Shares of professional services company Accenture (NYSE:ACN) are little changed in today’s trading as investors await its Q3 earnings results on June 20 before the market opens. Analysts are expecting earnings per share to come in at $3.16 on revenue of $16.539 billion. This represents a decline from the $3.19 per share seen in the year-ago period, according to TipRanks’ data.

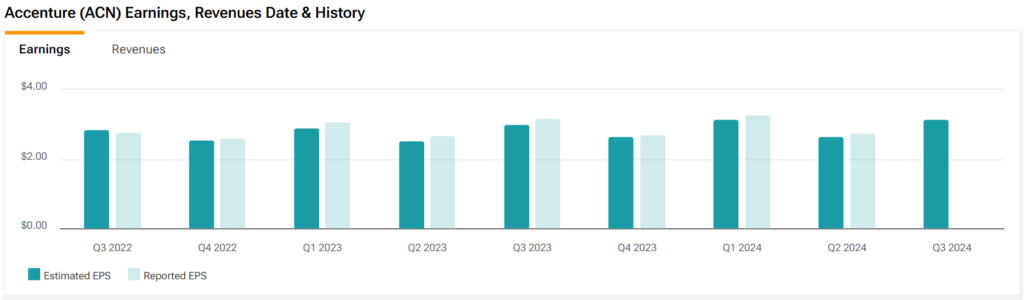

However, ACN has enjoyed a good track record lately when it comes to beating estimates. Indeed, it has beaten EPS forecasts seven times during the past eight quarters, as demonstrated in the image below. Thereofre, it’s possible that it could potentially see year-over-year growth.

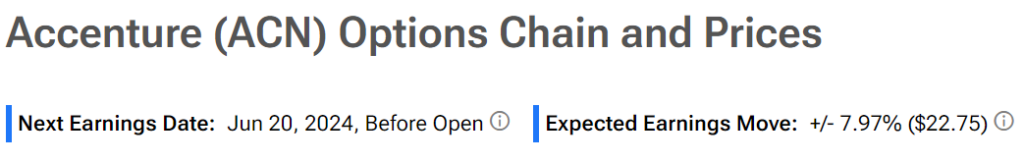

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a 7.97% move in either direction.

Is ACN a Good Stock to Buy?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ACN stock based on nine Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After an 8.7% decline in its share price over the past year, the average ACN price target of $348.24 per share implies 22.04% upside potential.