adverse impacts of the fuel volatility caused by the ongoing Ukraine-Russia conflict.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company also provided modified capacity predictions and its growth expectations for the rest of the year. Its solid fundamental and growth expectations seem to have boosted investors’ sentiments. Shares of Alaska Air gained 6.8% on Tuesday to close at $46.67.

Based in Seattle, Washington, Alaska Air provides air transportation services (both cargo and passenger). The holdings company operates through its Horizon Air Industries, Inc. and Alaska Airlines, Inc. subsidiaries.

Inside the Headlines

With the impacts of the pandemic fading gradually, the airline industry was on the recovery path until the conflict between Russia and Ukraine started. The ongoing war between the nations has impacted multiple industries in the U.S., including energy, airline, electric vehicles, and technology.

For Alaska Air, volatility in fuel prices will be concerning. The airline now predicts its economic fuel costs to be within $2.60-$2.65 per gallon in the first quarter of 2022, higher than its previous expectation of $2.45-$2.50 per gallon.

The revised first-quarter prediction for economic fuel costs is higher than $2.26 per gallon recorded in the fourth quarter of 2021.

The company now predicts a 3%-5% decline in capacity for the first half of 2022. A pre-COVID level is expected to be reached by summer and profitability is predicted to be obtained in the second half of 2022.

Stock Rating

Recently, Scott Group, an analyst at Wolfe Research, maintained a Buy rating on Alaska Air and a price target of $67 (43.56% upside potential).

Wall Street is optimistic about Alaska Air and has a Strong Buy consensus rating based on 6 Buys and 1 Hold. The average ALK price target of $74.43 suggests 59.48% upside potential from current levels. Over the past year, shares of Alaska Air have decreased 30.2%.

Bloggers Opinion

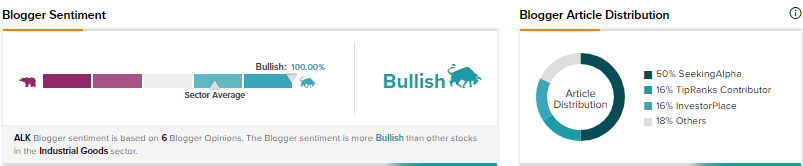

Per TipRanks data, the financial blogger opinions are 100% Bullish on ALK, as compared with the sector’s average of 69%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Stock Futures Move Up as Investors Monitor Geopolitical Situation, Rising Commodity Prices

Shell Stock Climbs after Breaking Off Russian Oil

Commodity Costs Climbing: These Stocks Stand to Benefit