Air Canada (TSE:AC) lowered its full-year profit forecast on Monday due to overcapacity in some markets and increased competition on international routes, which impacted its pricing power. In fact, airlines are offering more discounts to attract summer travelers. This led to a nearly 4% drop in the airline’s shares at the time of writing.

Air Canada now projects 2024 adjusted EBITDA between C$3.1 billion and C$3.4 billion, down from its previous estimate of C$3.7 billion to C$4.2 billion. According to the firm, this update reflects a lower yield environment, below-expected load factors for the second half of the year, and competitive pressures.

Interestingly, when looking at Air Canada’s website traffic, we can see that this year’s trend (bluish-green line) is beginning to converge with last year’s trend (grey line). This could be evidence of competitors chipping away at Air Canada’s market share, especially since summer traffic was trending upward last year while the opposite is happening this year.

In addition, preliminary second-quarter operating revenue was reported at C$5.5 billion, which is a 6% increase from the previous year but below the expected C$5.65 billion. Meanwhile, operating income for the period is anticipated to be C$466 million, compared to C$802 million the previous year.

Is Air Canada a Good Stock to Buy?

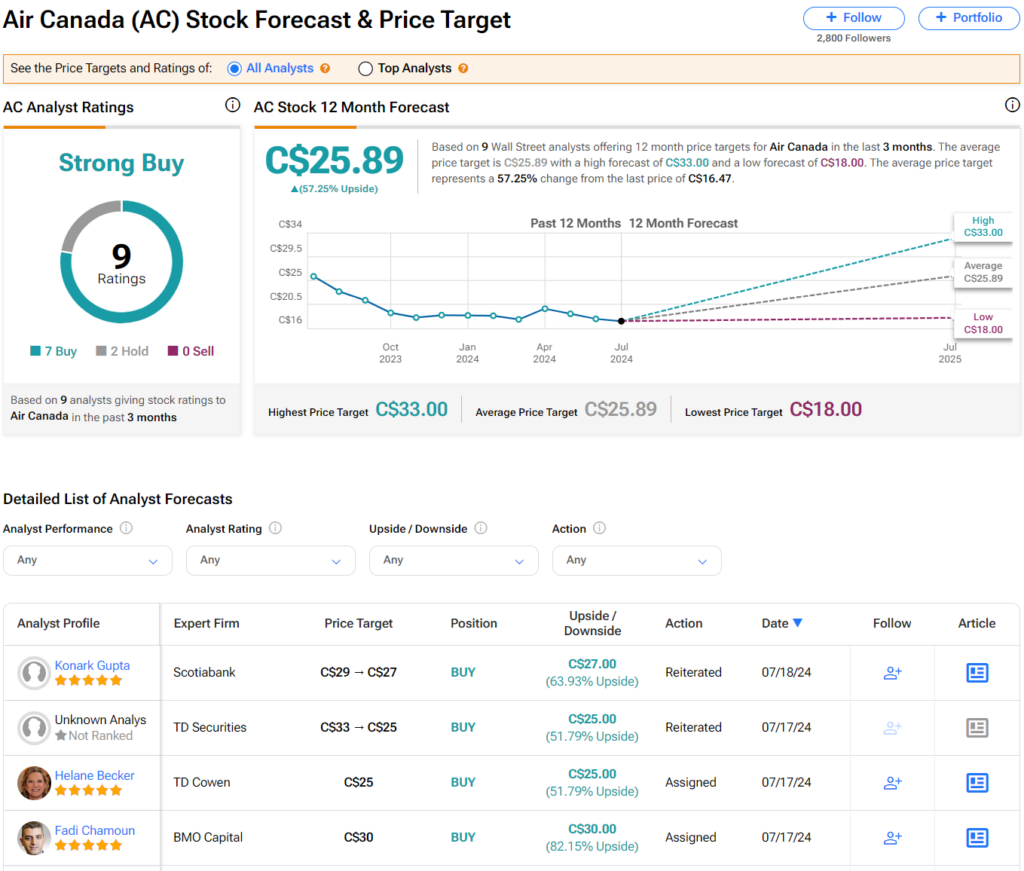

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Air Canada stock based on five Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 36% loss in its share price over the past year, the average Air Canada price target of C$25.89 per share implies 57.25% upside potential.