Home rental company Airbnb (ABNB) has reported mixed third-quarter financial results.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company announced earnings per share (EPS) of $2.13, which was slightly below the consensus forecast of $2.14. Revenue in the July through September period totaled $3.73 billion, which was slightly ahead of the $3.72 billion expected on Wall Street. Sales were up 10% from a year earlier.

In terms of guidance, Airbnb said that it expects to report revenue of $2.39 billion to $2.44 billion during the current fourth quarter. The high end of that range is slightly ahead of the $2.42 billion estimate of analysts.

Global Expansion

Management at Airbnb said they remain focused on expanding beyond its core markets and into under-penetrated markets around the world. The average growth rate of nights booked in Airbnb’s expansion markets was double that of its core markets during the third quarter.

Airbnb said it saw hosting growth across all regions and market types during Q3 with more than eight million active listings and has worked to improve listing quality. Airbnb has removed more than 300,000 listings since last year. Average daily rates increased 1% from a year ago to $164 in the third quarter.

The stock of Airbnb has increased 8% so far in 2024.

Is ABNB Stock a Buy?

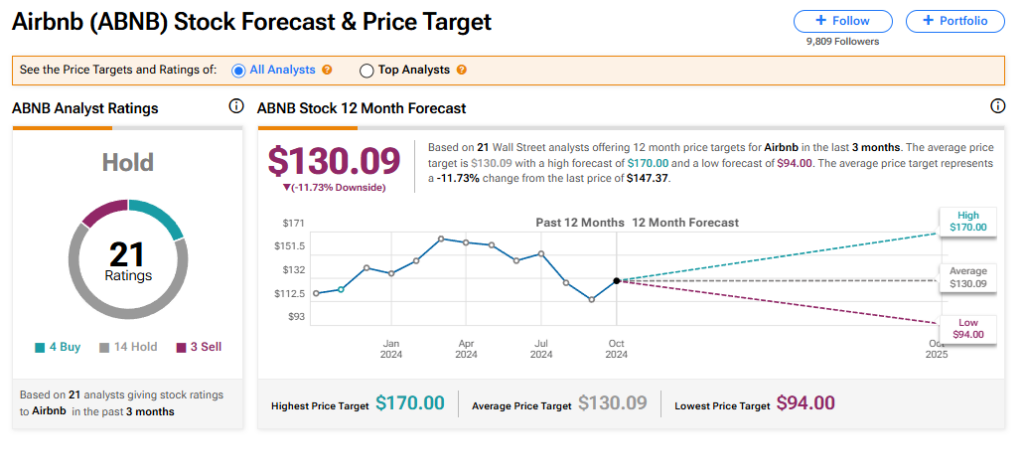

Airbnb has a consensus Hold rating among 21 Wall Street analysts. That rating is based on four Buy, 14 Hold, and three Sell recommendations made in the last three months. The average ABNB price target of $130.09 implies 11.73% downside from current levels.