Adobe (NASDAQ:ADBE) is scheduled to report its second quarter Fiscal 2024 results on June 13, after the market closes. Strong demand momentum for the company’s cloud offerings might have supported performance in the quarter. It is worth highlighting that Adobe’s web traffic increased year-over-year during the quarter, potentially indicating strong top-line numbers in Q2.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

ADBE is a software company known for its creative and multimedia software products, such as Photoshop, Illustrator, and Acrobat.

Encouraging Website Traffic Trend

According to TipRanks’ Website Traffic tool, total visits to adobe.com grew by 15.42% year-over-year in Q2. The company’s website traffic jumped to 1.37 billion from 1.18 billion in the year-ago quarter.

The rising website traffic indicates that the demand for the company’s products remained strong during the quarter.

Learn how Website Traffic can help you research your favorite stocks.

ADBE – Q2 Expectations

Wall Street expects Adobe to report sales of $5.29 billion in Q2, up 10% year-over-year. Further, the company is expected to post earnings of $4.39 per share, reflecting an increase of 12.3% from the year-ago quarter.

Interestingly, Adobe has a consistent history of delivering strong quarterly performances. The company surpassed earnings expectations for 15 consecutive quarters, indicating its potential to outperform estimates again in the to-be-reported quarter.

Analyst’s Opinion

Ahead of the Q2 results, 11 Wall Street analysts rated Adobe stock a Buy.

Among the bullish analysts, BMO Capital analyst Keith Bachman believes that weak spending trends in enterprise software might impact the company’s performance in Fiscal 2024. However, he finds the stock’s valuation to be reasonable.

Is Adobe Stock a Buy, Sell, or Hold?

Wall Street is cautiously optimistic about Adobe. It has a Moderate Buy consensus rating based on 22 Buy, seven Hold, and two Sell ratings. The analysts’ average price target on Adobe stock of $605.90 implies 30.95% upside potential. Shares of the company have declined 27% over the past six months.

Options Traders Anticipate a Decent Move

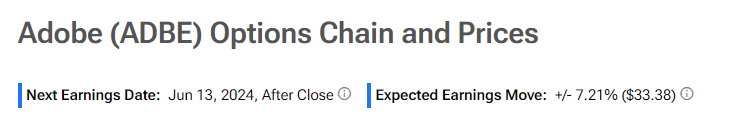

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry; the Options tool does this for you. Indeed, it currently says that options traders are expecting a decent 7.21% move in either direction.

Concluding Thoughts

The website traffic trend and analysts’ estimates suggest that the company is expected to witness positive momentum in Q2, driven by strong demand for its cloud-based products. Additionally, Adobe’s consistent track record of surpassing earnings expectations suggests that it may exceed analyst predictions in the upcoming quarter.