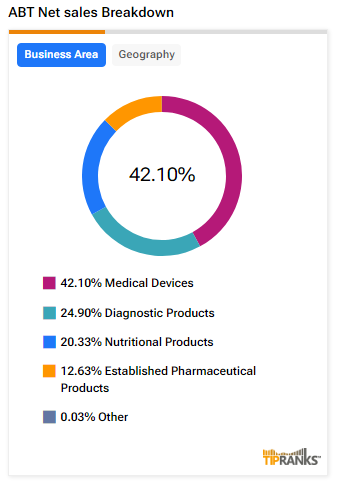

Abbott (ABT) reported better-than-expected third-quarter results on Wednesday. The medical devices and healthcare company’s sales increased by 4.9% year-over-year to $10.63 billion and surpassed analysts’ expectations of $10.55 billion. The rise in revenues was driven by the sales of its medical devices, which increased by 13.3% on an organic basis to $4.75 billion in the third quarter.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This segment comrpised more than 40% of ABT’s total revenues in the third quarter. In addition, adjusted earnings rose by 6.1% year-over-year to $1.21 per share, above consensus estimates of $1.20 per share.

ABT Declares Quarterly Dividend

Furthermore, the company declared a quarterly dividend of $0.55 per share, payable on November 15 to shareholders of record at the close of business on October 15, 2024. Notably, Abbott has raised its dividend for the past 52 straight years and is part of the S&P 500 Dividend Aristocrats Index, which includes companies that have increased their dividends for more than 25 years. Additionally, the company’s Board of Directors has authorized a new $7 billion share repurchase program.

ABT Raises FY24 Earnings Outlook

Looking ahead, ABT reiterated its FY24 organic sales guidance, which is now expected to grow in the range of 9.5% to 10%, excluding sales related to testing kits for COVID-19. Adjusted earnings are projected to be between $4.64 and $4.70 per share, which at the midpoint of this range is $4.67 per share. This is higher than consensus estimates of $4.66 per share.

Moreover, adjusted earnings are estimated to be in the range of $1.31 to $1.37 per share in the fourth quarter, compared to Street estimates of $1.34 per share.

Is ABT a Good Stock to Buy Now?

Analysts remain bullish about ABT stock, with a Strong Buy consensus rating based on 14 Buys and three Holds. Over the past year, ABT has increased by more than 25%, and the average ABT price target of $129.06 implies an upside potential of 11.2% from current levels. These analyst ratings are likely to change following ABT’s results today.