The software giant Adobe (ADBE) has been trading sideways for over a year now, even as most tech stocks have recorded exceptional gains during the same period. In fact, you may be surprised to hear that Adobe’s shares are currently priced at the same levels they did all the way back in August 2020. Yet, recent developments suggest that Adobe stock may be poised for a strong rebound. In particular, the company has sustained double-digit growth while making remarkable progress in enriching its AI capabilities. Along with the fact that shares are trading at an attractive valuation, I believe that the bullish case for Adobe is stronger than ever.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Growth Remains Robust Despite AI Concerns

One of the primary reasons Adobe’s shares have failed to deliver meaningful gains recently is investors’ concerns that AI advancements could threaten the company’s business model. The worry is that generative AI tools might democratize creative capabilities, so that industry-standard tools like Adobe’s could become obsolete. I mean, think about it: if AI enables anyone to create sophisticated content simply by providing detailed instructions and having it generated automatically, why pay for an Adobe subscription?

Despite these fears, Adobe’s actual performance in recent quarters tells a different story. In its latest Q3 report, for instance, Adobe achieved 11% year-over-year revenue growth, driven by solid demand across Creative Cloud, Document Cloud, and Experience Cloud. Notably, not only has Adobe’s business model remained resilient, but it also appears that Adobe’s subscribers are embracing its AI-driven tools, which have led to record demand for its creative suite.

Specifically, according to management, this growth has been partly fueled by the widespread adoption of AI-powered features like Firefly, Adobe’s suite of generative AI tools, which are deeply integrated into its software. These tools are designed to boost productivity and creativity, with features like Generative Fill in Photoshop and Generative Recolor in Illustrator. This makes it easier than ever for creators to bring their visions to life and, while still in the early stages, suggests that AI is here to support and enhance the work of creators and editors, rather than replace them.

Ongoing Developments Set to Drive Future Growth

Now, let’s take a look at some of Adobe’s ongoing developments, including in AI, which are setting the stage for continued growth. At Adobe MAX 2024, hosted last month, the company unveiled a series of new features and innovations that further solidified its leadership in creative software. Its strategy seems to focus on using AI to boost user experience and productivity, while the event highlighted multiple exciting advancements in this area.

One such example is the company’s major updates to its Firefly models, introducing new video and audio capabilities such as auto-dubbing and generative video tools. I think these features are going to be quite helpful for users, as they integrate seamlessly with Adobe’s existing ecosystem, like Premiere Pro, making it easier to merge sophisticated AI-driven elements into their projects. Therefore, there shouldn’t be a long learning curve for users who can adopt these tools quickly. In turn, I believe this should help Adobe maintain its industry-leading position.

In addition, Adobe unveiled GenStudio, a performance marketing platform that links creative production with marketing analytics. Simply put, it helps creatives track how their content performs by setting up a feedback loop to improve their work. Adobe also improved its Experience Manager with generative AI, making it easier for businesses to deliver personalized and engaging customer experiences. Overall, these updates shouldn’t only keep Adobe ahead of the competition but also bolster customer engagement and loyalty, as they provide real value thus far.

Valuation Setup Positions Stock for Upside

So, what makes Adobe a compelling investment opportunity now? Despite the stagnation of share prices in recent years, Adobe’s valuation now appears compelling. While the stock is trading at its August 2020 levels, Adobe has consistently grown its EPS at double-digit rates year after year. In fact, for Fiscal 2024, consensus estimates point to an EPS of $18.27, representing a growth rate of 13.7%. This momentum is expected to endure into Fiscal year 2025, with an estimated EPS of $20.56. This lasting EPS growth against a stagnant share price has led to Adobe trading at just 24.5 times next year’s expected earnings, one of the lowest forward valuations it has ever commanded.

I believe this represents a compelling entry point, given Adobe’s solid growth, strong qualities, and unique position within the industry. Whether the company sustains its current multiple and delivers gains aligned with EPS growth or, even better, experiences a multiple expansion as the market recognizes the transformative potential of AI in its business, the stock seems well-positioned for strong returns.

Is ADBE Stock a Buy?

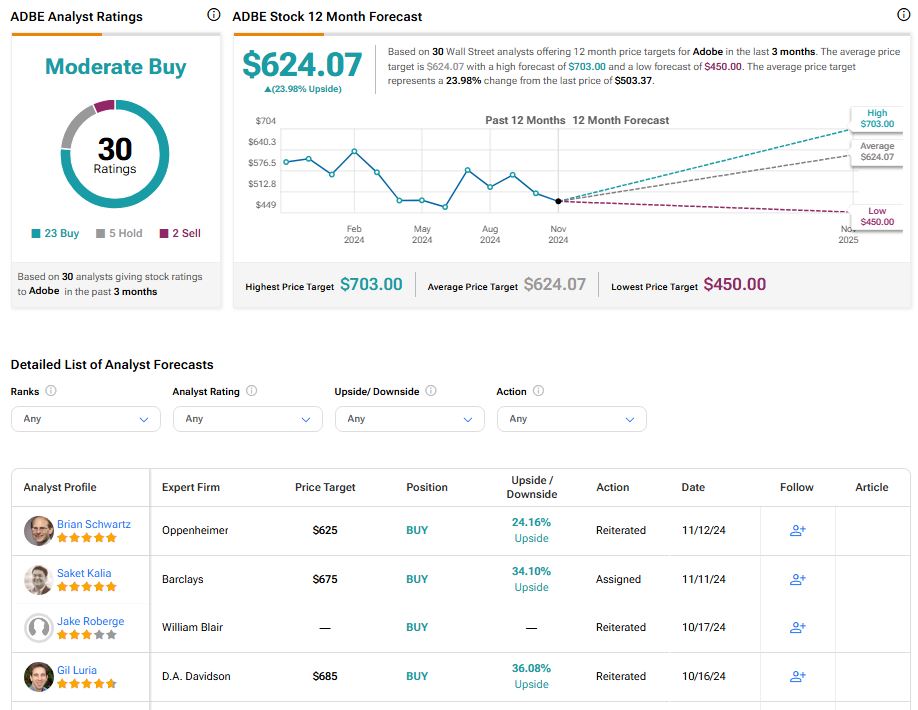

Wall Street analysts appear optimistic that Adobe’s stock may finally be positioned for meaningful upside. The stock holds a consensus rating of “Moderate Buy,” supported by 23 Buy ratings, five Hold ratings, and only two Sell ratings in the past three months. With an average price target of $624.07, Adobe appears to have a promising 24% upside from its current share price.

Summing up

Adobe’s blend of robust double-digit growth, advancements in AI, and attractive valuation present a compelling case for a rebound. While investors appear concerned about AI disrupting its business, Adobe’s integration of AI tools like Firefly has bolstered its value proposition and subscriber base. Thus, with double-digit growth expected to persist in the coming years and a historically low earnings multiple, Adobe seems well-positioned for future growth, presenting an attractive long-term investment opportunity, in my view.