A group of AI startups has given rise to a new debt market on Wall Street, largely due to their demand for Nvidia (NVDA) chips. Several top investment banks have collectively loaned $11 billion to smaller companies operating in the “neocloud” computing space, which refers to new cloud computing startups that leverage advanced AI technologies. This debt market has boomed over the past year, as these tech startups have acquired thousands of Nvidia GPUs. According to The Financial Times, these chips are being used as collateral for the large-scale loans being distributed.

A New Boom for Wall Street and Nvidia

This rush for chips has only propelled Nvidia stock upward over the past year. The AI leader has struggled recently but has still enjoyed a year of steady growth. As of this writing, it has surged 200% for the year and has outpaced most competitors. While some experts have raised concerns about the company’s ability to sustain this explosive growth, Nvidia continues to prove them wrong.

Now, this debt market development demonstrates that demand for Nvidia’s chips isn’t slowing down. As The Financial Times reports, “The frenzied dealmaking has shone a light on a rampant GPU economy in Silicon Valley that is increasingly being supported by deep-pocketed financiers in New York.” The AI gold rush has taken new forms and is still creating unique opportunities for investors to profit.

For Wall Street to be lending out this much money to companies that are still fairly new to the tech sector shows a clear confidence in both the firms and the industry. The list of neocloud companies that fueled this new debt market includes startups CoreWeave, Crusoe Energy, and Lambda Labs, all of whom operate in the cloud computing space.

What This Means for Nvidia

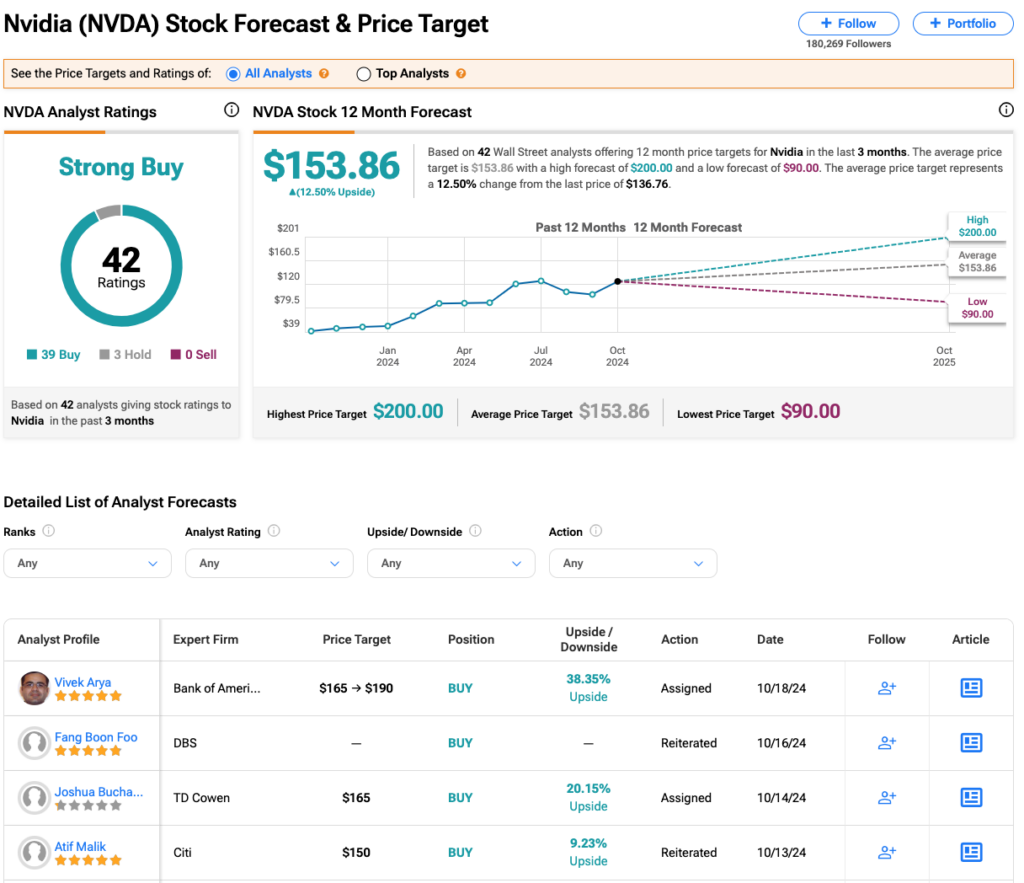

Wall Street remains highly bullish on Nvidia, as it has been all year. Analysts have a Strong Buy consensus rating on NVDA stock based on 39 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 200% rally in its share price over the past year, the average NVDA price target of $153.86 per share implies 12.5% upside potential.

As TipRanks’ Radhika Saraogi notes, reports indicate that Nvidia may be considering an investment in xAI, Elon Musk’s AI startup venture. But even if it opts against this, NVDA stock is likely to keep rising over the coming year. As the debt market news makes clear, demand for its chips remains robust and isn’t likely to decrease.