Artists the world over are growing increasingly concerned about artificial intelligence (AI). Whether it is how the systems are trained with already-existing, human-created art that gets no compensation for such use or how there is a very real possibility those systems may steal jobs from living humans in the future, there are concerns enough to go around. But software giant Adobe (ADBE) is embracing it, and investors could not be much happier. Shares are up around 4.5% in the closing minutes of Tuesday’s trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Adobe is adding some new updates to its stock photography operations, perhaps the biggest of these being artificial intelligence editing systems. The new tools came out today, and with these, users will be able to start out with a stock image and then modify it to their needs or preferences. However, in this case, the original producer of the stock image gets compensated regardless of the modification. However, one point that did not come up was who the copyright holder of the modified image is.

Matthew Smith, an executive with Adobe, declared this a means to take out the “blank canvas problem” and that “Generative AI is not replacing stock (imagery).” Smith also noted that the new tools were “…not replacing creatives or contributors. It’s enhancing and giving them more potential opportunity to increase their earnings.”

A Welcome Tool for Some

As noted previously, not everyone believes that AI modifications will be the death knell of human-produced art. Some even believe that generative workspace will be the hit of Adobe’s lineup, thanks to a set of features like “potential cross-platform access” and “a library of all your past generated images,” noted a report from Make Use Of.

Meanwhile, Techradar also revealed that Adobe may be stirring up trouble in other areas, particularly in terms of its licensing decisions. Its original play, perpetual licensing for the Elements software, was a commonly enjoyed notion. But with perpetual licensing gone, some customers are looking for other options. Even as Adobe adds some new features to soften the blow of a new subscription model, others simply refuse, and are looking for an alternate platform.

Is Adobe Stock a Good Buy Right Now?

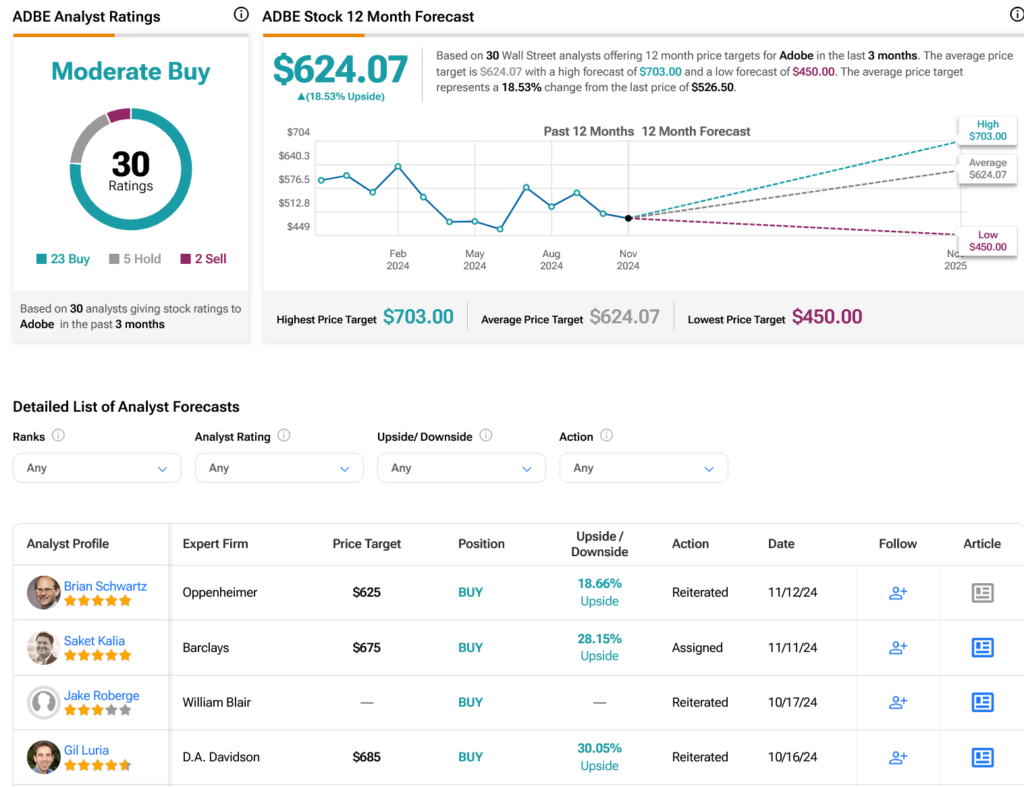

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ADBE stock based on 23 Buys, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 10.78% loss in its share price over the past year, the average ADBE price target of $624.07 per share implies 18.53% upside potential.