Shares of U.S. clothing retailer Abercrombie & Fitch (ANF) are up 8% after JPMorgan Chase (JPM) raised its price target on the stock and added it to its “Positive Catalyst Watch” list.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Highly regarded retail analyst Matthew Boss raised his price target on ANF stock by $1 to $195 and maintained an Overweight rating on the shares. He also lifted his forecast for Abercrombie & Fitch’s third-quarter earnings estimate, saying the company’s brands, which include Hollister, have momentum following recent back-to-school shopping.

In a note to clients, Boss said that after “recent fieldwork and management access,” they were raising their outlook for Abercrombie & Fitch’s Q3 earnings per share (EPS) to $2.40, based on a 13% increase in revenue. The JPMorgan analyst also expects Abercrombie’s gross margin to rise 10 basis points. Abercrombie & Fitch is scheduled to report its Q3 results on November 19.

Hollister Brand Shines for Abercrombie & Fitch

Boss said that he sees Abercrombie & Fitch benefitting from accelerating sales of its Hollister brand that sells casual wear such as hoodies, polar fleeces and track suits, as well as accessories and perfume. Boss also noted in his report that Abercrombie & Fitch CEO Fran Horowitz said during the summer that she was “thrilled with the start to August” and “thrilled with back-to-school” sales at the company.

The 8% jump in ANF stock is no doubt welcome relief to Abercrombie & Fitch shareholders. Since hitting a 52-week high of nearly $200 in June of this year, the company’s share price had declined more than 30% and was trading below $140 in recent days. Despite the pullback, Abercrombie & Fitch’s stock is still up 64% this year and 165% over the last 12 months.

Is ANF Stock a Buy?

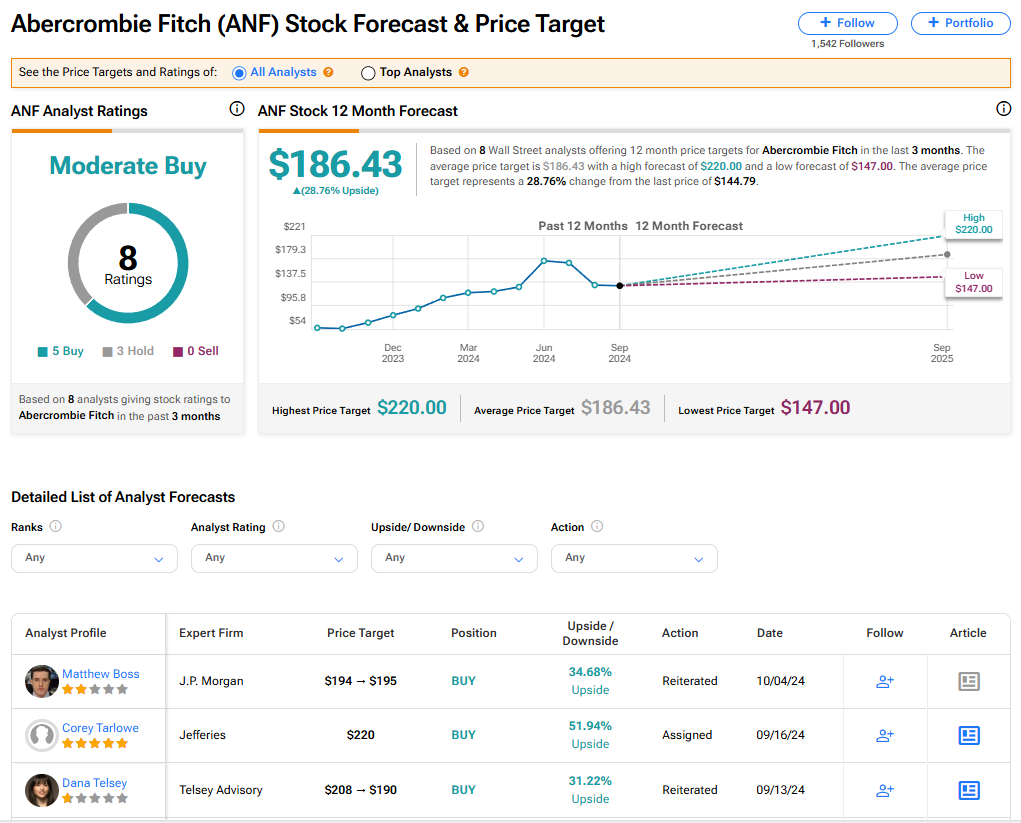

Abercrombie & Fitch stock has a consensus Moderate Buy rating among eight Wall Street analysts. That rating is based on five Buy and three Hold ratings assigned in the last three months. There are no Sell ratings on the stock. The average ANF price target of $186.43 implies 28.76% upside potential.