Adobe (ADBE), which specializes in creative software solutions such as Illustrator and Photoshop, has unveiled a new generative AI video product. Specifically, San Jose, California-based Adobe launched a new version of its Firefly video editing suite that includes AI enhancements and additional tools. It’s the company’s response to privately held start-up OpenAI’s competing AI-based video platform called Sora.

Adobe Stock Falls on AI Concerns

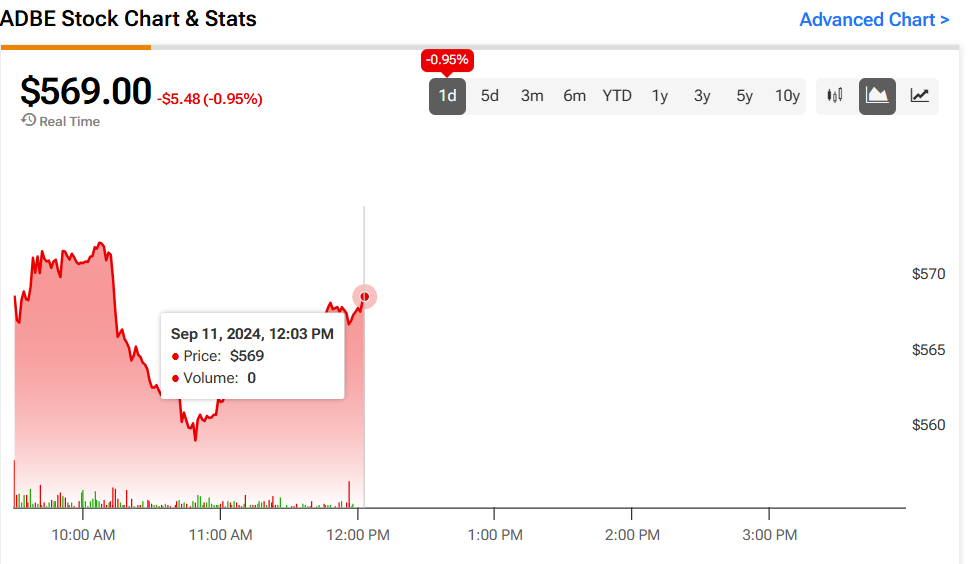

Concerns that AI-generated images and videos will eat into Adobe’s sales and market share have hurt the company’s stock over the past year. In the last 12 months, Adobe stock has gained less than 1% compared to a 22% gain for the benchmark S&P 500 index (SPX). ADBE currently trades at $569 per share. News of the AI version of Firefly doesn’t seem to have helped, as Adobe’s stock is trading down 1% on the news.

Improving the Video Editing Process

The new Firefly, which can reportedly convert text and images to video, will be available in beta mode this fall before a wider launch in 2025. Adobe said that the AI-enabled Firefly will allow users to add new elements to existing footage and improve the video editing process.

Specifically, editors will be able to use text prompts and images to create and insert B-Roll footage that fills gaps in existing videos. The new software also allows editors to bring still shots and illustrations to life by transforming them into video clips, said the company.

Adobe’s Upcoming Earnings

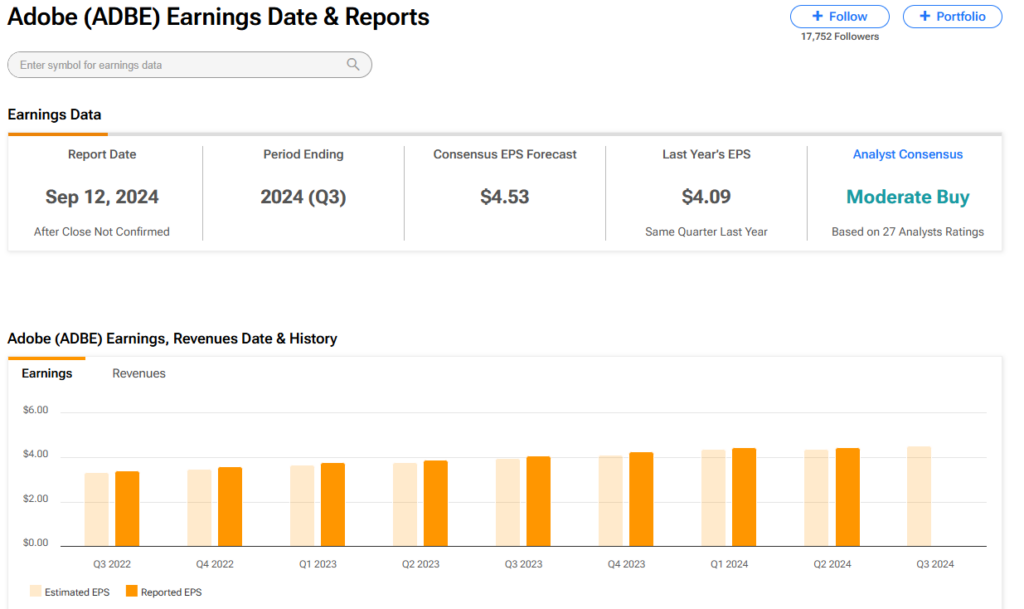

The new edition of Firefly was announced a day before Adobe is scheduled to report its fiscal third-quarter financial results on Sept. 12. The consensus expectation among analysts is for the company to report earnings per share (EPS) of $4.53 on revenue of $5.37 billion.

ADBE stock rallied 15% the day after the company’s previous earnings report on June 13. Adobe reported Fiscal Q2 EPS of $4.48, which topped estimates on Wall Street that called for $4.39 a share in profits. Revenue of $5.31 billion slightly beat the consensus estimate of $5.29 billion.

Despite the strong results, Adobe’s stock has remained flat over the past year as concerns persist about the future impact of AI on the company’s business.

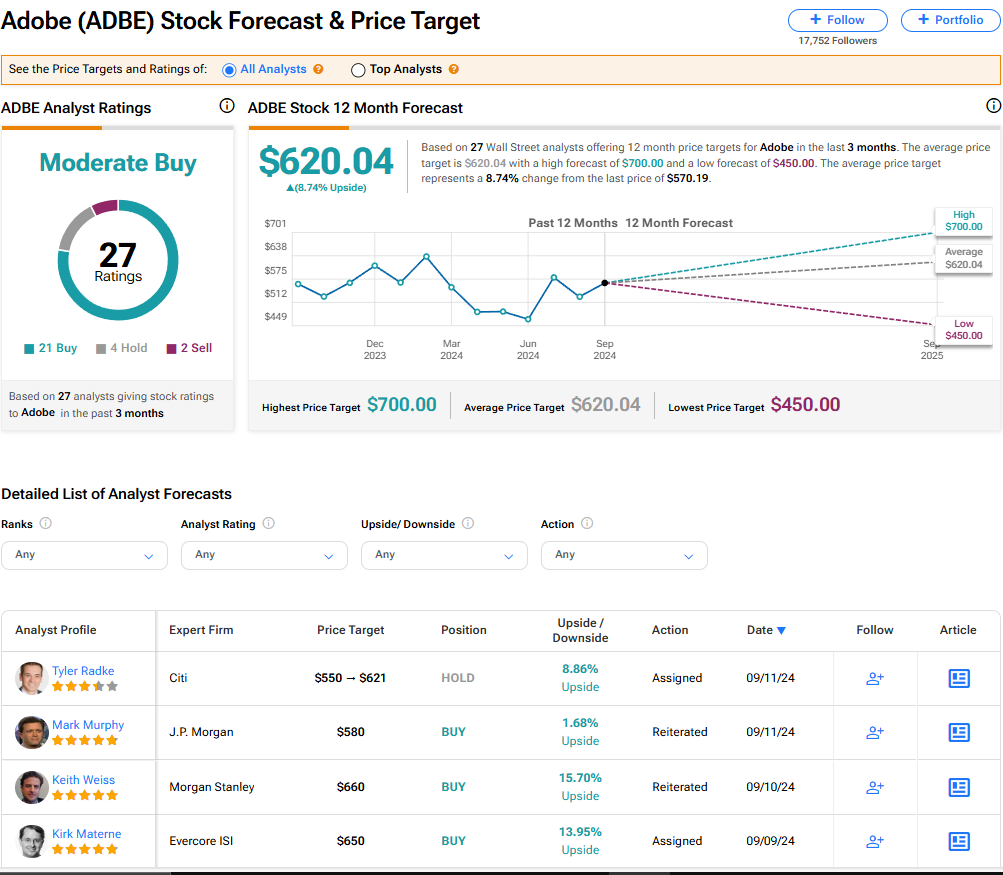

Is ADBE Stock a Buy or Sell?

Analysts remain cautious with Adobe stock. There is currently a Moderate Buy consensus rating on the stock based on 21 Buys, four Holds, and two Sells. The average ADBE price target is $620.04, implying 8.74% upside from current levels. It is worth noting that analyst ratings are likely to change after Adobe announces its Fiscal Q3 results.