Today, we will look at 5 stocks that hedge funds love and are buying in bulk lately. We used the TipRanks Stock Screener tool to scan for stocks that have a Very Positive Hedge Fund Confidence Signal. We went a step forward and selected those stocks that also have a very high share price appreciation potential in the next twelve months, indicating that Wall Street analysts also favor these stocks.

Hedge funds often have the best understanding and knowledge of a particular company, backed by thorough research and years of active stock screening. Investors wishing to earn reasonably high returns on investments can refer to the stocks that hedge funds are buying. Our list today includes companies from the pharmaceutical sector. These companies usually enjoy attention owing to the success of a drug or their solid pipeline of drugs that are poised to become commercial hits.

#1 Alphatec Holdings (NASDAQ:ATEC)

Alphatec is a medical technology company focused on revolutionizing the approach to spine surgery. the company designs, develops, and markets spinal fusion technology products and solutions for the treatment of spinal disorders. Alphatec has a Very Positive Hedge Fund Confidence Signal, as five hedge funds increased their holdings of ATEC shares by 2.6 million in the last quarter.

On March 19, Alphatec presented its ATEC Long-Range Plan Update, which caught analysts’ attention. The company aims to achieve revenue of $555 million in Fiscal 2025 at a compound annual growth rate of 23%. With a breakeven of adjusted EBITDA met in 2023, Alphatec is targeting the figure of $80 million in FY25. Plus, a free cash flow of $10 million is forecasted for FY25. In the roughly $8 billion+ spine market in the U.S., ATEC enjoys a roughly 5% market share and is poised to grow from here.

Should I Buy Alphatec Stock?

Following the presentation, five analysts reiterated their Buy ratings on ATEC stock and maintained their high price targets. With nine unanimous Buys, ATEC has a Strong Buy consensus rating. The average Alphatec price target of $23.28 implies 68.9% upside potential from current levels.

#2 Evolus Inc. (NASDAQ:EOLS)

Evolus provides medical aesthetics and performance beauty treatments and procedures. Evolus targets the younger generation of consumers, the millennials, for health and wellness treatments.

EOLS stock has a Very Positive Hedge Fund Confidence Signal as four hedge funds increased their EOLS holdings by 3 million shares in the last quarter.

For Fiscal 2024, Evolus forecasts revenue between $255 and $265 million, reflecting a 26%-31% growth. Also, for Q4 FY24 and Fiscal 2025, Evolus expects to reach positive non-GAAP operating income. The company even announced the pricing of 3,554,000 shares of its common stock at an underwritten offering price of $14.07 per share, with gross proceeds of approximately $50 million.

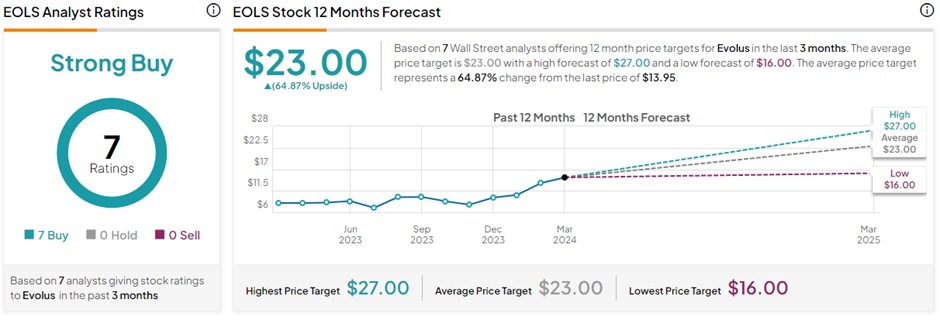

Is Evolus a Good Investment?

With seven unanimous Buy ratings, EOLS stock has a Strong Buy consensus rating on TipRanks. The average Evolus price target of $23 implies 64.9% upside potential from current levels.

#3 Darling Ingredients (NYSE:DAR)

Darling Ingredients is a consumer defensive play. The company collects materials from the animal agriculture and food industries and processes them into high-quality fats and proteins, which are then used to feed animals and crops and fuel the world with renewable energy.

Darling Ingredients has a Very Positive Hedge Fund Confidence Signal since 13 hedge funds increased their holdings of DAR by 2 million shares in the last quarter.

For Q4 FY23, Darling Ingredients posted a 9% decline in net sales. Its diluted earnings came in significantly lower at $0.52 per share compared to $0.96 per share reported a year earlier.

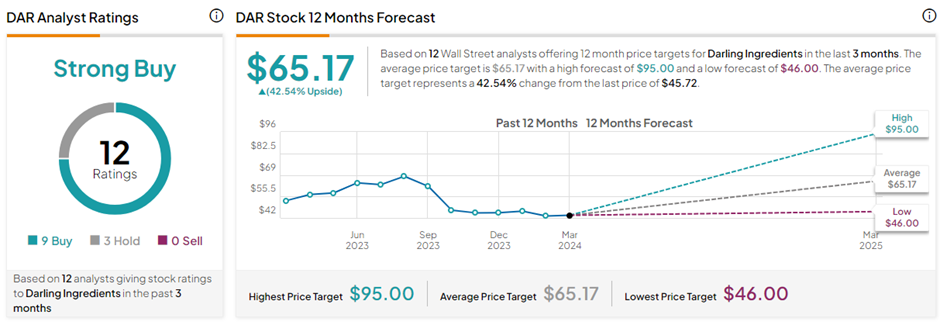

What is the Price Target for DAR Stock?

On TipRanks, the average Darling Ingredients price target of $65.17 implies 42.5% upside potential from current levels. Furthermore, with nine Buys and three Hold ratings, DAR stock wins a Strong Buy consensus rating.

#4 Cytokinetics (NASDAQ:CYTK)

Cytokinetics is a biopharmaceutical company that engages in the discovery and development of muscle activators and muscle inhibitors as potential treatments for debilitating diseases. Cytokinetics aims to increase the health span of people with devastating cardiovascular and neuromuscular diseases of impaired muscle function.

Cytokinetics is a pre-revenue company undergoing clinical trials on its various potential drug candidates that are showing positive results. The company is also preparing to apply for regulatory submissions for potential drug candidates.

In the last three months, 11 hedge funds increased their CYTK holdings by 1.9 shares, giving it a Very Positive Hedge Fund Confidence Signal.

Is Cytokinetics a Good Stock to Buy?

CYTK stock commands a Strong Buy consensus rating based on 14 Buys versus three Hold ratings. The average Cytokinetics price target of $94.63 implies 40.5% upside potential from current levels.

#5 Allegro MicroSystems (NASDAQ:ALGM)

Allegro MicroSystems designs and manufactures sensor ICs, application-specific analog power ICs, and photonics components. Its products are used in the automotive, industrial, energy, and infrastructure industries to enable reliable, high-performance solutions that precisely measure motion, speed, position, and current.

In the last quarter, six hedge funds increased their holdings of ALGM stock by 1.4 million shares, awarding the stock a Very Positive Hedge Fund Signal.

In its Q3 FY24 results, net sales rose 2% year-over-year, while adjusted earnings per share of $0.32 came in three cents lower than last year. For Q4, ALGM expects net sales between $230 and $240 million.

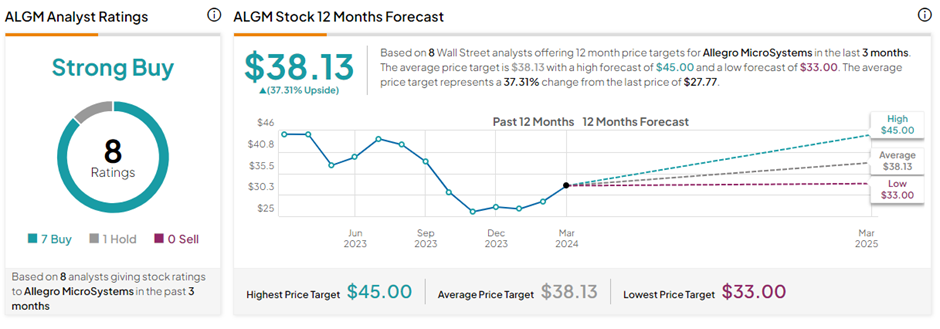

Is Allegro MicroSystems a Good Buy?

The average Allegro MicroSystems price target of $38.13 implies 37.3% upside potential from current levels. Also, ALGM stock has a Strong Buy consensus rating based on seven Buys versus one Hold rating.

Key Thoughts

The above 5 stocks have won the favor of hedge funds, showing promising future potential. Moreover, they have massive upside potential in the next twelve months, as per analysts, which makes them interesting stocks to consider for one’s portfolio.