This will be a big week for pharmaceutical company Abbott Laboratories (ABT), as it takes on a lawsuit over its baby formula. The case is being closely covered by the media, but investors seem less than concerned. ABT shares were up fractionally in Monday afternoon’s trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The lawsuit focuses on a mother whose son—born prematurely—ended up getting a serious intestinal disease as a result of being fed baby formula at the hospital. The mother is trying to connect the formula to the disease, and is part of larger litigation that has already yielded $495 million in judgments against Abbott.

The plaintiffs claim that the baby formula, made partially with cow’s milk, can result in a greater risk of premature babies developing necrotizing enterocolitis, a condition with a greater than 20% fatality rate. But Abbott asserts that the claims have no merit and that their products are useful and essential in protecting and supporting premature babies.

Growing Support

Meanwhile, there is quite a bit of growing support for Abbott Labs despite this latest lawsuit. CNBC commentator Jim Cramer declared “I want people in it,” referring to ABT stock, though also advised that investors wait for the loss that would likely result from this latest trial, using it as a “buy-the-dip” opportunity.

Another report suggests that Abbott Labs could be in for a major win thanks to one key metric: its return on capital employed (ROCE). A higher ROCE suggests that the company is constantly putting earnings back to work within the company and producing improvements. Recently, Abbott Labs saw some improvement in its ROCE figure, and thus, its long-term chances improved accordingly.

Is Abbott Labs a Good Stock to Buy Right Now?

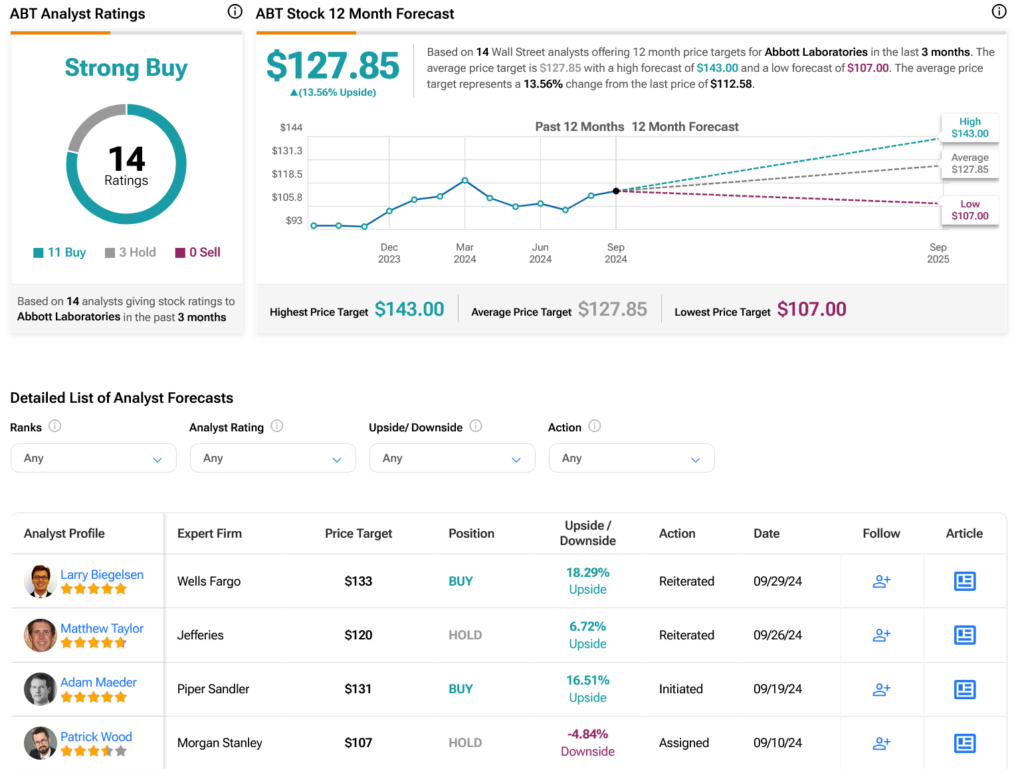

Turning to Wall Street, analysts have a Strong Buy consensus rating on ABT stock based on 11 Buy and three Hold ratings assigned in the past three months, as indicated by the graphic below. After a 19.9% rally in its share price over the past year, the average ABT price target of $127.85 per share implies 13.56% upside potential.